Jamestown to Acquire $2B Atlanta Subsidiary of North American Properties

By Andrew Coen August 13, 2024 8:00 am

reprints

Jamestown is acquiring a unit of North American Properties (NAP) with an intention to boost the firm’s footprint in suburban community development projects, Commercial Observer has learned.

The real estate investment firm announced Tuesday it will be acquiring the Atlanta subsidiary of Cincinnati-based NAP, which has $2 billion in assets under management as of June 2024. The owner/operator specializes in mixed-use properties in suburban East Coast markets.

Terms of the deal were not disclosed. Eastdil Secured advised NAP on the transaction.

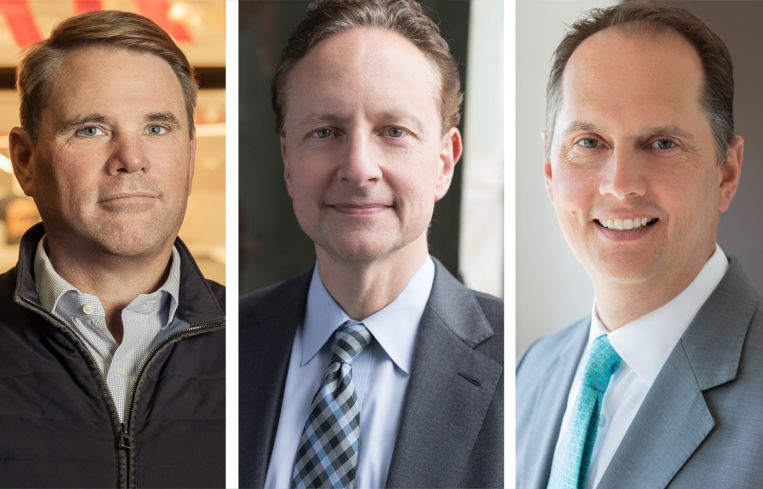

Michael Phillips, president of Jamestown, said NAP will complement its goal of creating community-centric projects through placemaking.

“This acquisition will bolster our differential advantage in the market as a vertically integrated, mixed-use operator with a focus on placemaking,” Phillips said in a statement. “[NAP’s]expertise around suburban placemaking is a great complement to our urban placemaking expertise, as well as our grocery-anchored shopping center business.”

The acquisition will involve a Jamestown affiliate making an investment in NAP’s portfolio whichincludes Colony Square in Atlanta;The Forum Peachtree Corners in Peachtree Corners, Ga., Avenue East Cobb in Marietta, Ga.;, Birkdale Village in Huntersville, N.C.; Ridge Hill in Yonkers, N.Y.; and Newport on the Levee in Newport, Ky.

NAP also has a real estate services business included as part of the transaction that manages Avalon in Alpharetta, Ga., Mercato in Naples, Fla. and Riverton in Sayreville, N.J.

“As part of the firm’s next chapter, Jamestown plans to continue to scale its vertically integrated platform and mixed-use expertise to more markets,” Matt Bronfman, CEO of Jamestown, said in a statement. “This acquisition advances our goal and is a major step toward realizing our long-term vision for the future.”

The deal is still subject to approval from lenders and investors with an anticipated closing of the 2024 fourth quarter, according to Jamestown. Once closed, the NAP Atlanta platform will be branded as Jamestown and bring on its more than 200 employees.

Tim Perry, managing partner of NAP’s Atlanta subsidiary, will also be joining Jamestown’s executive team as a managing director and co-chief investment officer.

Andrew Coen can be reached at acoen@commercialobserver.com.