Arbor Supplies $30M Acquisition Loan on Arizona Apartments Purchase

By Andrew Coen July 25, 2022 9:33 am

reprints

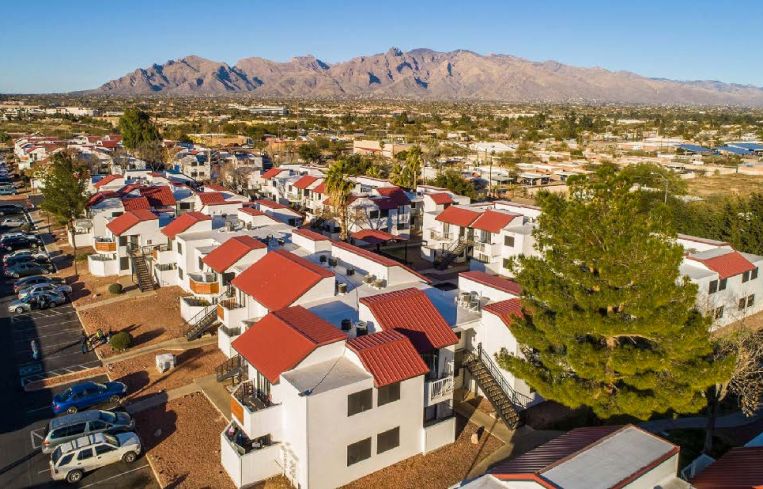

Vertical Street Ventures has nabbed $30 million of acquisition financing to purchase a multifamily property in Tucson, Ariz., Commercial Observer can first report.

Arbor Realty Trust was the lender on the deal for the acquisition of the 232-unit apartment asset at 3985 North Stone Avenue, sources told CO. The interest-only loan features a spread of 4.05 percent and a 36-month term.

Meridian Capital Group’s Barry Lefkowitz and Scott Rosenstock arranged the transaction out of the firm’s Iselin, N.J., office.

“Even in the unpredictable and volatile market we are currently facing, our team was able to leverage Meridian’s relationships to successfully close this transaction with the same proceeds as the application, while simultaneously guiding our client through the closing process,” Rosenstock said in a statement.

Located four miles from the University of Arizona campus, the two-story building sits on just under 7 acres. Community amenities include covered parking, nearby public transportation, a swimming pool, a barbecue and picnic area, a laundry facility, gated access and two dog parks.

“This transaction was a true testament of miraculous group effort, with a great client, broker and underwriter working together to achieve a mutual goal,” Lefkowitz said in a statement.

Officials at Arbor and Vertical Street Ventures did not immediately return requests for comment.

Andrew Coen can be reached at acoen@commercialobserver.com.