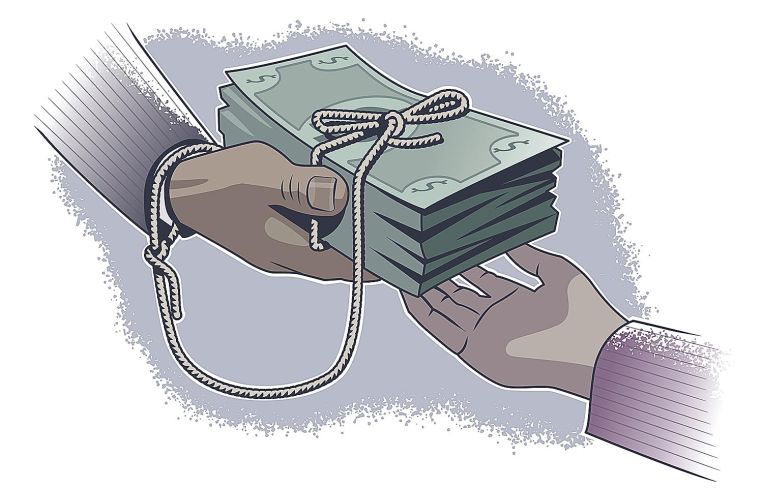

Commercial Real Estate Attorneys Drag Deals Over the Hump in a Bear Market

By Andrew Coen August 1, 2022 11:40 am

reprints

As deal volume slows dramatically amid interest rate hikes and other disruptions, commercial real estate lawyers find themselves busier than usual finding financing sources and doable timelines for their clients.

It’s a fraught environment. Many clients are pausing deals, or even walking away from some altogether, as sponsors contend with higher borrowing costs brought on by higher interest rates.

Laura Swihart, a partner at Dechert, said she would be surprised if transaction volume picks up anytime soon to the busy level it was the last two years, even as market stakeholders adjust to “a new normal” with valuations and interest rates.

Swihart, who co-chairs Dechert’s global finance and real estate practice groups, said attorneys can play a unique role in the current market by helping to craft more outside-the-box deals involving mezzanine loans, preferred equity or private label CMBS.

“When things are going gangbusters, you throw the sausage into the sausage factory because it’s easy and it’s working, but the minute that stops you have to go back to the toolbox and see what other products are there,” Swihart said. “As lawyers we know everyone in the industry, so part of what we are doing during this period that I think is important is matchmaking. We know what a lender or issuer is trying to accomplish and what the investors who have money on the sidelines are looking for, and we make introductions and suggest products and structures that might work for both.”

The Federal Reserve once again hiked its benchmark interest rate by 75 basis points at its July 27 meeting, marking the central bank’s second three-quarters of a percentage point hike in six weeks after previously having none that sharp since 1994. Fed Chairman Jerome Powell said at the June meeting he projects the benchmark rate to rise up to 3.4 percent by the end of the year from its current range of 1.5 percent to 1.75 percent in order to combat inflation concerns. Economic forecasts in March had estimated that the federal funds rate would hit 2.5 percent by the end of 2022.

Michael Lefkowitz, managing member of Rosenberg & Estis, noted that rising interest rates have caused buyers to rethink how much they can pay for properties while also questioning whether enough rental revenue can be achieved to offset higher borrowing costs. Higher interest rates have also resulted in a “derisking” of CRE portfolios from lenders, which puts the onus more on borrowers to find additional equity to fill gaps.

“There have been sellers who have decided to finance out proceeds instead of sell because they don’t feel that they could garner the price that they want on a sale, and there are a number of private commercial lenders who have definitely taken a harder look at what they’re willing to finance,” Lefkowitz said. “On the buy side, I’ve had clients who have said, ‘I know this is a pretty good deal and I would consider buying this in a different market, but I’m going to keep my cash in my pocket because I know there’s going to be some real opportunities over the next several months or a year as things are really starting to tighten up.’ ”

Michael Rishty, a partner at Davis Polk & Wardwell, said higher interest rates coupled with many banks cutting back significantly on lending has resulted in far slower transactional activity from both buyers and sellers. Rishty noted that some clients on the sell side have either pulled back deals or are looking to restructure deals due to interest rates negatively affecting bids they were receiving, while buyers are rethinking borrowing strategies.

