A Day in the Life of Aaron Hancock

By Brian Pascus December 5, 2023 12:10 pm

reprints

Aaron Hancock, vice president of Artemis Real Estate Partners, is a busy man. The 30-year old oversees a $500 million emerging manager investment platform, and quarterbacks the training of Artemis’ analysts development program. Hancock generously allowed Commercial Observer to tag along with him on Nov. 30 to see how hectic things can get for an up-and-coming commercial real estate executive.

Aaron Hancock, vice president at Artemis Real Estate Partners, typically gets up around 5 a.m.

He arrives at the gym in his building to work out five to six days per week, alternating days between weight lifting and cardio. The son of a U.S. Air Force pilot, Hancock defines himself as a regimented and organized person.

“The gym is in the building, which is a huge relief when it’s cold out,” he says with a laugh. “It helps with the morning routine moving quickly.”

He’ll then walk his dog, a mini cavapoo puppy, before making himself a smoothie for breakfast – same ingredients every morning: ice, frozen banana, greek yogurt, peanut butter, oat milk, protein powder, veggie supplement powder. Hancock leaves his apartment around 7 a.m. to commence his 45-minute commute into Manhattan.

7:45 a.m. to 8:30 a.m.

Le Cafe, 250 West 57th

This is Hancock’s quiet spot. Every morning at Le Cafe he orders a latte, takes a seat at a small table and catches up on work that he knows will be hard to finish once the swarm of activity starts at the office.

His most important responsibility is the firm’s $500 million emerging manager platform, which Hancock personally oversees, and is only one vehicle of a larger $2.5 billion fund. This pool aims to invest various buckets of capital into partnerships with minority-owned or women-owned developers and real estate investment firms.

“What we try to do is find those operating partners who are currently being overlooked,” says Hancock. “We think building those relationships is just good diversification.”

Artemis normally provides 80 to 90 percent of the capital on deals. Their partner provides 10 to 20 percent and serves as the local, boots-on-the-ground expert for that particular market or asset strategy.

9 a.m. to 9:45 a.m.

Artemis Real Estate Partners, 888 Seventh Avenue, 30th floor

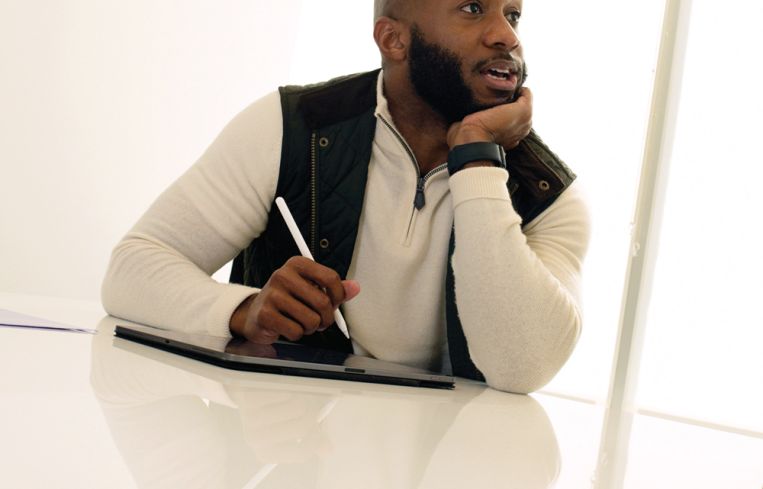

When he gets to his desk, Hancock begins applying himself to his time-tested organization strategy: Todoist — a streamlined, to-do list website — and his iPad, which he writes on religiously during meetings to remember all the moving pieces of his multifaceted career.

Shortly after 9 a.m., he sits down with Lauren Lefebvre, senior vice president and in-house counsel at Artemis, where the two discuss a potential development with a joint venture operating partner. The pair go over a legal document that Hancock drafted and that Lefebvre has provided edits on. Everything is in legalese.

“Some of the best learning I’ve done in my career has been when I’ve been sitting with Lauren and being able to be a sponge about legal structures as it pertains to real estate,” says Hancock. “When it comes to doing deals here, the deal folks are expected to be very knowledgeable and very in the weeds when it comes to the legal work.”

Not bad for a guy who never went to law school.

9:30 a.m. to 9:40 a.m.

Hancock walks over to the bullpen to have a quick chat with Elyshia Geter, senior associate at Artemis. Geter and Hancock discuss the cash-flow models on a hypothetical deal sheet a trio of young Artemis junior analysts completed the previous week.

Together, Hancock and Geter lead the analysts development program at Artemis: a two-year apprenticeship that teaches new employees the fundamentals of the business. It begins over the summer with a three-week training session in Washington, D.C.

“For the last three years or so, even while I was in grad school, I really led the efforts there, in person, down in D.C.,” recalls Hancock. “This past year, I was very fortunate to have Elyshia step up and take on a lot of that. It was really her show that she was running.”

10 a.m. to 10:30 a.m.

After getting some work done in his office, Hancock strolls over to the corner office of Anar Chudgar, co-president of Artemis. As sweeping, panoramic views of Central Park and Upper Manhattan frame the discussion, the two get down to brass tacks and go over ways the firm can update and streamline its database of different emerging manager platforms. More than 600 firms and hundreds of transactions are within the company-wide Excel database.

“We’re now trying to track all of our operating partners because of this lack of capital availability in the market,” says Chudgar. “We’re going to use this as a great opportunity, not only to touch base with our emerging manager and operating partners, but also provide more capital access to those groups.”

10:30 a.m. to 11:15 a.m.

Hancock now heads into another office. From the 30th floor, striking views of the skyscrapers of Seventh Avenue and Times Square open up behind Hancock as he holds court over Zoom with Tyson Pratcher, senior managing director at Artemis.

