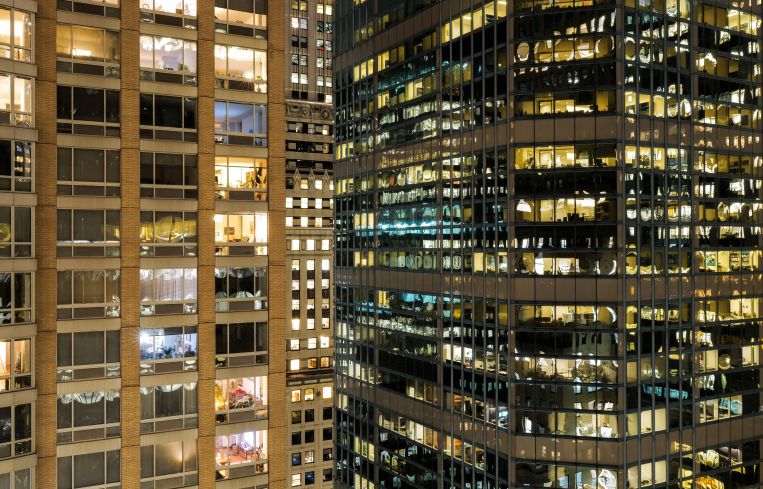

Distress Looms Over U.S. Office Heading Into Summer: Report

By Greg Cornfield May 24, 2024 5:15 pm

reprints

The U.S. office market appears to be stuck in a holding pattern riddled with weak demand and falling property values.

The nation’s top 91 markets saw a total of $7.49 billion in office investment sales through April, with assets trading at an average of $157 per foot, according to a report released this week by data firm CommercialEdge.

Washington, D.C., still leads the country in the highest year-to-date sales at $937 million, at an average of $345 per square foot, thanks largely to PRP Real Estate’s single-asset acquisition of Market Square for $323 million in the first quarter.

Miami saw $252 million in office investment sales through April at $279 per square foot. Miami also maintained its standing as the most expensive office market in the South in terms of asking rents, closing April with a $49 per square foot average, per CommercialEdge.

In Southern California, Los Angeles recorded just $182 million in office deals through April at an average of $359 per square foot. San Diego’s market saw $253 million in deals for $397 per square foot.

Nationally, the 18.8 percent vacancy rate in April was 210 basis higher than it was at the same point last year. Markets that are home to the tech industry have been hit the worst when it comes to occupancy. For example, San Francisco’s vacancy rate was up 650 basis points over the 12 months ending in April. Major life sciences and lab markets such as Boston and San Diego have also seen vacancies rise due to the recent spikes in lab and related office construction along with a rise in remote work.

Under-construction office space totaled 83.7 million square feet at the end of April, representing 1.2 percent of total stock. The pipeline measurement has shrunk by more than 50 percent in the past 18 months, as “starts have slowed to a crawl,” according to the report

Following the construction spikes in 2022 and 2023, office starts have been nearly nonexistent this year, with just 3.2 million square feet of new space breaking ground through the end of April, according to CommercialEdge. And none of the top Midwestern markets broke ground on office projects so far this year. However, Greater Boston still finished April with the most amount of space under construction in the U.S. at 13.9 million square feet.

“We anticipate that once interest rate cuts begin, developers will slowly dip their toes back into the water,” CommercialEdge’s report reads. “But, given the current state of office demand, it may be years until there is a meaningful uptick in office starts.”

Debt service coverage ratios — which measure the property’s income against its debt — have declined due to rising debt costs and expenses, and receding cash flows. CommercialEdge said the highly anticipated mega-wave of office distress has yet to materialize, but many markets are exposed to potential distress.

“Everyone has been asking, ‘Where is this wave of distress?’ ” Peter Kolaczynski, associate director at CommercialEdge, said in a statement. “The reality is that it didn’t materialize with extensions the last few years, but we are seeing an uptick, and this data shows the threat is still there in many areas.”

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.