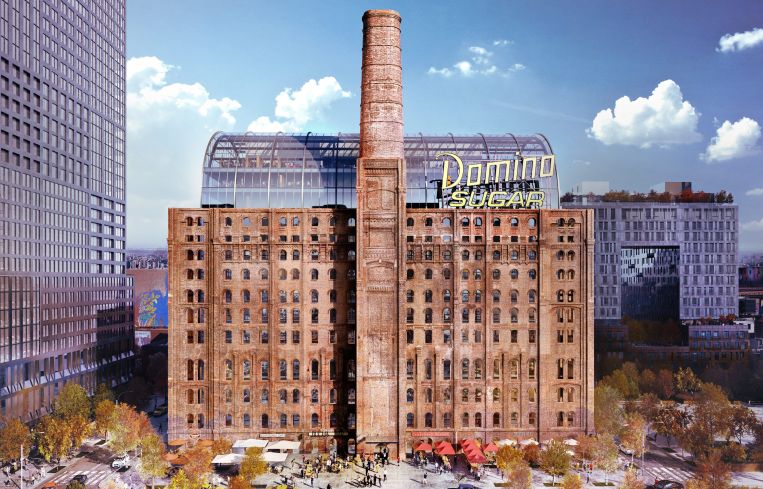

M&T Bank Provides $80M in Financing for Two Trees’ Domino Sugar Refinery Project

Two Trees Management has secured $79.8 million in financing for its Domino Sugar Refinery project in Brooklyn, according to property records filed on Monday.

M&T Bank provided a $43.8 million project loan plus a $36 million building loan for the buzzed-about Williamsburg development.

Two Trees bought the 11-acre former sugar refinery factory, at 292-314 Kent Avenue, from The Community Preservation Corporation (CPC) for $185 million in 2012.

The original plan was to redevelop the designated landmark by building 2,200 new apartments in four towers over 50 stories in 2013. Under Jed Walentas‘ leadership, Two Trees turned to SHoP Architects for a different proposal in the same year. The developer added more than 600,000 square feet of commercial space, increasing the overall square footage of the site by 10 percent, according to a 2013 report in Brownstoner. The renovation was priced at $250 million by David Lombino, Two Trees’ managing director for external affairs, and is expected to be completed next year, with CBRE marketing the site’s 460,000 square feet of rentable office space.

“We are proud to continue our lead role with Two Trees in financing the transformative Domino Sugar redevelopment,” Matt Petrula, EVP and senior group manager at M&T Bank, told Commercial Observer. “You only need to look at Two Trees’ leasing accomplishments and their intimate understanding of the Brooklyn market to recognize their continued success in the commercial arena. For M&T, this project is an example of our ability to craft tailored solutions to meet client needs.”

Two Trees officials declined to comment.

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.

Emily Fu can be reached at efu@commercialobserver.com.