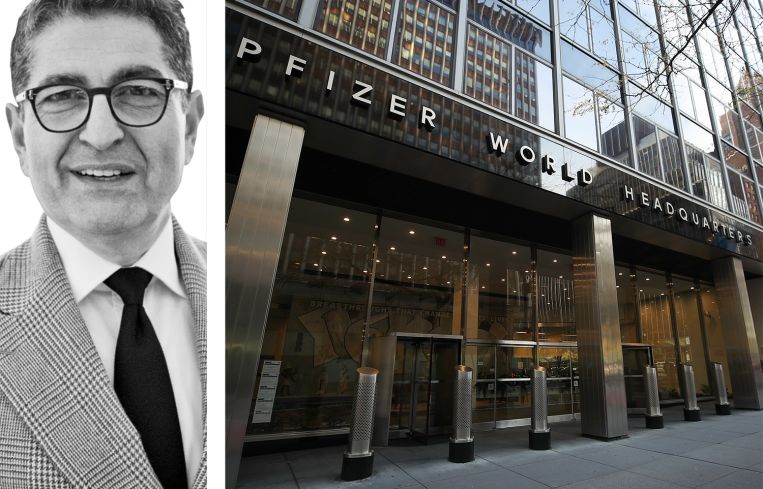

Metro Loft and David Werner Secure Full Control of Former Pfizer HQ

The plan is to convert the buildings at 235 East 42nd Street and 219 East 42nd Street into housing.

By Amanda Schiavo October 23, 2024 3:33 pm

reprints

Metro Loft Management and David Werner Real Estate Investments have acquired full control of the ground lease for the Grand Central office building at 235 East 42nd Street for $18 million, in a deal that places the building’s value at $45 million, according to city records.

The final ownership stake for the Midtown building — formerly the headquarters of pharmaceutical company Pfizer — was acquired through the entity 235 East 42 Owner from Alexandria Real Estate Equities, which sold it through the entity 42nd & Second Holding, property records show. PincusCo. first reported the deal, which city records show closed on Oct. 8 and was made public Wednesday.

Earlier this year, the joint venture between Metro and Werner secured $75 million in acquisition financing to develop the neighboring building at 219 East 42nd Street, as Commercial Observer previously reported.

The joint venture plans to convert the two office properties into housing with roughly 1,600 combined rental units, Nathan Berman, CEO of Metro Loft, told Commercial Observer.

“At 219 [East 42nd] we’ve acquired the land and the building,” said Berman. “And at 235 [East 42nd] we have the ground lease, and we’re on a path to acquiring the land as well. So we currently have the entire site and we are busy demoing and abating.”

The two buildings have a total of 1.2 million square feet, and Berman anticipates them to have their first residential leases somewhere between 18 to 20 months from now.

And the East 42nd Street properties aren’t the only office-to-residential conversions Berman has in the works across the city. Metro Loft teamed up with InterVest Capital Partners to turn 111 Wall Street into a luxury apartment building with 1,350 units and is in the process of turning 25 Water Street into a residential tower with GFP Real Estate and Rockwood Capital.

David Werner Real Estate Investments could not be reached for comment.

Amanda Schiavo can be reached at aschiavo@commercialobserver.com.