Top Freddie Mac Issuers: CRED iQ’s Midyear Rankings

Building upon our new issuances and loan volumes projections in last week’s research, our team dug a bit deeper with a focus on the Freddie Mac ecosystem. We wanted to understand the firms behind the new issuances that have hit the market in 2025 year-to-date.

It has been a robust year of growth thus far for the agency sectors. Freddie Mac and Fannie Mae are projected to add approximately $9 billion and $10 billion, respectively, this year compared to 2024.

Freddie Mac has enjoyed the lowest average interest rate (5.71 percent) out of all securitized lending sectors so far this year, so we thought that would be the ideal place to start.

The top 5 issuers

Berkadia Commercial Mortgage takes the top spot with just over $1 billion in new issuances thus far in 2025. JLL Real Estate Capital issued $922.5 million in Freddie Mac multifamily loans, enough to secure second place in our midyear rankings.

Not far behind in third place was CBRE Capital Markets with $882.9 million in new Freddie issuances in 2025 year-to-date. Berkeley Point Capital and J.P. Morgan Chase Bank round out the top five with $684.6 million and $472.8 million, respectively.

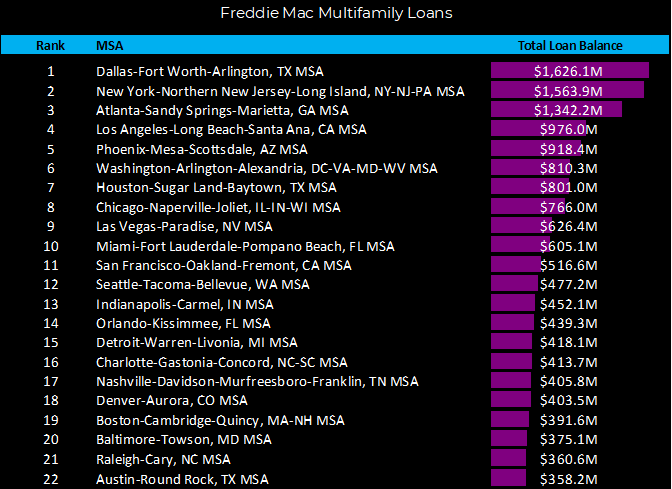

Top metro areas

It is a tight race for first place between the Dallas and New York metropolitan areas, with Dallas inching its way to the top spot with $1.63 billion in 2025 year-to-date Freddie Mac loan balances. The New York metro is right behind Dallas with $1.56 billion.

The Atlanta metro saw $1.34 billion originations so far this year and is currently in solid control of third place. Los Angeles and Phoenix rounded out the top five with $976 million and $918.4 million, respectively.

Property types

Garden-style apartments dominated all other property types with 70.1 percent of all new issuances collateralized with assets in this category. Mid-rise residential developments at 11.4 percent was a distant second, and high-rise rounds out the top three at 5 percent.

Mike Haas is the founder and CEO of CRED iQ.