Paramount Takes Solace in AI Leasing as J.P. Morgan Plans to Ditch 244K SF

By Mark Hallum October 31, 2024 12:18 pm

reprints

Paramount Group is keeping its chin up despite losing J.P. Morgan as a tenant, with the bank leaving 244,000 square feet at One Front Street in San Francisco.

The office landlord believes that the number of tours it’s giving in other markets like New York City and subsequent leasing deals will offset the loss, and it has 230,000 square feet of leases among 80 new tenants in the pipeline, executives said in Paramount’s third-quarter earnings call Thursday.

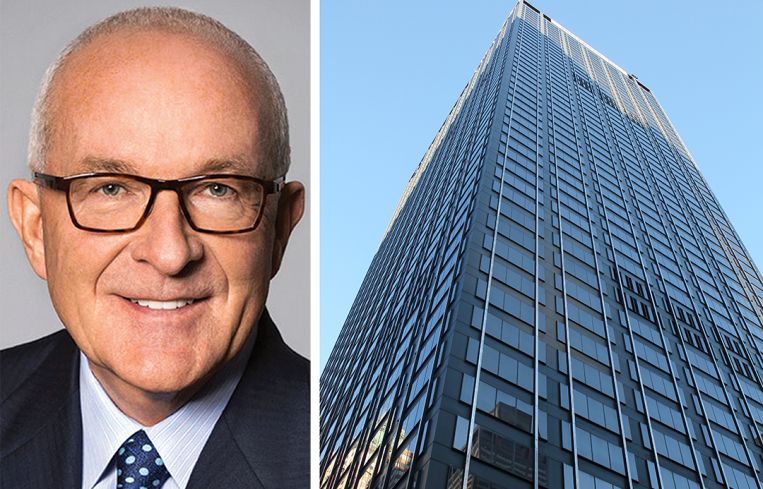

“We have 230,000 square feet of leases out, most of which is on vacant space,” Albert Behler, chairman, CEO and president of Paramount, said during the earnings call. “That’s what gives us the comfort to say that we’re going to have a really good fourth quarter.”

Paramount reported a net loss attributable to common stockholders of $9.7 million at the end of the third quarter compared to the $8.4 million in net losses in the same period last year, while funds from operations was $40.1 million compared to the $46.7 million in the third quarter of 2023.

Paramount’s New York City portfolio is currently 85 percent leased with only 2 percent of its leases expiring by the end of the year. As for San Francisco, 60 artificial intelligence firms have signed leases recently, 70 percent of them new to the market, and they’re expected to backfill the vacancy left by J.P. Morgan.

But the San Francisco market is still expected to dip, leaving further vacancies, Behler said.

“We do think that some of our product mix in our buildings will appeal to these AI-based companies that, in many cases, are looking for built space and they’re looking to move quickly,” Peter Brindley, head of real estate for Paramount, said during the call. “We’re expecting north of a million square feet of velocity attributable to AI-based companies in this calendar year.”

AI companies have been hunting for a lot of office space around the country in recent months and have already started to sign major deals. OpenAI signed on for 486,800 square feet at 1455 and 1515 Third Street in San Francisco last year and locked down its first New York City office earlier this month, taking 90,000 square feet at the Puck Building.

It’s not just OpenAI. Firms such as Anthropic and Palantir have signed deals in cities such as New York City, Denver, Atlanta and Seattle, the Wall Street Journal reported.

But with uncertainty surrounding whether AI will be a bubble in the coming months or years, investors questioned how Paramount is protecting itself from its potential fallout. Brindly explained that the company is examining every tenant’s capital outlay and securing it with a letter of credit, “irrespective of industry.”

There were a total of 12 leases signed across Paramount’s entire portfolio in the third quarter totaling 179,403 square feet, with an average asking rent of $84.55 per square foot.

Paramount is carrying about $3.61 billion in debt, but does not have any maturities on loans until 2026.

Mark Hallum can be reached at mhallum@commercialobserver.com.