Redaptive, Proptech Firm With Clients Like T-Mobile, Secures $100M Investment

Canada Pension Plan Investment Board backs energy-as-a-service company that aims to curb emissions for large property portfolios

By Philip Russo October 22, 2024 9:00 am

reprints

Redaptive, an energy-as-a-service (EaaS) proptech company, announced Tuesday that it had secured a $100 million strategic investment from the Canada Pension Plan Investment Board (CPP Investments).

Founded in 2015, the Denver-based Redaptive seeks to enable large organizations to achieve energy efficiency, sustainability and resilience at scale.

“Our mission is to drive global impact and curb climate change,” said Arvin Vohra, CEO and co-founder at Redaptive. “The success that we’ve had with our existing customers, the growth we’ve seen in the business, and the appetite in the market for more sustainable business models is what led to the compensation from the Canadian pension plan.”

Redaptive said the latest capital infusion will help it grow its customer base of 150 companies, which includes more than 40 Fortune 500 companies. The funding brings Redaptive’s total capital raise to more than $1 billion, including investments from channel partners CBRE and Honeywell, said Vohra, a former investment banker at Lehman Brothers and Barclays who focused on energy-structured finance such as wind and solar projects.

Redaptive bills itself as one of the oldest EaaS companies in the U.S. and claims to make it easier for its customers to achieve their energy and sustainability goals at a faster and greater scale than they could do on their own. The company focuses on sustainable energy and efficiency solutions for EV, HVAC, LED, solar and more in large-scale building portfolios. Its customers include Cintas, Iron Mountain, McKesson and T-Mobile.

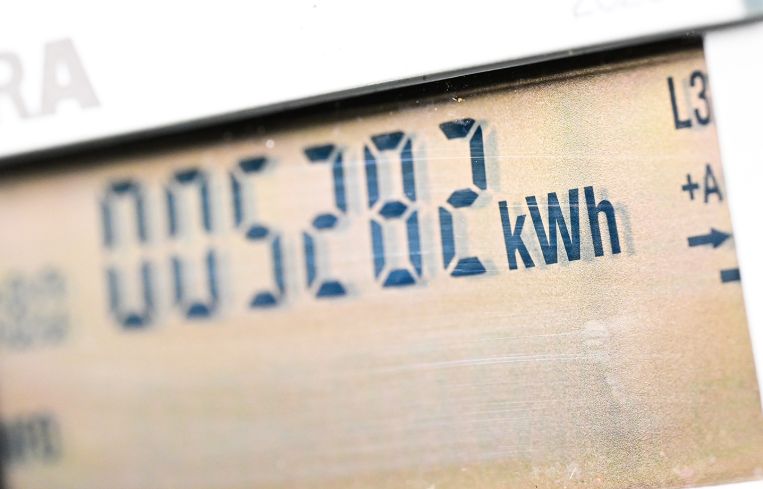

Redaptive is aimed at commercial, industrial and health care building mechanical contractors, who want to use its technology to meter and measure energy use faster and more efficiently, Vohra said.

“We’re leveraging a lot of technology on the analytics side,” he said. “From the industry standpoint, we’re focused on data analytics and automation to optimize energy use and to provide deeper insights. Other energy efficiency planners are actually physically putting more efficient assets, HVAC and other products, into facilities. We are a software and data platform that has financing that enables those incumbent players in our industry to do more work at scale. Instead of competing on individual products and projects, we’re building a software platform that the industry will rely on. We’re the ecosystem’s best friend.”

Global carbon emissions from fossil fuels jumped in 2023, including an estimated 37 billion tons from fossil fuels. Overall emissions were up 1.1 percent compared to 2022 levels and 1.5 percent compared to pre-pandemic levels, continuing a 10-year plateau.

Redaptive claims to have saved customers in industries with high levels of emissions, like the commercial and industrial building sector, an equivalent of 2.3 million metric tons of CO2 reductions.

Philip Russo can be reached at prusso@commercialobserver.com.