Bronx Real Estate Thrives Despite Uncertain Market

By Rebecca Baird-Remba March 1, 2023 11:48 am

reprints

The New York City rental market is hotter than it’s ever been, so it’s no surprise that the Bronx — with a wealth of affordable and rent-regulated housing — has a strong residential and investment sales market.

The borough has industrial and retail space that’s been trading at record levels during the pandemic. So much so that 2022 saw a slight slowdown in industrial property sales, as high prices for warehouse space collided with high interest rates. Both the dollar volume and number of industrial transactions dipped 8 percent last year compared to 2021, according to Ariel Property Advisors’ annual report. Still, warehouses and truck depots in the northernmost borough were trading for their highest prices to date, at $421 per square foot.

At the same time, the residential investment sales market across the city took a hit, as many buyers and landlords shied away from expensive financing. However, the Bronx’s array of local, state and federally subsidized housing has actually remained more attractive to investors than the unsubsidized rent-regulated housing common across the city. Properties with Section 8 have a reliable source of income — via vouchers or project-based funding — and are often eligible for tax abatements that run-of-the-mill rent-stabilized or market-rate properties are not.

“The demand for those rent-stabilized assets is coming down,” said Jason Gold, a Bronx investment sales broker at Ariel. “Investors are looking for higher cap rates, higher yields, usually assets with not too much deferred maintenance. Affordable housing is a safer asset, because there are mechanisms for government financing.”

Properties with agency financing — typically from the federal Department of Housing and Urban Development — seem like safer bets for investors trying to navigate the choppy waters of inflation, rising operating costs and skyrocketing interest rates.

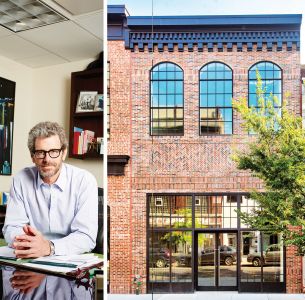

Camber Property Group, for example, owns a number of Section 8 and affordable properties in the Bronx.

“In the event that someone loses employment or has COVID, the Section 8 picks up the part of the rent that they’re unable to pay,” said Rick Gropper, the firm’s principal. “It provides the rent in order to continue to operate the building. As collections dipped across the city, we’ve seen in our Section 8 buildings the collections there have remained strong.”

He added that Camber has “investors that are impact-driven and really see the mission of providing good, clean, state of the art affordable housing and appreciate the security they’re getting from the government. We’re not susceptible to the same market forces as a market rate developer.”

Camber has continued to acquire affordable housing despite the headwinds in the investment sales market. It picked up two federally subsidized Section 8 properties in the Bronx — at 1695 Grand Avenue in Morris Heights and 2105 Daly Avenue in West Farms — for $56 million in January.

“The overall market across the city is down right now, because of costs like insurance, utilities and other operating costs,” said Gropper. “There’s been a resetting of expectations on a lot of the sellers, and there still needs to be a resetting because of the cost of financing. We’ve gotten more selective and we’ve been reaching out to owners who have some level of distress or want to make a life change. We still have positive leverage to purchase at a basis where it makes sense.”

However, the Bronx’s subsidized stock and cheaper prices helped insulate it from the larger slowdown. Multifamily investment sales in the borough were up 16 percent year-over-year in 2022, to $1.2 billion, according to Ariel’s report. Bronx apartment buildings traded for their highest price per square foot — $195 — since the rent laws changed in 2019. And one of the largest sales in the Bronx last year was a 477-unit portfolio of Section 8 units — located variously in Morrisania, High Bridge and Belmont — for $107.5 million. The sale — from Joel Gluck’s Spencer Equity to a joint venture led by Gilbane Development Company — also included a 525,000-square-foot development site adjacent to one of the apartment buildings at 280 East 161st Street in Morrisania.

