Stonehill Originates $42M for Columbus Hilton Property

By Andrew Coen August 5, 2022 10:38 am

reprints

A joint venture between Indus Hotels and Schottenstein Property Group has landed a $41.8 million debt package to refinance and implement green energy upgrades at a Hilton-branded hotel in Columbus, Ohio, Commercial Observer has learned.

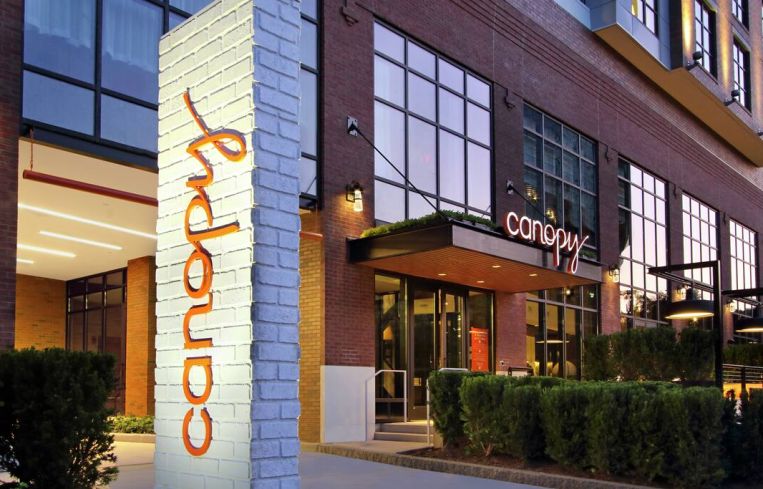

Stonehill originated a five-year, $26.3 million, fixed-rate bridge loan for the JV to refinance Canopy By Hilton Columbus Downtown Short North, a 167-key hotel that opened in July 2019. The lender, which is affiliated with the Peachtree Hotel Group, also originated a $15.5 million Commercial Property Assessed Clean Energy (C-PACE) loan with a 25-year term to finance recent energy improvements made to the property.

“We were able to do the senior loan and PACE together and create a fixed-rate deal. And given rate volatility right now and the hedging costs that are included in doing floating-rate bridge loans, being able to do fixed-rate on hotels is extremely attractive,” said Jared Schlosser, head of originations at Stonehill. “The hardest thing is to find a senior lender that will consent to PACE, and us being able to do both of it makes a one-stop shop attractive.”

Located in Columbus’ Short North Arts District at 77 East Nationwide Boulevard, the Canopy by Hilton hotel offers three flexible meeting spaces totalling 1,950 square feet, a business center and a fitness center. It is two blocks from the Greater Columbus Convention Center and about three miles from Ohio State University.

The hotel’s occupancy is trending upward, according to Schlosser, and it should be positioned for continued strong growth as the Columbus convention industry bounces back from the COVID-19 pandemic. In addition to attracting business travelers, the hotel also takes in visitors for sporting events involving Ohio State and the National Hockey League’s Columbus Blue Jackets.

Schlosser said he is bullish on the hospitality sector overall and sees revenues and occupancies up across Stonehill’s portfolio. He said newer hotels in strong growth markets like Canopy by Hilton Columbus Downtown are in an especially strong place to succeed.

“Certainly, there’s still some issues on the expense side, but I think right now is a good time to be in these types of newer, well-positioned assets given that the performance is increasing,” Schlosser said. “Being in an asset that was delivered in 2019 versus an older asset is pretty attractive.”

Officials at Indus Hotels and Schottenstein Property Group did not immediately return requests for comment.

Andrew Coen can be reached at acoen@commercialobserver.com.