Single-Family Rentals’ Profit Margins Start to Narrow in Pricier Markets

Returns on rentals are likely decreasing in most U.S. counties

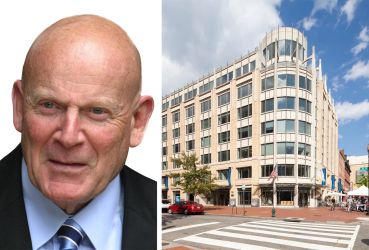

By David Nusbaum June 1, 2022 12:20 pm

reprints

The single-family residential industry has been growing at tremendous rates, boosted by rapid rental growth due to rising home prices.

However, a report from property data firm ATTOM shows that profit margins on three-bedroom single-family home rentals declined in the first quarter of 2022 as the higher costs of construction and acquisition outpace rents in the vast majority of U.S. markets. Yet yields are still strong, and institutional buyers have made acquisitions this month despite contending with higher interest rates and inflation.

The outlook for the sector was positive last month at the National Rental Home Council’s annual conference held at the Park Hyatt in Washington, D.C., where industry executives gathered to discuss housing trends.

“Everybody was optimistic for the rental housing sector,” said Sudha Reddy, founder and managing principal of Haven Realty Capital. “We’re providing housing that is affordable, attainable and in high demand. It will only become more in demand as homeowners get priced out. Costs have been rising for the better part of two years. Returns are still healthy enough that folks will continue to invest.”

There’s certainly recent evidence of that.

Los Angeles-based Haven Realty, in a joint venture with funds managed by Yieldstreet, closed in May on the first phase of a $28.6 million acquisition in Chattanooga, Tenn., dubbed Hartman Hill. The single-family rental community will have 71 purpose-built single-family rentals upon completion on a 26-acre site. Homes range in size from 1,538 to 2,515 square feet.

It is the fourth investment in Tennessee over the past year. Haven also owns properties in Nashville and Knoxville. The investment firm was an early entrant to the single-family rental industry and operates a $1.1 billion portfolio comprising more than 3,400 homes across nine states in various stages of development, construction or stabilization.

Other new entrants to the market are raising funds with plans to acquire thousands of units this year.

Dallas-based NexPoint Advisors, an alternative investment platform, announced earlier in May the formation of a REIT in partnership with HomeSource Operations to acquire, build and operate single-family rentals. The REIT launched with an existing portfolio of 1,000 units and will target both existing homes and new construction with plans to add several thousand units by year’s end. Through an affiliate, NexPoint is the adviser of a different REIT that owns and operates more than 22,000 homes.

Single-family rental yields were above 7 percent as of the first quarter in about half of the 212 counties tracked in the ATTOM report. The report noted that median home prices jumped by more than 15 percent from 2021 to 2022 in half of the counties tracked, while average rents went up by that much in only one-third of those markets.

“The good news for these property owners is that their yields should improve as annual rental rates increase, and they should also benefit from home price appreciation over time,” Rick Sharga, executive vice president of market intelligence at ATTOM, said in a statement.

The highest overall yields were in suburban areas where home prices are low. The top returns were in markets in Florida (Naples and Vero Beach) and New Jersey (Atlantic City and Trenton). Conversely, the Bay Area has the smallest returns.

In counties with median home prices above $500,000, the largest annual declines in projected yield were in the New York area and outside of Boston, where returns fell by 16 percent or more annually in the first quarter. The biggest declines in small markets include Lexington, Ky., and Augusta, Ga., down 36 percent and 13 percent, respectively. The analysis evaluated annualized rent data and the median sale prices of residential properties along with wage data from the Bureau of Labor Statistics.

David Nusbaum can be reached at dnusbaum@commercialobserver.com.