Vornado Sees Sunnier Days Ahead Despite Upcoming Office Vacancies Thanks to Retail

A $350 million sale to Uniqlo and 150,000 square feet of retail deals in the pipeline has Vornado feeling bullish about the rest of the year

By Abigail Nehring August 6, 2024 1:52 pm

reprints

There’s plenty of upheaval in the commercial real estate market today, but Vornado Realty Trust executives were riding the high of a $350 million deal to hand over a prized Fifth Avenue retail condominium in the company’s second quarter earnings call Tuesday.

The deal with Japanese clothing retailer Uniqlo is the third major retail sale Vornado closed this year and “obviously a transaction we’re quite pleased about,” the real estate investment trust’s (REIT) chief financial officer, Michael Franco, said during the call.

“I don’t think you’ve seen the last,” Franco added.

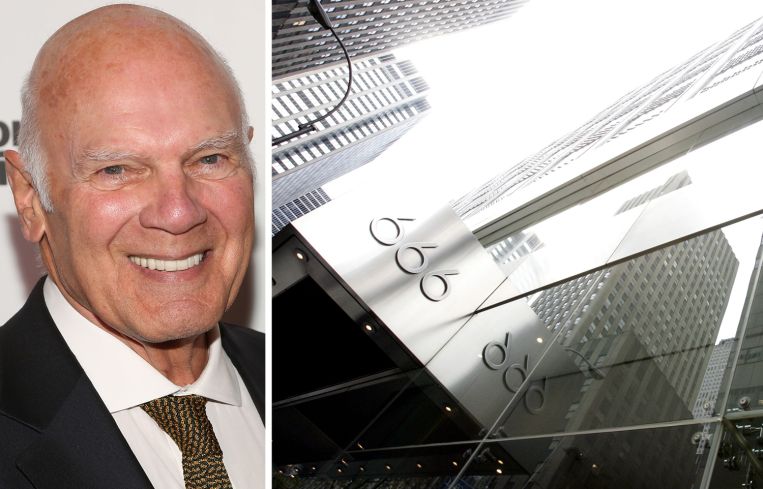

And, with a half dozen Fifth Avenue retail properties still remaining in its portfolio, the $20,000-per-square-foot sale price of Uniqlo’s flagship store at 666 Fifth Avenue is a good omen for the REIT’s future in retail.

And that’s great news for Vornado, since its retail portfolio in New York is currently struggling with a 77 percent occupancy rate — lower than the 89.3 occupancy rate its office portfolio ended the second quarter with, but a slight improvement from the 75 percent retail occupancy rate it had in the last quarter.

It’s not just selling off retail properties that has Vornado feeling confident about that sector since the REIT has about 150,000 square feet of retail in the pipeline in various stages of negotiations, according to the company’s executives.

“Retailers are more active and we’re seeing continued recovery there, both in terms of rents improving and vacancy rates,” Franco said.

Vornado’s funds from operations (FFO) rose in the second quarter to $112.8 million from $108.8 million last quarter, but that’s still down 19.9 percent year-over-year.

Part of that yearly FFO drop was caused by tenants moving out of Vornado’s portfolio — which contributed to a 7 cents per share decline in net operating income. Another 3 cents per share was lost via higher expenses.

Things could get worse as Vornado has yet to feel the impact of major vacancies coming just around the bend, including Facebook parent Meta’s departure from 770 Broadway and other chunks of space opening up soon at 1290 Avenue of the Americas and 280 Park Avenue. (Vornado executives did not specify who was leaving those buildings.)

Vornado CEO Steven Roth was nonplussed about the upcoming vacancies, and even hinted that a deal was in the works to fill the 275,000 square feet left behind by Meta at 770 Broadway by masterleasing the entire 1.2 million-square-foot building to a mystery tenant, according to Roth. He declined to share further details.

Meanwhile, the occupancy rate is looking stellar at 731 Lexington Avenue, thanks to Bloomberg’s 946,815-square-foot renewal in May, but trouble could lie ahead for the debt tied to the office tower. The $500 million loan on it comes due later this year and negotiations are in the process to refinance, Franco said during the call.It’s the last major office maturity Vornado will face this year after refinancing 640 Fifth Avenue’s $400 million debt in June and modifying and extending 280 Park Avenue’s $1.1 billion loan in April.

The nosedive the stock markets saw in the last 48 hours was the “elephant in the room,” Roth said. But he was bullish about the long-term success of the Federal Reserve’s crusade against inflation and predicted “a significant reversal of interest rates” soon.

“All this will have a significant positive impact on our numbers and our values,” Roth said.

Abigail Nehring can be reached at anehring@commercialobserver.com.