Lenders 2023: What Scares the Bejesus Out of Top Lenders Today

By Cathy Cunningham November 14, 2023 2:42 pm

reprints

The commercial real estate market has been dealing with its fair share of things that go bump in the night for some time now. COVID turned the industry upside down, and just when you thought it was safe to go back in the water, the dorsal fin of high interest rates approached at high speed.

Indeed, even Steven Spielberg couldn’t mastermind the unseen (yet firmly felt) marauding villain in today’s market, skulking in the shadows of buildings with the power to freeze transactions in their tracks, magically dilute investor confidence from 100 down to zero, and terrorize those in need of any kind of financing.

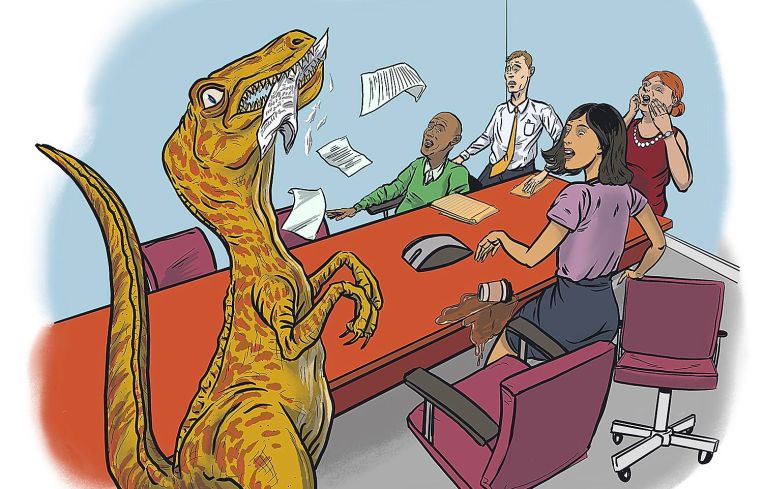

Now, we all tiptoe carefully through a dense forest of uncertainty and volatility, under the canopy of unknown property values, not knowing what may jump out of the foliage next — although some would likely prefer it to be a carnivorous dinosaur rather than Jerome Powell with news of yet another rate hike.

You’d think after all that our lenders have been through, not much would scare these tough gals and guys, though. Right? Well, not necessarily. Heck, they’re only human, and we all check for monsters under the bed before we close our eyes.

When we asked our lenders what’s fodder for their nightmares today, Bank of America’s Maria Barry said her REM cycle is sometimes disturbed by “rising rates, increasing costs, and pressure on federal and state housing subsidies to meet demand — it is very challenging to get the capital stack to balance in the current environment.” Thankfully — as the equivalent of a melatonin gummy, perhaps — “our clients and housing agency partners continue to be innovative in finding ways to make deals work.”

Powell’s subliminal presence hovers over several of our lenders like the ghost of Jacob Marley.

Barclays’ Steven Caldwell said “Higher for much, much longer” is the worry keeping him awake today. Meanwhile, in a house across town you may also find Wells Fargo’s Nipul Patel pacing back and forth in the wee hours over “the uncertainty around interest rates and borrowers’ ability to generate enough cash flow to cover debt servicing requirements.”

In the grander scheme of things, “the scariest things are always those out of your control,” Brookfield’s Nailah Flake reminds us. BGO’s Abbe Franchot Borok concurred, simply stating “the geopolitical environment” is what scares her, while Flake said “the geopolitical environment and its impact on the market are not getting more predictable.”

For Goldman’s Tim Richards, his blood is currently curdled by “the multifamily properties that were purchased by operators who syndicated out their equity, borrowed at high LTVs, and used floating-rate debt to finance their acquisitions.” Additionally, the element of surprise doesn’t sit well with Richards, and some borrowers have let him — and likely his game nights — down. “I honestly didn’t have interest rate cap purchasing on my ‘Reasons in 2024 to Return Keys to a Lender’ bingo card,” he sighed.

UBS’s Chris LaBianca isn’t afraid of monsters, but swans sure don’t float his boat — black swans in particular. “Having been through a few cycles, most of the things you need to prepare for you have seen before. Those can be identified, planned for, and you can do your best to try and mitigate the impact. It’s what comes out of left field that catches you without a plan, and typically requires quick thinking and decision-making,” he added.

Ultimately, in every scary movie the baddie has to be overcome, and if they can’t be overpowered, they need to at least be put in their place. Acore’s Tony Fineman simply said “I am not scared,” so our money is on Tony, and also KKR’s Joel Traut as this epic market tale plays out.

“Fortunately, there is very little that scares us to any material level,” Traut said. “While we’d prefer a lowerrate environment and more confidence in underlying fundamentals, we invest with humility in all market dynamics and focus on lending into defensible capital structures. One of the worst mistakes an investor can make is to allow emotion — whether exuberance or fear — to overwhelm the discipline that is required to invest.”

OK, everyone. Let’s keep calm and carry on. (But let’s also stand behind Joel Traut and Tony Fineman until this volatility subsides. They’ll protect us all.)