Ally Bank Provides $115M Bridge Loan on Four-State Senior Living Portfolio

The four assets were built more than 20 years ago but were recently renovated by the sponsorship group

By Brian Pascus August 29, 2024 2:57 pm

reprints

Chicago Pacific Founders and Grand Park Capital have secured $115 million in bridge financing after renovating a four-asset portfolio of independent living properties across Alabama, Tennessee, Oklahoma and Michigan.

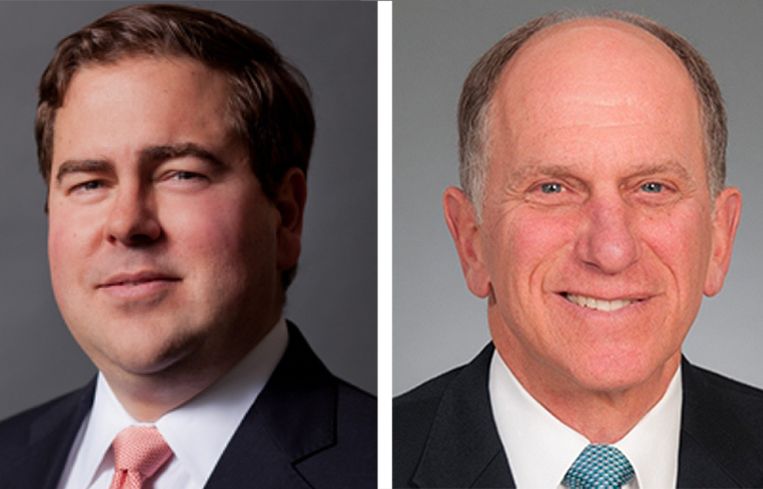

Ally Bank provided the three-year, nonrecourse loan. A JLL Capital Markets team of Jay Wagner, Rick Swartz, Joel Mendes, Dan Kearns, Jim Dooley and Robert Tonnessen arranged the financing.

In a statement, JLL’s Mendes said the sponsorship group has executed a “terrific” renovation of what’s known as the Town Village portfolio while operating the four properties, and spoke to the strength of the capital markets system.

“The financing markets responded favorably to the strength of the ownership and asset-level performance,” he said. “The loan closed as proposed and on schedule.”

Totaling 852 units, the four independent living assets are spread across four states and were all built between 2000 and 2002, according to JLL. All four properties have been renovated and now include common areas with amenities such as restaurant-style dining halls, libraries, game rooms and fitness facilities.

In a statement, JLL’s Wagner noted that each of the assets are located in “high-demand” areas.

“We are thrilled to have secured the bridge financing for the Town Village portfolio,” he said. “The four assets … [benefit] from excellent demographics and offer residents top-notch amenities with exceptional living experiences.”

Chicago Pacific Founders is a Chicago-based tech and health care investment firm that targets the senior care and independent living asset classes. Grand Park Capital is a family office.

Brian Pascus can be reached at bpascus@commercialobserver.com