Capital One Closes $43M in Fannie Mae Loans to Refinance SoCal Apartments

By Greg Cornfield August 2, 2023 10:40 am

reprints

SC Development has secured two Fannie Mae loans totaling $43 million from Capital One to refinance two multifamily communities in Orange County, Calif., Commercial Observer can first report.

The separate 10-year, fixed-rate loans feature interest-only payments for their entire term. The loans replace two Capital One loans maturing this year.

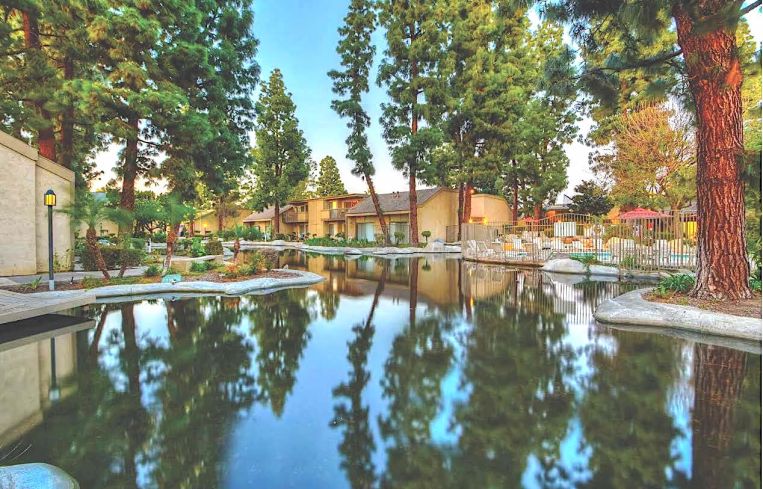

The multifamily portfolio features the 271-unit Streams and the 222-unit La Villita-La Costa, both in Fullerton, Calif. Both communities have a swimming pool, spa and fitness center. SC Development has maintained both properties since they were constructed in the mid-1970s.

“Refinancing into the current loan structure enables us to continue meeting our business and property-level goals,” Paul Conzelman, president at SC Development, said in a statement.

Agency Finance’s Greg Reed, Kristen Croxton and Tina Quirin originated the transactions.

“Both properties support Fannie Mae’s focus on preserving affordable and workforce housing, providing hundreds of mission-driven units to the community,” Quirin said.

McLean, VA-based Capital One provides multiple financing solutions for multifamily investors, including Fannie Mae, Freddie Mac, and FHA programs nationwide. Along with its subsidiaries, the company had $343.7 billion in deposits and $467.8 billion in total assets as of June 30.

Gregory Cornfield can be reached at gcornfield@commercialobserver.com.