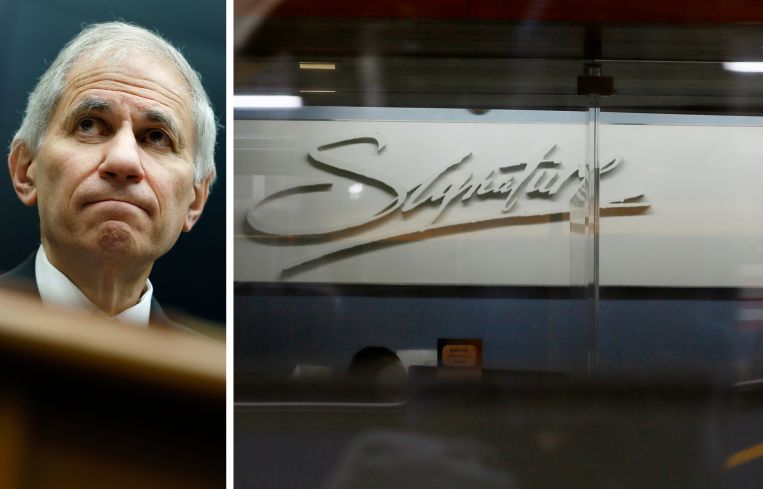

Signature Loan Pool Winning Bid Was 36% Less Than Auction Winner, FDIC Docs Show

The sale, which comprised loans on rent-regulated properties, raised some eyebrows at the time of the auction.

By Andrew Coen March 12, 2025 3:06 pm

reprints

More than a year after controversy surrounded the Federal Deposit Insurance Corporation’s selection for a highly coveted Signature Bank loan portfolio, a clearer picture has emerged showing the true disparity between the winning bid versus those that pitched far higher amounts.

A bid summary released by the FDIC Tuesday outlining the 2023 sale of a 5 percent equity stake in Signature’s nearly $6 billion rent-regulated portfolio in the New York metro area showed the $129.3 million winning bid was 36 percent less than the highest offer.

The winning bid, led by Community Preservation Corporation (CPC) in concert with Related Fund Management and Neighborhood Restore, was $47.1 million million lower than a $176.4 million offer made by Brookfield Asset Management in partnership with Tredway, according to the FDIC documents.

But the Brookfield-Tredway bid was not the only one that surpassed CPC and Related; the FDIC bid summary also showed figures of $174.5 million and $172.8 million with the names of the bidders not included. There was also one other slightly higher bid of $130.8 million from an undisclosed bidder.

Sources previously told Commercial Observer of three other bids not chosen by the FDIC that were north of 80 cents on the dollar, compared to the winning bid, which was 59 cents on the dollar. In addition to the Brookfield-Treway bid, there were also substantially higher bids from multifamily investor Skylight Real Estate Partners in partnership with Rithm Capital as well as a proposal from Brooksville Company and Sabal, according to sources.

New York Mayor Eric Adams’s administration endorsed the CPC, Related and Neighborhood Restore bid and sent a letter to the FDIC in late November 2023 citing the trio’s experience with rent-regulated and affordable housing in the Big Apple.

The FDIC said at the time of its decision to select the CPC-led bid that it was based on “a statutory obligation to maximize the preservation of the availability and affordability of residential real property for low- and moderate-income individuals.” The statutory factors cited by the FDIC in the decision also took into account trying to “maximize the net present value return” of the transaction, minimize realized losses and to ensure “adequate competition.”

In response to reports that surfaced in November 2023 of the FDIC selecting a winning bid that was far lower than the loan portfolio’s value, Brookfield sent a letter to the FDIC accusing the agency of running a “secret” process. The letter noted that the FDIC had indicated it would not give preference to proposals with support from political leaders, with pricing being the main factor of who would be selected.

The Signature loan portfolio the auction addressed included 868 permanent loans secured by properties with nearly 35,000 units, with 80 percent of the apartments rent-regulated. The pool comprised a large chunk of the roughly $15 billion Signature had tied to rent-stabilized or rent-controlled assets before the bank collapsed in March 2023.

Loans in the rent-regulated portfolio had been crushed by changes to New York state’s rent laws in 2019. Those changes placed strict limits on future rent increases at rent-stabilized properties coupled with the Federal Reserve aggressively hiking interest rates in early 2022 from near zero-level borrowing conditions.

Officials at Brookfield, CPC, Related Fund Management, Neighborhood Restore and the FDIC did not immediately return requests for comment. Tredway declined to comment.

Andrew Coen can be reached at acoen@commercialobserver.com