Development sites also traded well in the first half of 2022, until the 421a tax abatement expired on June 15. The average price per buildable square foot, $93, hit its highest level on record, while the overall dollar volume of sales declined 44 percent year-over-year to $329 million.

The South Bronx remains a hotbed of development activity, thanks to a crop of rezonings completed back when Michael Bloomberg was mayor. The industrial swath of Mott Haven between the elevated highway and the Bronx River has sprouted a number of new residential buildings in the past few years. One such property — a warehouse that once housed Zaro’s Bakery — sold in January 2022 for $35 million to MSP Capital Investments. Roughly 305,000 square feet of apartments, or 480 units, can be built on the site.

The neighborhood is also home to luxe projects like Bankside, Brookfield’s sprawling residential megaproject by the Third Avenue Bridge and the Harlem River. The first phase — the three-tower, 450-unit Third at Bankside complex — started welcoming tenants last year. When the entire project is finished, Bankside will include 1,350 apartments, a 34,000-square-foot waterfront park and 13,000 square feet of retail.

Further north, just past the Madison Avenue Bridge, Lightstone Group controls 355, 399 and 375 Exterior Street, where it had previously planned to build 2,000 apartments. It unloaded one of its waterfront properties at 325 Exterior Street last year to Verizon for $75 million, and it has been trying to sell the rest of the Exterior Street lots.

A few blocks further north, next to the 145th Street Bridge, is L+M Development Partners’ and Type A Projects’ $349 million, 530,000-square-foot mixed-use Bronx Point project. The first phase will include 542 permanently affordable rentals along with the Universal Hip-Hop Museum. L+M expects to finish work on the building at 475 Exterior Street in six months.

The rest of the development will include a 2.8-acre park and 400 more apartments, with 100 affordable co-ops and 300 low- and middle-income rentals. The for-sale apartments would be financed through the city’s Open Door program, which sets the sale prices and income restrictions for the affordable co-ops. Spencer Orkus, L+M’s president of development, said he expected the co-ops would be priced for middle-income New Yorkers, but wasn’t entirely sure yet.

“We want to create a situation where people can allow their apartment to appreciate and build wealth while also keeping these apartments available to the middle class,” said Orkus. He noted that the current version of the program only allows apartments to appreciate in value by 2 percent per year, which may not keep up with the market. “If the value of people’s apartments don’t increase, they’re going to be reluctant to keep it in good condition. It’s hard to be able to put money into an apartment if you’re not going to be able to sell the unit for a higher price to recoup the investment,” Orkus added.

L+M is also working on a few other affordable rental projects in the Bronx, including a 170-unit supportive and low-income housing project called Williamsbridge Gardens in Williamsbridge, and a 250-unit project called River Commons at Jerome Avenue and 168th Street in University Heights.

But L+M isn’t the only firm doing income-limited co-ops in the Bronx. Camber Property Group is working on an affordable home ownership project at Stevenson Commons, an affordable housing complex in Soundview. The original Soundview Commons complex consists of nine Mitchell-Lama towers with 948 apartments, and Camber went through a rezoning process to build several new towers on parking lots in the existing development. The first phase of the 650-unit project will be a series of three- to six-story co-op buildings, again financed through Open Door. The later buildings will include affordable rentals.

Overall, developers feel that Bronx elected officials support new development. Indeed, Bronx Borough President Vanessa Gibson said as much at a recent luncheon hosted by the Real Estate Board of New York, where she discussed housing policy with the city’s four other borough presidents.

“If we are going to be the ‘City of Yes,’ we have to say yes,” said Gibson, who oversaw the Jerome Avenue rezoning during her tenure as a Bronx councilmember. “But we need to look at what a neighborhood needs. Is it affordable housing or is it pathways to the middle class by building condos and co-ops? Two-, three- and even four-bedroom units. When we are building this housing it needs to be built to last for the next 50 years. We want to create those pathways to the middle class and the way to do that is with affordable housing.”