Pratcher was a senior adviser to Hillary Clinton when she served in the U.S. Senate. He also has experience as an attorney, investor and adviser to finance firms.

Hancock and Pratcher think through the next evolution of organizing the firm’s emerging manager platform, realizing that ongoing meetings will be necessary to determine the perfect software fit for their ambitions.

In less than three hours, Hancock has worn the hats of private equity, commercial real estate finance, commercial real estate law, development, and now big tech. It’s not even noon.

11:30 a.m. to 12:30 p.m.

La Esquina, 200 West 55th Street

Hancock heads out to lunch with Olivia Cherry, an associate on the capital raising team. Cherry is a former participant of the firm’s summer enrichment program (more on that soon), who has been mentored by Hancock for years.

Hancock believes mentorship helps young associates become better professionals by allowing them to feel working at Artemis is a career, rather than merely a job.

“It’s about reaching back and paying it forward,” says Hancock.

Hancock absolutely loves mentoring and teaching, and he especially cherishes his role as an advocate for young Black professionals.

“For me, I really enjoy being an advocate for people who look like me, whether it’s on the deal side, whether it’s working with Olivia, you name it, and I get to do that as a natural part of my job here at Artemis,” he says.

The pair sit down for tacos, green beans, chips and guac, and tortilla soup.

12:45 p.m. to 1:45 p.m.

Artemis Real Estate Partners, 888 Seventh Avenue, 30th Floor

Aaron and Geter reunite to take a Zoom meeting in the firm’s conference room with the three young analysts the firm recently hired.

This meeting is to review the hypothetical cash-flow models the trio have completed and that Hancock and Jeter discussed earlier. For the next hour terms like NOI, DSCR, waterfall, mill levy and IRR are bantered back and forth as various Excel formulas pepper the screen. Hancock and Geter shower the young professionals with Socratic questions and easy-to-understand explanations concerning the intricacies of commercial real estate finance.

“They have all the work that’s coming through their pod system, but we’re trying to be really intentional about augmenting that experience by providing them opportunities to build models from scratch,” explains Hancock.

2 p.m. to 2:45 p.m.

Hancock stays in the conference room and turns his attention to Artemis’ Summer Enrichment Program (SEP). Started 12 years ago, the SEP allows around 40 college students the opportunity each year to spend five weeks living in D.C. and working directly at firm headquarters in Chevy Chase, Md.

Here, young college students finishing their freshman years are given the chance to learn about the industry just as they reach the midway point of their undergraduate education.

“Our objective is simply to provide access and exposure to the commercial real estate industry, with the hope that these freshmen will consider real estate as a career path,” explains Hancock.

Hancock sits with the three Artemis’ leaders: Amanda Khazem, program lead, SEP; Lynda Anderson, training and development specialist; and Skylar Murphy, vice president. They discuss the first round of candidates who have applied to the 2024 program.

3 p.m. to 3:30 p.m.

Hancock returns to his office and commences a Zoom meeting with Ade Sanusi, vice president of The Integral Group, a Black-owned development firm headquartered in Atlanta.

The marriage between Artemis and Integral is the firm’s emerging managing platform in action. Integral has been developing and acquiring property — primarily multifamily — since 1993, but Artemis is their door into Wall Street’s world of capital. The two firms closed a $100 million ground-up, multifamily, affordable housing development this past July in the Carrollton submarket in Texas.

“I think they’re really indicative of the types of groups you can find out there if you just look where other people aren’t looking,” says Hancock. “Integral’s been around for 30 years, has an organization of hundreds of people, and has really pioneered the concept of mixed-income living in this country.”

3:30 p.m. to 11 p.m.

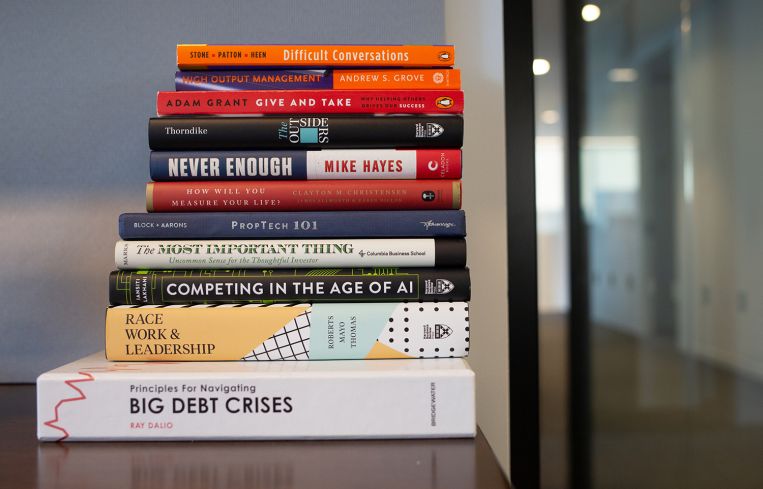

Once the meeting ends, Hancock sits back in his chair and exhales. His office is quiet but his mind is racing. For the next several hours, with his calendar finally cleared, Hancock will concentrate on the deals, developments, and acquisitions that are his responsibility at Artemis.

He’ll leave the office around 8 p.m. and make it back home by 9 for “Thursday Night Football.” A former cornerback at Cornell University, Hancock loves America’s Game and usually unwinds by watching football and sitting on the couch with his dog and girlfriend. He’ll check in on work a few more times, and then read a fantasy novel before bed — he’s slowly making his way through Robert Jordan’s 14-volume “Wheel of Time” series.

But by 5 a.m. the next morning, he’ll do this all again — and he wouldn’t want it any other way.

“This is a career. I wake up every morning and come to work and I love it,” says Hancock. “I wake up excited to come to the office and excited because I genuinely feel fulfilled.”