Office Suffered on Power 100 2023. Here’s Who Took Its Place.

A couple of Power 100s ago, a former honoree who shall remain nameless called this editor in a huff to gripe about our rankings:

All you guys care about is office, he complained. Everybody on the top of the list is office! What about retail?

It was not a completely misguided critique. But that is not to say Commercial Observer should have taken this power player’s advice and simply swapped out office for retail, per se. What about housing? Industrial? Data centers? Hospitality? Life sciences? Health care?

When this particular conversation happened, the urban office market appeared very different than it does now. New York, in particular, looked relatively invulnerable. A small number of companies and families owned what everyone assumed was an extremely safe commodity that had long been paid off and was now sitting there printing money every month for its owners.

Truly, something profound has happened.

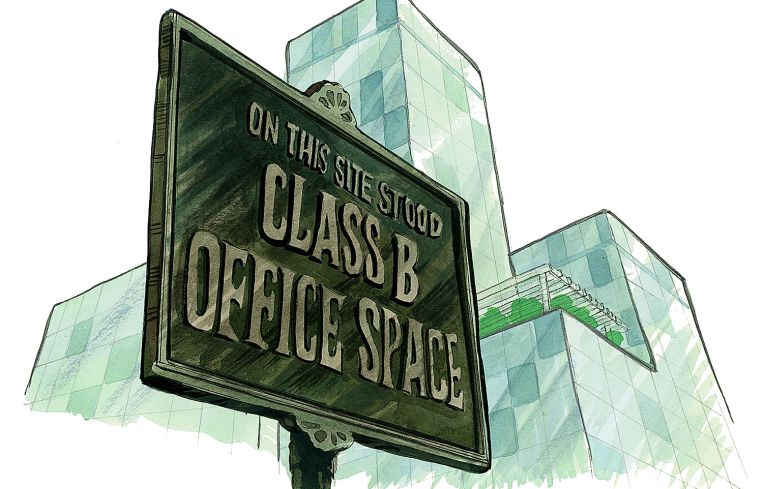

It has become cliche to say that COVID didn’t change market trends, it only accelerated them. Perhaps. But, whatever the reason, the office market isn’t nearly as stable as it was three years ago. If one were to look at the stock prices for the major office REITs, it’s a virtual slaughterhouse of red ink. Nearly every single major office owner in New York, Los Angeles, Chicago and San Francisco watched their stock tumble by double digits. SL Green’s stock price is down by two-thirds from a year ago; Boston Properties saw a 56 percent decline; Vornado put a pause on its multibillion-dollar Penn Station plans; Blackstone handed back the keys on 1740 Broadway; Paramount had to stave off takeover attempts.

This is serious, secular change.

This is the reason that a lot of the office owners that seemed to have much of the Power 100 list to themselves in past years have come down quite a bit in our ranking. (Or, in some cases, been removed from the list entirely … with, always, the chance to come back in the future.)

Naturally, just because office has suffered does not mean that it is gone. Nor does it mean that its success doesn’t vary with locale. In South Florida, for instance, the office market is younger and a lot less overbuilt than it is up north, and the companies coming for the sun, the tax breaks, and myriad other reasons need space.

All of which is to say, the plot surrounding office has twisted in a bad way in our estimation. But the story isn’t over.