Proptech Startup HqO Secures $50 Million Series D Funding

Koch Real Estate Investments led the raise, which the real estate experience platform says will go toward its growth

By Philip Russo October 18, 2023 10:00 am

reprints

Another day, another massive funding for a proptech startup.

On Wednesday, real estate experience platform HqO announced it has secured “more than” $50 million in Series D funding in its effort to take advantage of “a fundamental evolution in the real estate economy, as space has moved from a required commodity to a service, and now to an experience,” according to the company’s statement.

Koch Real Estate Investments, a subsidiary of Koch Industries, led the funding round, which also included participation from HqO’s existing investors, as well as venture capital and commercial real estate firms Accomplice, Insight Partners and The Related Companies. The additional capital brings the company’s total funding to more than $200 million.

The $50 million funding will be used to expand what HqO sees as merger and acquisition opportunities for the company, said Chase Garbarino, its co-founder and CEO.

“There’s too many proptech solutions chasing too few problems,” Garbarino said. “And we have a lot of good entrepreneurs who have created really good features, but they’re not full products.”

Bringing such products together on the HqO platform for end-to-end solutions matches the converging interests of property owners and tenants, he added.

“These different constituencies, asset managers and occupiers, really are starting to come together,” Garbarino said. “And I think historically, proptech has been relatively single-threaded on solutions for one persona. It’s our belief that, collectively, there needs to be more end-to-end solutions that really tie together the whole experience. In order to do that we need to become a multi-product platform.”

Koch leading the round is among the latest examples of the energy- and mining-based giant’s more than decadelong campaign to promote its “green” investments, some of which have been charged as deceptive “green washing.”

When asked about such accusations, Garbarino declined to comment, but said that Koch became an investor through his friendship with Justin Wilson, managing director at Koch Real Estate Investments, who is joining HqO’s board of directors.

“Justin was previously with The Gores Group and before that he was at SoftBank doing technology investments,” said Garbarino. “Justin and I go back several years. He’s an incredibly thoughtful and knowledgeable proptech investor.”

As part of the funding announcement, Wilson reaffirmed Koch Real Estate Investments’ focus on growing proptech in the industry: “As the real estate industry continues to radically evolve, we firmly believe that its future lies in the convergence of innovative technology, data and customer-centric experiences,” Wilson said in a prepared statement. “By developing cutting-edge technology and tools that prioritize user sentiment, HqO is not only adapting to the rapidly changing real estate industry, but driving its progression. With HqO’s vision and our investment, we are confident that together we are building a more transformative ecosystem.”

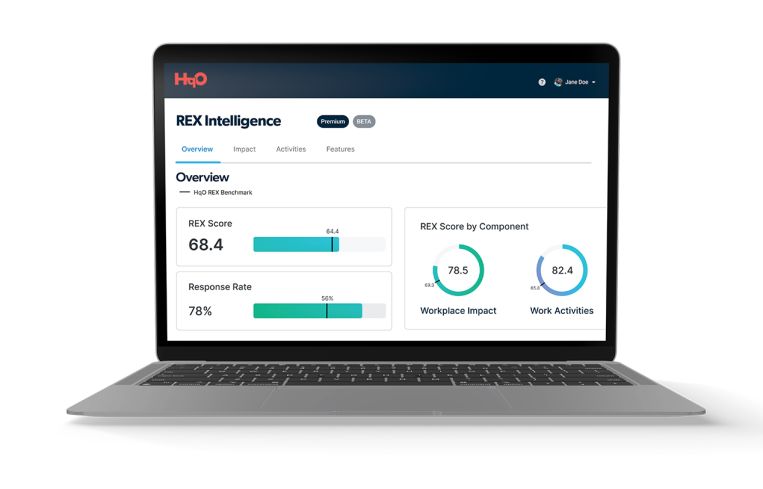

Along with the funding announcement, HqO said it has launched the HqO REX Platform, which it claims is the first end-to-end experience custom-built for clients. The platform addresses pain points across the real estate ecosystem for owners, operators and occupiers alike, as users are able to gain immediate access to global real estate insights from more than 1.3 million employees and over 8,000 workplaces.

According to HqO, the platform’s suite of products includes the REX Assessment, a tool for quantifying employees’ work styles, preferences and overall satisfaction; the REX Score, which quantifies the value operators and occupiers get from a building using data from the REX Assessment to show the success of customers’ experiences at a property; and the REX Index, the industry’s first global real estate user experience indicator, benchmark and tool for certifying and exploring properties through the lens of people’s experiences, ranking landlords and occupiers with REX Scores.

Philip Russo can be reached at prusso@commercialobserver.com.