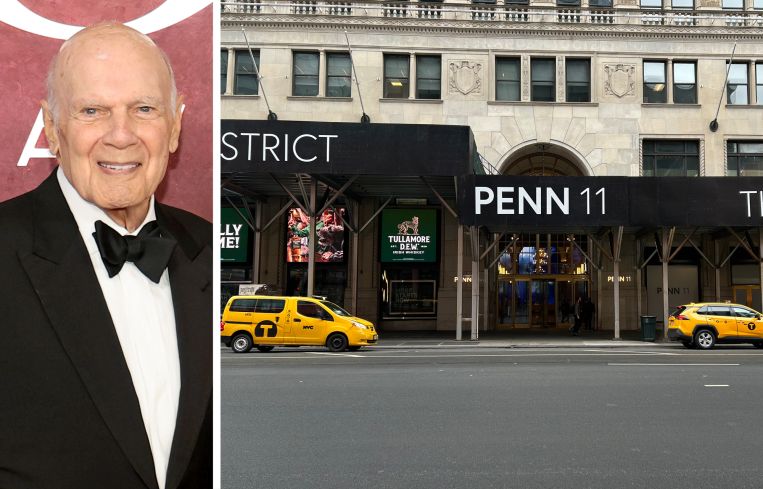

Vornado Lands $450M CMBS Loan to Refi Penn 11

By Andrew Coen July 16, 2025 6:39 pm

reprints

Vornado Realty Trust has secured $450 million of commercial mortgage-backed securities (CMBS) debt to refinance its Penn 11 Midtown Manhattan office property.

The real estate investment trust announced Wednesday it closed the refi for the 1.2 million-square-foot office building as part of a five-year loan with a fixed interest rate of 6.35 percent.

The 2025-P11 single-asset, single-borrower CMBS transaction was co-originated by Citigroup, BMO Capital Markets and Société Générale, according to Bloomberg data. It was a direct deal with no broker.

A Morningstar presale report on the deal noted it equated to a “high leverage” 85.9 percent loan-to-value ratio.

Penn 11, a 26-story tower on Seventh Avenue between West 31st and West 32nd streets, was 96.6 percent leased as of March 31, according to Morningstar. The building features 10 tenants. Apple occupies the largest space, consisting of 460,639 square feet, which comprises 39.9 percent of the total net rentable area (NRA). Apple moved to the property in 2021 and expanded its footprint in November with a lease that runs through 2035.

AMC Networks is Penn 11’s second-largest tenant with 323,922 square feet, or 28.1 percent of NRA, in a lease that runs through 2027. The media company is expected to give back two floors at its next lease renewal date, according to Morningstar.

Morningstar noted that the loan does not include any upfront reserves for tenant turnover, but is structured with a “trigger period” that would sweep excess cash into a reserve account for new leases, accounting for the space occupied by AMC if necessary.

The loan collateral also includes 15,263 square feet of retail space that is boosted by the property’s location across from Pennsylvania Station and Madison Square Garden.

Vornado, Citigroup and Société Générale did not immediately return requests for comment. BMO declined to comment.

Andrew Coen can be reached at acoen@commercialobserver.com.