CMBS Distress Rate Reaches 11%

The commercial mortgage-backed securities (CMBS) distress rate increased from 10.3 percent in April to 11 percent in May, according to CRED iQ’s latest analysis. The latest print reverses a three-month trend of distress rate reductions.

The underlying metrics saw increases as well, with the delinquency rate rising by 40 basis points (bps) to 8.4 percent and our special service rate notching a 30-bps increase to 10.2 percent.

CRED iQ’s distress rate, a composite metric capturing loans at least 30 days delinquent and those in special servicing, increased by 70 bps in the latest reporting period. The trend reversal, which is further supported by increases in delinquencies and special servicing, underscores the heightened volatility of the commercial real estate sector. These upticks highlight the need for vigilance as underlying pressures persist.

The CRED iQ research team analyzed the payment status of approximately $58 billion in distressed CMBS loans. The core objective of our research was to achieve a clear view of the current state of payment status reasons and associated near-term trending.

Our team then explored each payment status reason from a historical perspective. We wanted to understand the trends and evolution of each category dating back to February of 2024. Our team built a trend line that reveals trends for each category, to potentially augment current forecasting models.

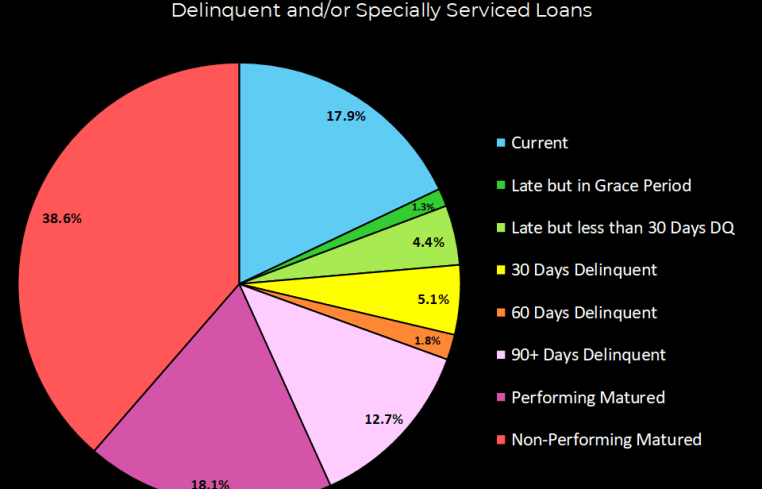

Encouragingly, $10.4 billion (17.9 percent) of CMBS loans are current, up from $8.3 billion (15.7 percent) in the prior month.

Around a quarter (25.3 percent, or $14.7 billion) of loans are delinquent, including those within grace periods, marking a 40-bps decrease from a percentage basis.

Our data showed that $33 billion of CMBS loans have passed their maturity date. Of these, 18.1 percent are performing (up from 16.6 percent) while 38.6 percent are nonperforming (down from 42 percent), indicating a notable swing toward nonperformance.

Loan highlight

The $39.9 million Encino Financial Center loan, backed by a 227,223-square-foot office property in the Los Angeles market, highlights maturity-related challenges. Set to mature in May 2025, the loan defaulted to nonperforming mature status and transferred to the special servicer. Year-end 2024 financials reported a debt service coverage ratio of 1.67 and occupancy of 87 percent.

Methodology

CRED iQ’s distress rate provides a holistic view of CMBS performance by combining delinquency (30-plus days past due) and special servicing activity, including both performing and nonperforming loans that fail to pay off at maturity. Our analysis focuses on conduit and single-borrower large loan structures, while separately tracking Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO metrics.

Mike Haas is the founder and CEO of CRED iQ.