Nation’s Top Industrial Markets Show Signs of Strength Amid Economic Adversity

By Abigail Nehring December 15, 2023 4:00 pm

reprints

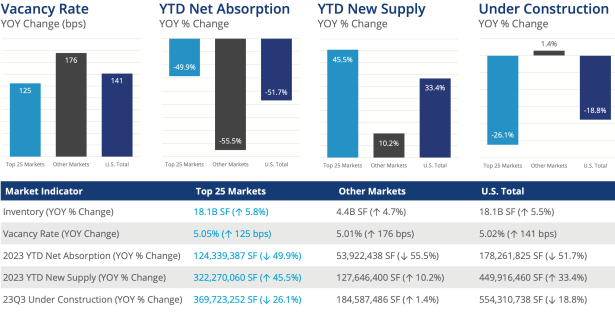

America’s top industrial boom towns are weathering the economic headwinds better than the national market as a whole, according to new research by Colliers.

Demand for industrial space nationwide has cooled this year as new construction and investment sales calm down. But the 25 most established markets have tacked on some 322 million square feet of new inventory in 2023 that tenants snapped up at a faster pace than the rest of the country, making those locales “a little more resilient than others,” said Colliers industrial research director Craig Hurvitz.

“Really, it’s returning to what we saw prior to the pandemic,” Hurvitz said. “Over the last two years, the amount of demand that we’ve seen for industrial space nationwide was just completely unparalleled. Never seen anything like it.”

Dallas-Fort Worth is leading the pack in inventory growth, adding 52.6 million square feet of industrial space as of the third quarter of 2023. Chicago comes second with 27.8 million square feet hitting the market.

Greater Los Angeles remains the nation’s top industrial market in terms of sheer inventory size — boasting 1.7 billion square feet — but it has grown at a slower rate of under 2 percent this year, or 25.7 million square feet of total new space. That fact helps account for Los Angeles’ 2.6 percent vacancy rate, the lowest in the country, and far below the 6 to 8 percent Hurvitz considers a “healthy” vacancy rate.

The New York City metro area remains the fourth largest industrial market in the nation, with 879 million square feet. It has gained a modest 8.5 million square feet this year and its vacancy rate climbed to 4.1 percent in the third quarter.

Vacancy rates in the industrial sector bottomed out in the first half of 2022 at 3.6 percent across the 77 markets Colliers tracks. Industrial took off at a frenetic pace during the pandemic, aided by e-commerce giant Amazon’s warehouse building boom, plus the growth of third-party logistics companies and data centers.

However, that has started to recede as climbing interest rates tempered the industrial market and Amazon closed, canceled or delayed opening 90 warehouses nationwide in 2022.

“When you deliver that much space and your demand drops off, that can cause an imbalance between supply and demand, which is exactly what we’re seeing in 2023,” Hurvitz said.

On the plus side, the construction pipeline has started to shrink so there won’t be a glut of space entering the market in the next few years as demand cools, Hurvitz added.

Vacancy rates have climbed around the country every quarter since the middle of last year, finally passing the 5 percent threshold in the third quarter of 2023.

The top 25 markets are on par with the rest of the country in that category, with an overall vacancy rate of 5.05 percent — just a hair above the national average.

Given their continuing inventory growth and strong demand, Hurvitz said the top markets are “showing their strength” and will continue to lead the charge in 2024.

Abigail Nehring can be reached at anehring@commercialobserver.com.