Sunday Summary: A Mixed Bag for Office-to-Resi

By The Editors September 1, 2024 9:00 am

reprints

Office-to-residential conversions might be hotter than your Labor Day barbecue, but last week may have tempered those flames a bit.

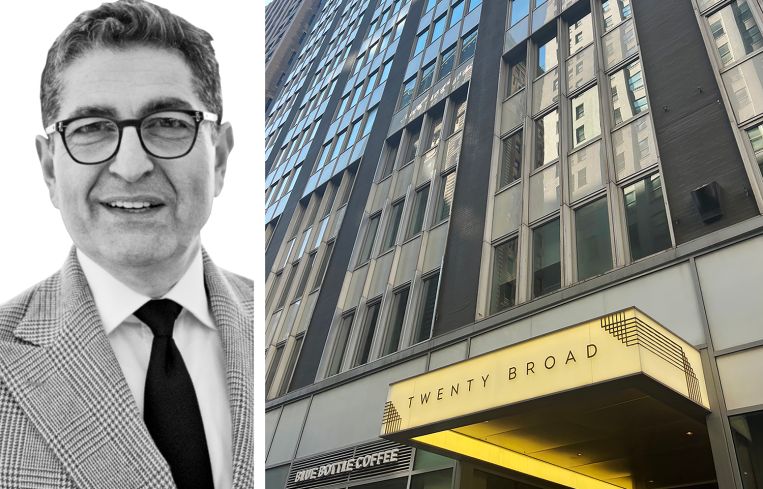

First up, a $250 million commercial mortgage-backed securities loan secured by the converted 20 Broad Street hit special servicing (on its way to a likely default), tarnishing the crown of the king of these projects, Metro Loft Management’s Nathan Berman.

Berman converted the aging Financial District office tower to 553 residential units in 2018. Yet, even with a nearly 98 percent occupancy rate, its net cash flow dropped to $13 million in May.

What’s more, a new report from CommercialEdge found that fewer than one in six office properties across the U.S. — or 1.25 billion square feet of office space — are strong candidates for office-to-resi conversion. That’s only 14 percent of the country’s total stock.

However, New York City landlords have a bit less to fret about as Manhattan led the pack with the most potential for conversion, with 53.1 percent of its office stock in CommercialEdge’s top two tiers for conversions.

And at least one famed office building is following that route regardless. Details of The Brodsky Organization, GFP Real Estate and The Sorgente Group’s plans to convert the Flatiron Building to residential came out last week, with the joint venture aiming to transform the property into 60 luxury condominium units.

If all goes according to plan, the developers expect to allow homeowners to move in by the end of 2026.

Labor Day Weekend might be about celebrating all the good deals unions have won workers — little things like the 40-hour workweek and worker safety protections (and the concept of a weekend itself!) — but commercial real estate had some deals to celebrate last week.

That was especially true for financings. Lendlease and Aware Super secured $316 million in construction financing for its Culver City, Calif., mixed-use development; Hartz Mountain Industries locked down a $230 million refinancing for its Soho Grand Hotel and Roxy Hotel in Manhattan; and Namdar Group got a $152 million construction loan to build a 588-unit luxury apartment tower in Jersey City, N.J.

Plus, we saw a deal that made us question the space-time continuum and the invention of rock ’n’ roll. RCB Equities and Real Estate Development Associates secured a $115 million acquisition loan to buy the Puente Hills Mall in the City of Industry, Calif. You might know the spot better as the fictional Twin Pines Mall where Marty McFly first uses the DeLorean time machine in the 1985 film “Back to the Future.”

Back to the present: There were some sales with Fashion Nova founder and CEO Richard Saghian dropping $118 million to buy Fashion Nova’s Beverly Hills, Calif., headquarters; Eagle Rock Properties spending $70.5 million for Harbor Group International’s 13.2-acre apartment community in West Springfield, Va.; and Panattoni paying $29.9 million to buy the former Miami Herald headquarters in Doral, Fla.

Finally, a small deal in Queens got some big names behind it. Adam Gordon’s Wildflower offloaded a 40,037-square-foot Maspeth parking lot to Elon Musk’s Tesla for $18 million, with the car company likely turning it into an electric vehicle charging station.

It looks like the trend of companies following my in-laws in leaving New York City for Florida is continuing. This time Foot Locker confirmed long-rumored plans to move its headquarters from Midtown Manhattan to St. Petersburg, Fla., with the relocation happening sometime next year.

It’s not just New York losing an HQ here and there. Companies are leaving other East Coast cities for the Sunshine State. Ken Griffin’s Citadel and Citadel Securities already announced they would move from Chicago to Miami, and last week unveiled plans for a 54-story headquarters in Miami’s Brickell district.

Yet, not every tenant is making such a long trek. In fact, many aren’t even leaving their ZIP code.

More and more Manhattan tenants have started to relocate offices they have long occupied for ones only a block or three away.

“Companies, if they are relocating, will generally stay in the same proximity of their existing location, obviously subject to availability, subject to the right inventory being available that that specific tenant is seeking,” James Wenk, a vice chairman with the brokerage Savills, told Commercial Observer.

These short moves include Virtus Investment Partners relocating from 31 West 52nd Street to about 41,000 square feet less than a block away at 1301 Avenue of the Americas; Phipps Houses moving from 902 Broadway a block away to 257 Park Avenue South; and law firm Roper Majeski leaping all of three blocks from 750 Third Avenue to 800 Third Avenue.

However, not every company has such a short move to make, and plenty of them have workforces spread all across the world.

CO looked at how distributed workforces are becoming more common for proptech companies and how these high-tech workplaces are managing that. (Hint, a lot of applications.)

We hope you enjoy the long weekend!