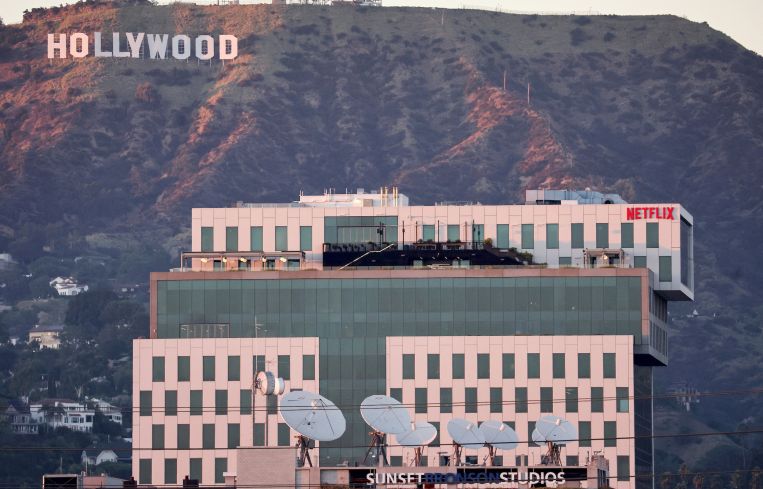

Hudson Pacific Says Hollywood Strikes Have Cost It $100M

L.A.-based REIT known for production studios reports lower revenues, higher losses after third quarter. Its soundstages have lowest lease rate since 2017.

By Greg Cornfield November 3, 2023 5:00 pm

reprints

It’s dark times for Hollywood studios when there’s no lights, cameras or action.

Due to six months of dealing with historic labor strikes, Victor Coleman — chairman and CEO of Los Angeles-based Hudson Pacific Properties — said the REIT is looking at $100 million in losses to its earnings this year (before interest, taxes, depreciation and amortization) because most productions have shut down. Although the writers strike ended in September, actors remain on the picket lines instead of in soundstages.

HPP President Mark Lammas explained during the firm’s third-quarter earnings call this week that the company estimates its studio portfolio could potentially generate as much as $120 million of net operating income in 2023. However, because of the strikes, its studio businesses have made just $10 million in NOI this year.

On average over the trailing 12 months, the in-service studio portfolio was 83.5 percent leased after one tenant vacated six soundstages at Sunset Las Palmas in Hollywood due to the strikes. It’s the first time HPP has ever had a vacancy in the history of owning the asset.

“Underscoring the uniqueness of this situation, this is the lowest lease percentage we’ve had at that facility during our ownership since 2017,” Lammas said.

But Coleman said the strikes are not a sign of a new trend. Rather, “this is a moment in time.”

“My guess is the parent company that left us [at Las Palmas] will be the first company that’s going to call us and want to put a show in there going forward (once the actors’ strike is resolved),” Coleman said. “When the strikes are over, we will see a tremendous upswing in activity in all forms and functions.”

HPP’s studios made $27.9 million in revenue for the third quarter, down 40.5 percent from the $46.9 million reported after the same period last year, prior to the historic strikes. HPP’s net losses for the quarter were more than twice what was reported after the third quarter last year.

“With the writers’ strike resolved as of September, we’re closely watching the progress of the SAG-AFTRA strike and discussions with AMPTP,” Coleman said, referring to the actors union and the trade group for production companies. “Both sides appear motivated to get a deal done soon. We’ve seen a pickup in pre-production activity on our lots related to in-place leases as well as an increase in tours, especially for production offices used by writers. Once the actors reach an agreement, we expect to experience an increase in stage bookings, positively impacting both occupancy and rental revenue as productions begin to prep.”

He added that, assuming that the SAG-AFTRA strike resolves by mid-November, Hudson Pacific expects production levels to return to normal by the second quarter next year.

Hudson Pacific has still continued to expand its studio operations despite the strikes. The firm entered into a joint venture with Vornado and Blackstone for the leasehold interest for Pier 94 in Manhattan, and will develop and operate a six-stage, 232,000-square-foot purpose-built Sunset Studios facility. It is expected to be completed by the end of 2025.

“New York has been a high-priority marketplace for expansion for our Sunset Studios brand, due to the established talent base production infrastructure and recently extended and expanded tax credits,” Coleman said. “We expect our new footprint in the city to drive further demand for and revenue from our existing New York City businesses, building a full-service platform in a city akin to what we’ve done successfully in Los Angeles. … Our vision is an end-to-end production solution.”

Meanwhile, HPP’s Sunset GlenOak Studios development near Burbank is set to be completed at the end of this year.

Including its office portfolio, Hudson reported $119.3 million in total net operating income in the third quarter compared to $155.3 million last year. It reported $26.1 million in funds from operation compared to $74.1 million in the third quarter last year.

HPP’s total revenue in the third quarter was $231.4 million as the firm continues to focus on deleveraging. Its office portfolio ended the quarter at 81.3 percent occupied and 83.1 percent leased, with the difference primarily attributable to Block’s 469,000-square-foot lease expiration at 1455 Market in San Francisco, as well as the sales of 3401 Exposition and 604 Arizona in Los Angeles. For reference, the firm reported a 94.8 percent lease rate in the first quarter of 2020 before the pandemic.

Coleman added that the firm has two more office properties and a potential third they expect to sell before the end of this year, but he declined to disclose which properties. HPP also executed 53 new and renewal leases totaling 519,167 square feet in the third quarter.

“It’s still taking considerably longer to get leases signed versus pre-COVID,” Lammas said. “This is especially true for new deals, and, as a result, approximately 80 percent of the leases we signed in the third quarter were renewals.”

Colmane said HPP expects to begin benefiting next year from more companies enforcing in-office policies. He said foot traffic and public transit ridership are growing along with a renewed public sector focus in HPP’s markets on addressing crime and safety and implementing more pro-business policies. But most of the improvements are seen in markets like Seattle and Vancouver as opposed to in Los Angeles.

“Because we have a strike here, and we are a media, entertainment-related city in Los Angeles, where we’re sitting right now, things have slowed dramatically until we get back up and running,” Coleman said. “So it’s not just the studio business. It’s the overall industry itself for people growing in real estate.”

HPP reported $555 million of total liquidity, with no loans maturing until the one secured by One Westside, which is fully leased to Google through 2036, matures in December 2024.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.