Presented By: Nuveen Real Estate

Essential Need for Housing Means Demand Is Steady Throughout the Economic Cycle

By Nuveen Real Estate November 7, 2022 8:00 am

reprints

The affordable housing sector remains an attractive strategy within real estate given the sector’s economic resilience compared to other housing sub-asset classes. The essential need for housing means demand is steady throughout the economic cycle, including recessionary environments. Regular income supported by strong market demand and high barriers to entry offer stability as opposed to traditional real estate investments. An added benefit is the ability to demonstrate direct social and environmental impact with favorable financial returns.

Favorable relative value

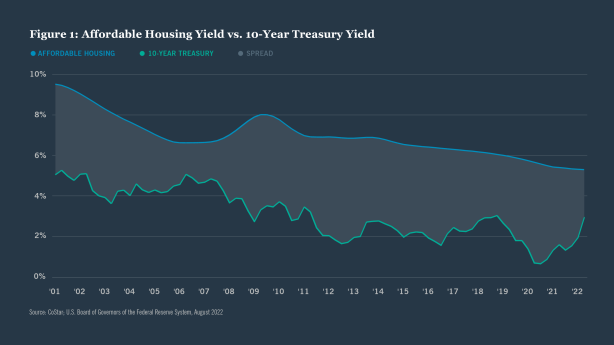

Affordable housing investments have provided a favorable yield for investors throughout the economic cycle. These yields have been higher relative to that of 10-year Treasuries over the last two decades

and compared to traditional real estate sectors for the majority of the last two decades.

Since 2001, the spread of affordable housing yields to 10-year Treasuries has averaged 384 basis points.

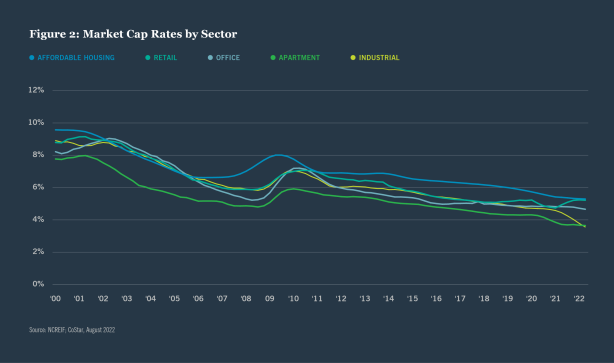

Throughout the last real estate cycle, cap rates for the majority of commercial real estate sectors have continuously compressed. For commercial real estate investors targeting higher-yielding investments, affordable housing investments present an attractive alternative to most commercial real estate sectors, including market-rate apartments.

Demonstrated resilience across economic cycles

Affordable housing investments also offer durable income streams for investors, which have demonstrated resiliency even throughout volatile economic environments.

Given that a large portion of housing market targeting a lower area median income (AMI) profile is backed by the government (e.g. Section 8), risks are largely mitigated as the government makes direct payments to the property owner. This support can provide stability in rent collections, a key advantage differentiating this segment of the rental market from conventional market-rate apartments. For example, when tenants residing in rent-subsidized housing lost jobs during the early innings of the COVID-19 pandemic, the government stepped in to assist with rent payments.

While many renter households are still financially recovering from the COVID-19 pandemic, the current inflationary environment is now pressuring renters and exacerbating the rental affordability crisis.

However, rent increases in a large portion of the affordable housing market, like the Low-Income Housing Tax Credit (LIHTC), are directly linked to AMI increases. These rent increases are on a two-year lag to income data, allowing affordable housing owners to maintain rents that cover growing expenses throughout inflationary periods, and avoiding immediate pressure on tenants amid other living expense rises.

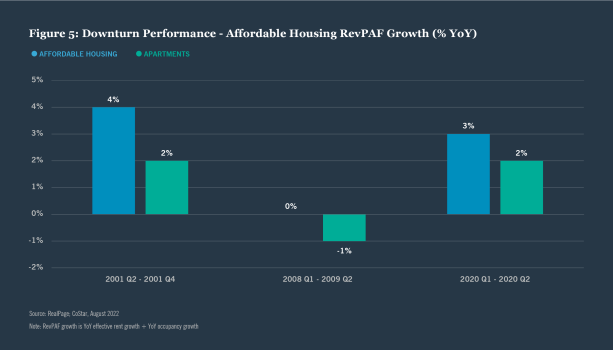

Affordable housing has shown a resilience during recessionary environments, as rents are not typically adjusted downward like market-rate apartments, further exhibiting this sector’s durable cash flow compared with other housing.

As outlined in our previous report, “Affordable Housing: The need for affordability preservation,” affordable housing demand remains strong. Not only are units not available today to meet the existing demand, but over 1 million units are at risk of losing their income, with rent restrictions over the next decade ultimately exposing those communities to unrestricted rental increases and displacement.

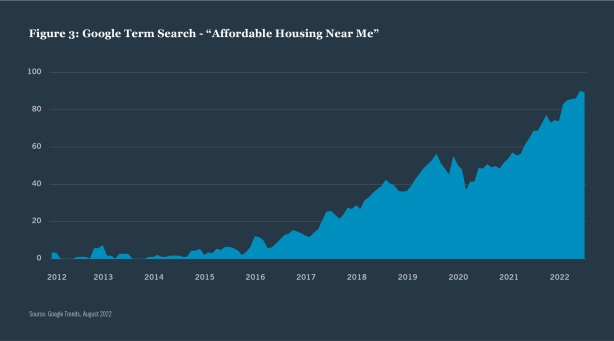

Google Search Trend data indicates that the search for “Affordable housing near me” in the U.S. has grown exponentially over the last decade, further solidifying the demand for this segment of the rental market.

Given the lack of supply and outsize demand, properties restricted to lower-income renters have boasted higher occupancy and less volatility than traditional apartments.

Demand for more affordable housing increases during recessionary environments as renters’ incomes drop and renters are priced out of higher-class, market-rate apartment units, further emphasizing the demand in place. Accordingly, throughout the last three economic downturns, affordable housing rent growth and occupancy growth outperformed traditional apartments.

Conclusion

Affordable housing investments can offer strong cash flows in a resilient sector and in challenging economic environments. Outsize demand for affordable housing, coupled with limited supply, positions the sector to have strong occupancy relative to other rental housing subtypes for the long term. While conventional market-rate apartment demand is partially driven by economic and employment growth, there is consistent demand for affordable housing throughout the economic cycle.

Given the government’s role in guaranteeing rent payments for a large portion of subsidized renters, we believe affordable housing is a favorable portfolio allocation decision.