RFR Trying to Stop Ground Lease Termination on Chrysler Building

By Mark Hallum September 27, 2024 2:22 pm

reprints

The men holding the keys to the Chrysler want to stay in the driver’s seat.

Cooper Union took action to terminate RFR Holding’s ground lease on the Chrysler Building and took over control of the building Friday, but RFR wants to block that move.

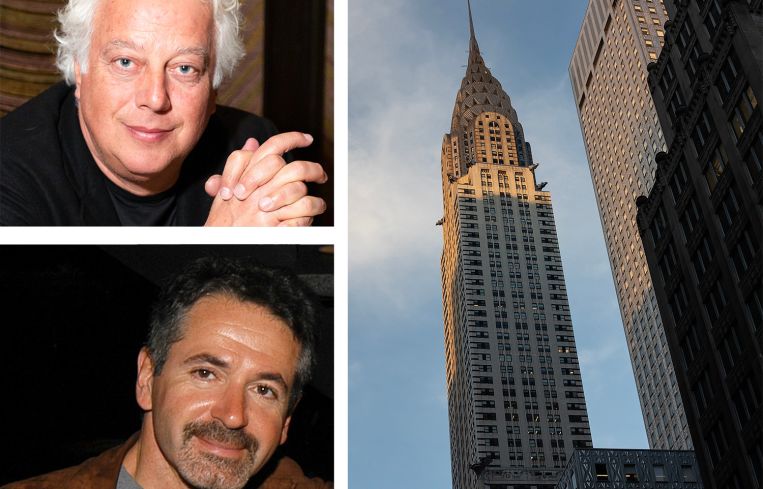

Aby Rosen and Michael Fuchs are asking for judicial intervention on the ground lease eviction proceeding after Cooper Union gave RFR a 10-day termination notice. That notice came after the college didn’t receive payment in June and July on the ground lease valued at $32.5 million, according to a source.

PincusCo first reported the news.

Cooper Union took control of the building after back-and-forth negotiations with RFR, which ultimately did not come to a resolution, the source said. Cushman & Wakefield was tapped to manage the property for the school, which uses the revenue to fund scholarship programs.

John Ruth, vice president of finance for Cooper Union, said in a statement that RFR’s default on the ground lease won’t impact its recent decision to offer free tuition to students.

“We anticipated the possibility of a lease agreement default as part of our financial turnaround work and implementation of the Plan to Return to Full-Tuition Scholarships,” Ruth said in a statement. “We built in guardrails to our financial turnaround plan through fundraising, revenue generation, and expense management to protect against a wide range of scenarios, such as this termination and the impacts of the pandemic, all while holding student tuition flat for six consecutive years and consistently raising scholarship levels for undergraduates.”

RFR claims Cooper Union went about the proceedings improperly and that the amount Cooper Union said RFR owed was “materially incorrect,” according to the court filing.

“RFR remains committed to the Chrysler Building for the long term, in keeping with the firm’s history of excellent restoration and stewardship of architectural landmarks,” a spokesperson for RFR said in a statement. “To date, RFR has invested over $240 million of its own capital into the property and is committed to working with Cooper Union to bring this iconic skyscraper back to stable and healthy financial standing.

“This legal dispute is a procedural step in the successful resolution to the ground lease between RFR and Cooper Union over the coming weeks,” the spokesperson added.

The termination notice was issued just weeks after RFR said that it had found a path through the distress wreaking havoc on its portfolio, and could keep its best properties, by waiting out the high interest rate environment long enough to refinance and recapitalize its billions in outstanding debt.

But the private college, which did not immediately respond to a request for comment, seems to want its money now.

RFR purchased the Chrysler Building at 405 Lexington Avenue with joint venture partner Signa Holding in 2019 for $151 million, a $650 million loss for the seller at the time, largely thanks to the onerous ground lease on the project. But the losses haven’t quite been the norm for Cooper Union, which was making a steady $50 million per year by leasing the ground that the iconic building sits upon, CO reported at the time.

Maybe it was a steal for RFR to acquire the famous New York City landmark, but at the time that RFR and Signa got the winning bid for the distressed property, some sources were telling CO at the time that $150 million was higher than they would be willing to pay.

Tishman Speyer got out while the getting was good in 2008 when it sold a 90 percent stake in the building to the Abu Dhabi Investment Council for $800 million.

The ground lease was set to expire on the building in 2049 and is the central revenue stream for Cooper Union.

Since RFR has taken over the Chrysler Building, it pitched converting the fading Art Deco icon into a hotel, but quietly abandoned the plan as it was too expensive to pull off. RFR’s also losing its partner, Signa, after the Austrian property conglomerate initiated bankruptcy proceedings and Signa put its 50 percent stake in the Chrysler Building up for sale in December.

As of July, the Chrysler building website was listing more than half of the office building, 650,000 square feet, as being immediately available to rent, The New York Times reported.

— With additional reporting by Brian Pascus

Update: This story has been updated to reflect that Cooper Union took control of the Chrysler Building.

Mark Hallum can be reached at mhallum@commercialobserver.com.