Strategic Refis U.S. Luxury Hotels With $1.6B CMBS Loan

Deutsche Bank and Bank of America provided the funds for nine hotels with almost 5,000 rooms across four states and D.C.

By Julia Echikson October 9, 2024 2:34 pm

reprints

Strategic Hotels & Resorts secured a $1.58 billion debt package from Deutsche Bank and Bank of America to refinance nine luxury hotels stretching from New York to California, mortgage documents filed to Miami-Dade County show.

The financing covers nine properties in Arizona, California, New York, Illinois and Washington, D.C, with a total of 4,957 rooms, Morningstar reported. Together, the hotels are valued at just over $4 billion.

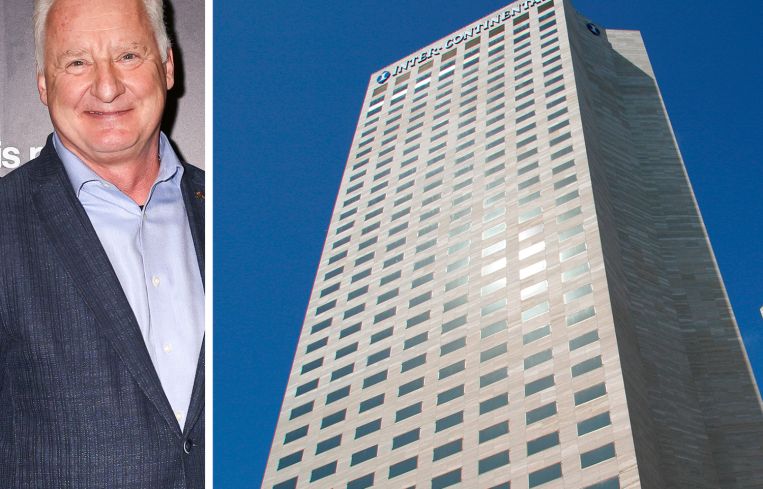

One of those properties is the InterContinental in Downtown Miami. The 465,000-square-foot waterfront hotel with 641 rooms is worth $392 million, according to mortgage documents.

Deutsche Bank affiliate German American Capital provided $948 million, and Bank of America loaned the remainder. The portfolio was last refinanced a decade ago.

Fairmont Scottsdale Princess, a 750-room property in Arizona, is the most profitable hotel of the deal, accounting for nearly 27 percent of the portfolio’s net cash flow, per Morningstar. Second is the oceanfront Ritz-Carlton Laguna Niguel in Southern California, which accounts for nearly 18 percent of the portfolio’s net cash flow share. The figures for the other properties were below 14 percent.

During the height of the pandemic, the portfolio foundered, but it has since recovered. In 2022, the portfolio’s revenue per available room averaged $263, up 73 percent from the year prior, according to Morningstar. In 2023, RevPAR grew by about $4.

Based in Chicago, Strategic Hotels & Resorts owns 12 hotels in the U.S. and Europe. In 2016, Chinese holding company Anbang bought the REIT for $6.5 billion.

A representative for Strategic Hotels & Resorts did not immediately respond to a request for comment.

Julia Echikson can be reached at jechikson@commercialobserver.com.