Interest Rate Trends Vary by Asset Class in CMBS Market

The CRED iQ research team recently analyzed underwriting metrics for the 28 commercial mortgage-backed securities (CMBS) conduit issuances in 2024. This analysis builds on our April report, which covered the eight conduit CMBS transactions that were issued in the first quarter, examining interest rate ranges and averages over the past 12 months.

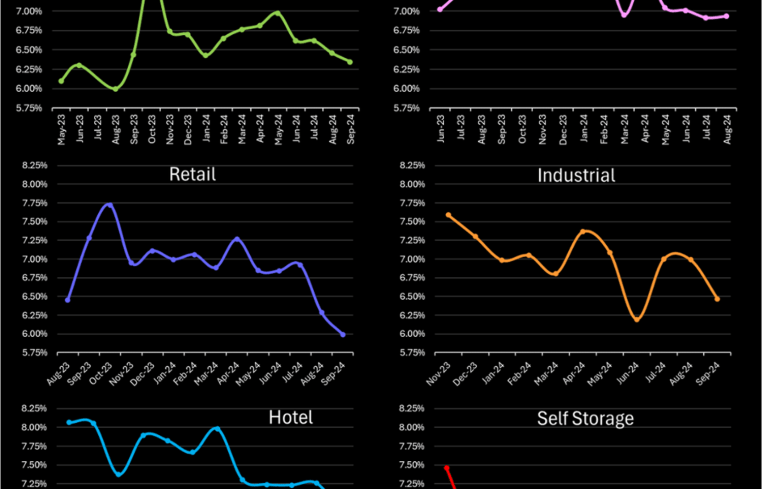

Average interest rates peaked/spiked in November of 2023 before starting the downward trend leading up to now.

Office saw the second-highest average interest rate for all loans at 7.16 percent. The office sector operated in an interest rate range between 4.84 percent and 8.44 percent.

Multifamily interest rates ranged from 4.68 percent to 8.33 percent. The average interest rates for the multifamily segment in this period was 6.68 percent.

Retail interest rates ranged from 5.18 percent to 9.04 percent. The retail sector’s average interest rate came in at 6 percent.

Hotels had the highest average interest rate over the past year at 6.96 percent.

Self-storage came in with the lowest average interest rate at 6.6 percent and operated at the lowest range of all property types (4.5 percent to 7.99 percent).

One transaction in Philadelphia highlights the challenge of increased interest rates.

The Piazza is a 332-unit, multifamily complex in the Northern Liberties submarket of Philadelphia. The asset backs a $108.6 million ($382,530 per unit) senior loan plus an $18.5 million mezzanine loan for a total debt package of $127 million.

Originated in August 2024, the interest-

only loan has a 5.91 percent interest rate and is scheduled to mature in August 2029. The previous loan was packaged into a CRE collateralized loan obligation in May 2021 that had a total loan amount of $134.9 million. In order to refinance this loan the borrower had to contribute $22.5 million in cash equity.

The mid-rise complex was constructed in 2006 and most recently renovated in 2019. The former WeWork space (20,951 square feet) at the property is in the process of being converted to 16 additional units that are expected to be completed by March 2025.

The property was valued as-is at $155.8 million ($469,277 per unit) in May 2024. At underwriting, the asset was 90.7 percent occupied and had a debt service coverage ratio of 1.35.

Mike Haas is the founder and CEO of CRED iQ.