Douglas Development Scoops Up D.C. Office Building for Hefty Discount

The company spent $34 million for the property, which was transferred back to its lender in lieu of foreclosure earlier this year

By Nick Trombola August 30, 2024 3:10 pm

reprints

Just a few weeks after defaulting on an eight-figure loan tied to a 14-property portfolio, Douglas Development is back on the horse with a purchase of an eight-story office building in Washington, D.C.

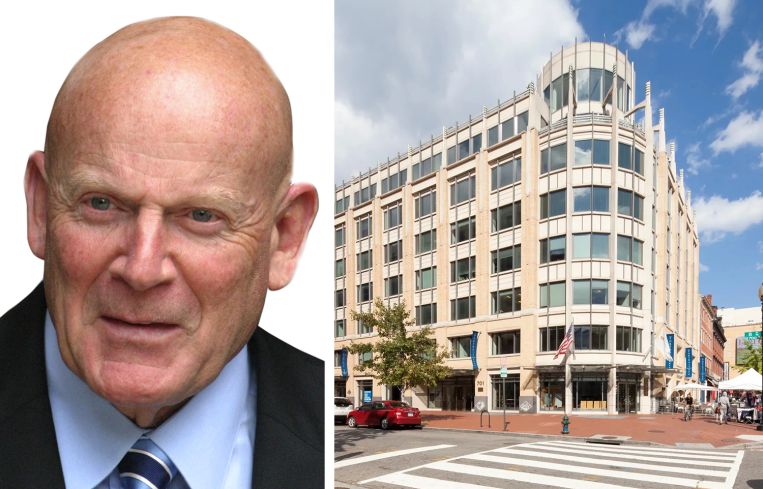

An affiliate of Douglas acquired the 138,000-square-foot building at 701 Eighth Street NW from an affiliate of Voya Investment Management for $34.3 million, according to the Business Journals, which cited property records. The property, known as The Portrait Building due to its proximity to D.C.’s National Portrait Gallery, was transferred from former owner Clarion Partners to Voya in lieu of foreclosure back in May.

Clarion had purchased the building in 2013 for $98.5 million, nearly three times what Douglas paid for the property. Clarion refinanced the building with a $41 million loan from Voya in 2020, but more than 80 percent of that loan balance was still outstanding when the landlord ultimately chose to hand the keys over to its lender earlier this year.

Clarion Partners still operates an office at the building. Other tenants include Boston University Federal Relations, architecture firm DLR Group and law firm Locke Lord. About 51,500 square feet in the building is vacant and available for lease, according to marketing materials for the property on Avison Young‘s website, though it’s unclear if that figure is up to date. The broker will be retained to market the property, according to Norman Jemal, Douglas Development’s managing principal.

Douglas, for its part, also recently obtained a $36 million loan from Voya, the vast majority of which was used for its purchase of the asset, per the Business Journals.

“The property is a Class A building, well-located, well-built and with great leasing velocity, and we encountered favorable terms, so we jumped on the opportunity,” Jemal told Commercial Observer.

A spokesperson for Voya declined to comment.

Yet Douglas is still licking its wounds after defaulting earlier this month on a $51.6 million commercial mortgage-backed securities (CMBS) loan tied to 14 properties in and around the District. That loan originated from the Royal Bank of Scotland in 2014, but was sold to an undisclosed CMBS trust that same year.

Nick Trombola can be reached at ntrombola@commercialobserver.com.