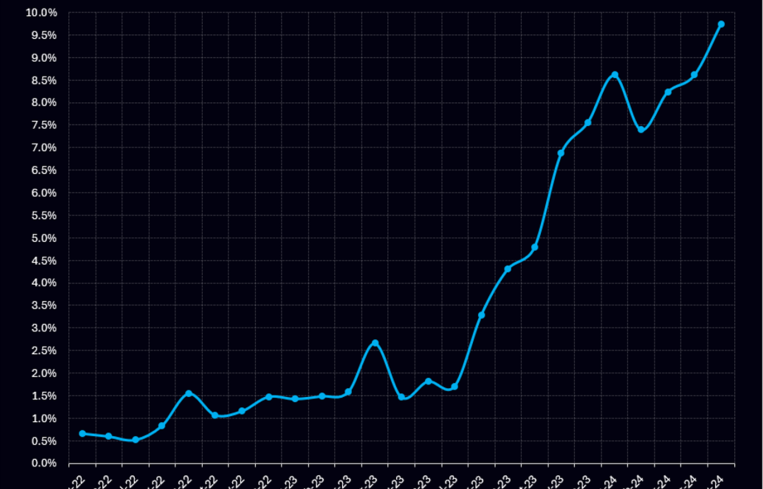

CRE CLO Distress Rate Widens to 9.74%

CRED iQ’s distress rate for commercial real estate collateralized loan obligations (CLOs) rose 114 basis points in May, up to 9.74 percent. This includes any loan reported 30 days delinquent, past their maturity, has reached special servicing, or any combination of these.

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Many of these loans were originated in 2021 at times where cap rates were low and valuations high amid low interest rates. Now, these loans are starting to run into maturity issues given the spike in rates.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, Rialto Capital and TPG.

Similar to CRED iQ’s last report that came out May 3, our research team analyzed approximately $78 billion in active CRE CLO loans (an increase of approximately $3 billion from the May report) to better understand current distress levels and expose any potential forecasting bellwether metrics. Along those lines we further explored loans that have been added to the servicer watchlist and triggers that caused this distressed designation.

Just over 36.5 percent of CRE CLO loans are currently on the servicers watchlist, a decrease of 2.1 percent since our May report. Combining the 9.74 percent distress rate with the 36.5 percent watchlist percentage, CRED iQ calculates 46.2 percent of these loans have some level of issues with their loans, which is generally flat compared to the previous 46.3 percent.

As mentioned in a previous report, our analysis exposes a wide gap between the distress and watchlist rates, which could imply that the special serving and delinquency percentages may be likely to grow.

By property type, it’s no surprise that office sector loans maintained their dominant lead, notching a 16.8 percent distress rate. Multifamily’s distress rate of 13.3 percent earned them a second-

place finish, followed by retail and industrial at 7.8 percent and 4.7 percent, respectively. Hotel loans were not far behind industrial at 4.1 percent. While the “other” loan category saw a 6 percent distress rate.

Breaking down the distress rate by payment status, 29.7 percent of loans were designated as performing matured, with nonperforming matured not far behind at 23.9 percent. Combined, performing and nonperforming matured loans comprise over half of the distressed universe (53.6 percent). The data also showed that 12.8 percent of loans have reached 90-plus days delinquent, and finally 11.7 percent of distress loan payment status are current.

Examining the watchlist breakdown by reason reveals that 37.8 percent of loans are on the watchlist due to pending maturity or an anticipated repayment date. Floating-rate debt service coverage ratio (DSCR) triggers account for 28.2 percent of the watchlist loans. Other notable categories include property affected by a safety issue or a potentially harmful environmental issue (6.5 percent) and occupancy decreases (excludes lodging) (5.6 percent).

The vast majority of the $78 billion in CRE CLO loans are structured with floating rates with three-year loan terms equipped with loan extension options if certain financial hurdles are met.

Mike Haas is founder and CEO of CRED iQ.