“As interest rates have increased, I’ve seen clients rethink what their financing packages might look like for certain transactions, while some clients suffer higher financing costs or lower proceeds than they initially expected when they began their financing process,” Rishty added. “For clients that are sellers, I have seen some transactions die because the bids have come in much lower than they were hoping to get a few months ago when they began marketing their asset.”

Rishty noted that developer sponsor clients are more “optimistic” and are trying to find the right transactions to tackle and see if they can price them appropriately to match the higher interest rates.

“There’s more conversations on the strategic side now and transactions take some more thoughtfulness,” Rishty said. “When deals get a little harder to put together, often clients will have to be more creative with their structures, and that also requires more thought and involvement on the legal side. We get a little more involved and try to structure things a little more creatively, but clients looking for that edge always will come to us and look for that kind of strategic advice.”

Laurie Grasso, co-global chair of the real estate practice at Hunton Andrews Kurth, said that while construction and financing costs have risen, her firm is still closing a number of deals, albeit with increased selectivity. She said clients have prioritized distressed debt platforms as well as multifamily deals and ones for high-end office assets in locations where COVID has affected commuting less.

“Deals are being more highly scrutinized and clients are being very selective moving forward on new transactions,” Grasso said. “Clients with ongoing development deals are lining up equity for balancing calls from lenders related to debt service shortfalls from rising rates — and they are trying to manage the timing as some of these calls are significant so as not to delay ongoing construction.”

While momentum for CRE property transactions continued in early 2022, U.S. commercial property prices fell 5 percent in the second quarter and may fall as much as 5 percent for the year compared with 2021, according to strategic research firm Green Street. Even the red-hot multifamily and industrial sectors are showing signs of a slowdown, with apartment prices dropping 4 percent in June compared to May and warehouse values falling 6 percent for the same period, Green Street data shows.

CRE lending is projected to fall 18 percent this year to $733 billion with multifamily loans expected to drop to $436 billion, a 10 percent decline from last year’s record of $487 billion, according to an updated baseline forecast from the Mortgage Bankers Association (MBA) released July 19. MBA previously forecast more than $1 trillion in financings in 2022 in February, prior to Russia’s invasion of Ukraine and the Fed’s interest rate hikes. The group now anticipates lending will rebound in 2023, to $872 billion in total CRE loans, including $454 billion in the multifamily sector.

Even though the multifamily sector has shown signs of a cooldown, Lefkowitz said there are still plenty of positive indicators. Many of his clients are prioritizing this asset class for deals both in New York City and nationally.

“We have a housing shortage in the city and we have a housing shortage in this country, and as long as that shortage exists there will be players who understand the economics of housing and will see it as a safe harbor for rough times in real estate and, in good times for real estate, a place where they can have real value grow,” Lefkowitz said. “Anecdotally, the one place where I still see my clients doing transactions and construction is in the multifamily arena more so than the other sectors.”

Michael Hurley Jr., managing partner at Cassin & Cassin, said many lender clients he works with are pausing deal activity, especially those who originate loans through commercial mortgage-backed securities (CMBS) or commercial loan obligations (CLOs). Those markets are largely at a standstill. Hurley said more borrowers will likely need to work with nontraditional lenders and achieve equity infusions of above 25 percent to execute deals in this market environment.

Hurley, who co-chairs the CMBS loan sales, acquisitions and balance-sheet lending practices at Cassin & Cassin, stressed that communication with clients takes on extra importance when there is concern about defaults even though overall delinquencies have remained low so far this year.

“It is important to stay in front of the clients and stay in touch with them and, to the extent they see a loan going the wrong way, counsel them on what their rights and remedies are,” Hurley said. “Most of our clients are trying to work with their borrowers, and we haven’t seen any delinquencies or defaults at this point.”

Allison Kidd, a partner in the San Francisco office of Gibson, Dunn & Crutcher, said that after an active first half of the year deal activity began to slow in the summer on the heels of the massive interest rate hike. She said deals that were fairly far along in the process are still getting executed while those that were in the early stages this summer are far less likely to be completed.

“I think a lot of people are in a wait-and-see mode to see where interest rates ultimately land,” Kidd said. “A lot of our clients had a very busy and successful first half of the year so they can afford to take a moment and let the market find equilibrium again.”

It is essential that commercial real estate attorneys act “practical” and find solutions when market conditions are less than ideal, Kidd said.

“We as lawyers can’t be the reason that deals are slowing down and getting dragged out, potentially risking not closing or having a price retrade,” she said. “It is important in this type of environment that we really focus on getting to the finish line.”