Brookfield in Talks With Lenders for $11B Buy of Spanish Plasma Firm

By Mark Hallum August 21, 2024 12:48 pm

reprints

Brookfield Asset Management is baring its fangs for fresh blood.

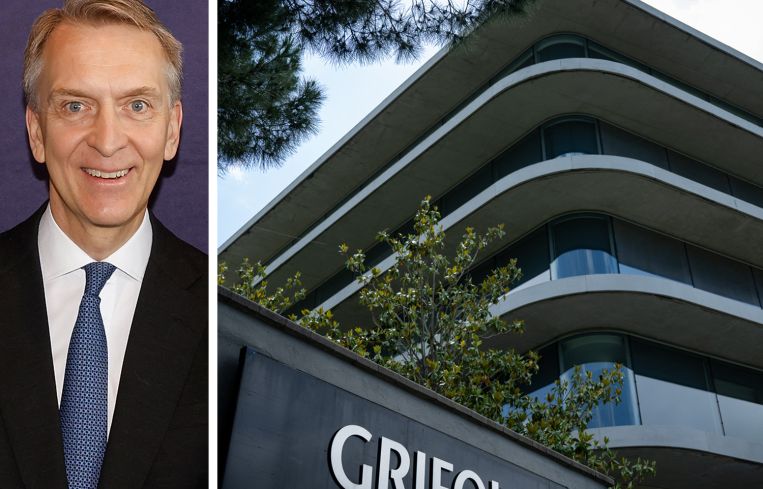

The global investment firm is working with lenders to line up $10.6 billion to acquire Barcelona-based plasma therapeutics company Grifols, which has been under financial duress in recent months, Bloomberg reported.

Through the acquisition, Brookfield would refinance Grifols existing billions in debt through the loan and high-yield bonds.

And the acquisition could mean farewell and adieu you fair Spanish (shareholders) as the deal could take Grifols private and obligate it to pay back cold-blooded bondholders above par in accordance with a financing clause.

Brookfield and Grifols did not immediately respond to requests for comment. The Spanish pharmaceutical company — which creates medicine using plasma — has an unknown amount of real estate, including an unknown number of blood donation centers.

The news sent Grifols’ stock on the Bolsas y Mercados Españoles (BME), also known as the Madrid Stock Exchange, climbing between 5 and 6 percent and its 2028 bonds gained more than 6 cents to 94 cents on the euro, according to reports.

The push and pull of bad news, mixed with a possible solution, led to consistently jumping stock prices for Grifols. On July 11, it reached $11 per share compared to its March 6 low of about $7 per share and its 52-week high of about $17 per share in late December, according to BME data. It’s currently standing at about $10.25 per share.

Talks of a bailout from Brookfield, and subsequently taking the company private, surfaced a month ago after Grifols reported a weak first quarter in terms of cash flow leading to high debt and a downgrade by Moody’s.

Mark Hallum can be reached at mhallum@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)