Housing Construction Data Puts Adams’s ‘Moonshot’ Goal Off the Table for 2023

By Abigail Nehring November 17, 2023 6:32 pm

reprints

It looks like New York City will fall far short of Mayor Eric Adams’s “moonshot” goal of building 50,000 new housing units each year, according to a new report.

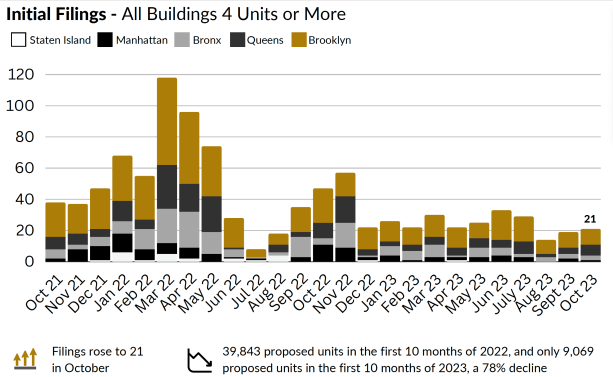

Despite a modest uptick since the end of the summer, housing construction in the five boroughs remains sluggish in the second half of 2023, with starts down 78 percent compared to last year, according to an analysis of building permits by the Real Estate Board of New York (REBNY).

Construction crews commenced work on 9,069 new housing units on 242 sites across the city between January and the end of October, far fewer than the 39,843 units that builders had gotten underway by this time last year, REBNY found.

That puts the city on pace to add 11,000 new units to the housing pipeline by the end of the year, far short of the 50,000 units that must be built annually for New York to meet Adams’s goal of half a million new units over the next 10 years.

REBNY has pinned the blame for the housing construction slowdown on the loss of the 421a tax abatement program. The real estate trade group has been pushing lawmakers to revive some version of 421a since it expired in June 2022.

Those hopes were dashed in the spring legislative session in Albany this year.

“The housing production was declining up to that point, and once nothing was realized in the budget at the end of June, it worsened,” REBNY spokesperson Chris Santarelli said. “It was bad before then, but it just continued to be a race to the bottom.”

Gov. Kathy Hochul has issued executive orders to spur affordable housing development in the state, but they have far more limited impact than originally proposed.

Yet critics say 421a enabled luxury construction with only a portion of affordable units, and that many were priced higher than an average family could reasonably afford. Also, a progressive coalition led by Comptroller Brad Lander pushed back against some of REBNY’s claims and found that when 421a expired in 2015 it did “not necessarily impair housing production in the short term,” according to a report released in March 2022.

REBNY’s data includes foundation filings for new buildings containing at least four dwelling units. REBNY data director Keith DeCoster said the research team chose this metric after hearing from members that it was “a real signal that a developer is serious and it’s highly likely you’re going to move forward with the project.”

The sharpest drop in housing construction since REBNY started keeping track in 2021 occurred in December 2022, which suggests there may be other culprits behind the construction slump in addition to the loss of 421a.

“Part of it can be seasonal, and there’s also financing challenges today,” said DeCoster. “We’re not saying that it’s all due to the expiration of 421a.”

DeCoster pointed to the historic 2019 state legislation on rent-stabilized housing and the overall slowdown in land acquisition as additional factors.

Abigail Nehring can be reached at anehring@commercialobserver.com.