Presented By: Walker & Dunlop LLC

How Walker & Dunlop Provides Certainty of Execution In Uncertain Times

Future Of Capital Markets Coast to Coast, brought to you by Walker & Dunlop

By Walker & Dunlop LLC June 13, 2022 7:00 am

reprints

Susan Mello joined Walker & Dunlop, one of the nation’s top commercial real estate finance companies, one year ago in the role of executive vice president and group head of capital markets. Her team consists of 96 originators, dedicated to finding financial solutions across the entire capital stack, for any property type across the nation. With so much happening over the past year, Partner Insights decided to check in with Mello to learn about her key achievements and observations over this time.

Commercial Observer: You’re coming up on your one-year anniversary as head of capital markets for Walker & Dunlop. What are some of the most prominent national trends you’ve seen in the capital markets over the past year?

Susan Mello: There are a number of different trends, but the most striking was the rise of alternative, or non-bank, lenders. If I look at Walker & Dunlop’s funding sources from 2019 to 2021, including the GSEs, HUD, etc., finance companies increased from about 14 percent of our volume to approximately 37 percent. Current trends in 2022 indicate it is even higher, although we are seeing some slowdown in activity over the past 45- 60 days. Another trend has been a pivot to floating-rate versus fixed-rate debt. In 2019, about two-thirds of the debt we placed was fixed rate. In 2021, not surprisingly given the sharp decline in interest rates during the pandemic, it was two-thirds floating-rate, practically the opposite.

What explains the growth of these alternative lenders?

The shift to investor driven lending is the result of more money allocated to commercial real estate, which has become a proxy for fixed-income investing. Declining interest rates put more pressure on fixed-income investors especially those such as pension funds which are concerned about meeting target returns. Investors could pivot into real estate debt in their search for yield without dramatically increasing the risk profile of their investment portfolios.

With so much uncertainty in the market right now plus big movements in Treasuries on an almost daily basis, how is all that affecting how you’re advising clients?

As trusted advisers to our clients, we do not focus solely on the economics, we talk to our clients about what they are trying to achieve and certainty of execution. Whether we are placing debt and/or equity, we know our funding sources and we look to match our clients to financing sources that understand and value the relationship side of the business. In a volatile market environment when it can feel like you’re walking on quicksand, our mission is finding solid ground for our clients. It’s in these uncertain times, when liquidity is less available, that we can really deliver value to our clients.

Given all these factors, which asset class is presenting the greatest opportunities now and why?

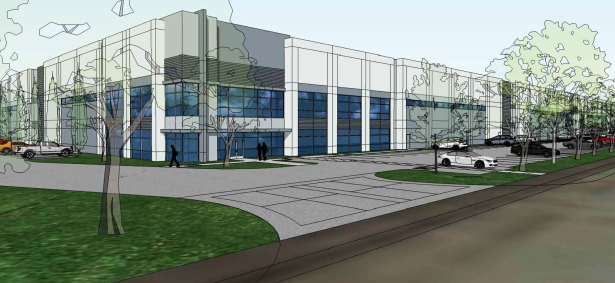

For the last couple of years, a lot of capital has been invested in both multifamily and industrial; you could make a broad bet on those sectors and given macro and demographic tailwinds there was not much risk in those investments. While we believe tailwinds will continue to support investment in those sectors, moving forward, investors will look more closely at the properties themselves, as opposed to just the property sector. For instance, our team completed a $34.1 million financing for Xebec in February this year in Chino, Calif., where competition for space is fierce. At the time of closing the region’s average rental rates were up by more than 10 percent over the previous 12 months. That product, location, and sponsorship are still very appealing.

New online retailers and traditional retailers alike continue to lease space to solidify their position in the hierarchy of e-commerce platforms like this 315,320-square-foot, 36-foot clear, Class A industrial building situated on approximately 14 acres in Chino, Calif.

But as greater certainty is required to move forward with deploying capital, we’ll see investors become more discerning about the specific assets in which they are investing, looking for those that provide relative value.

Which is a greater concern in commercial real estate right now, inflationary pressures or rising interest rates?

I don’t believe it is any one thing, it is a confluence of events. Inflationary pressures, brought on at least in part by supply chain issues, have led to the rise in interest rates. Those issues, as well as the geopolitical environment, COVID etc., are causing the tremendous uncertainty we have in the market today. For instance, if you’re a developer, not only are you feeling pressure because of rising costs due to labor and supply constraints, but now you also have interest rates and increased debt costs putting upward pressure on your budget. For sponsors acquiring assets today, unless and until we see cap rates expanding (and we are in certain places/assets) it’s going to be about how much they can push their rent-growth assumptions. With this low cap rate environment for certain asset classes and debt costs increasing, you have negative leverage. To make your deal pencil you often need to rely on hefty rent-growth assumptions, and that’s where there’s pressure, because there’s a question about how long that will last before returning to more normalized growth.

What would you characterize as Walker & Dunlop’s greatest strength compared to its competition?

We are a relatively small company compared to some of our peers, but it’s our ongoing investments in people, brand and technology that have fundamentally changed our competitive positioning within the commercial real estate industry. We deliver a highly personalized experience for our clients while delivering the best-in-class financing execution our clients need and want.

We also have a diverse platform, with a wide variety of solutions, whether from third-party or proprietary capital, as both a lender and an adviser. In 2021 alone, we sourced transactions from more than 350 capital sources. That access and background allows us to be hands-on and creative when it comes to managing complex financial structures for our clients.

Looking back on your first year, what are the Walker & Dunlop achievements and advancements you’re proudest of from the past year?

Although we have had a debt brokerage platform for a number of years, Walker and Dunlop is well known, and has established itself as the premier agency lender in the country, ranked as the No. 1 Fannie Mae (FNMA) lender, and No. 4 with Freddie Mac lending. Our core debt business was dominated in 2020 by our GSE lending, and our capital markets advisory business was down as lenders took stock of the impact of COVID. However, in 2021, GSE lending was down, and our debt advisory business was able to step in and offer financing solutions to our sponsors and ensure liquidity for their assets. We knew we needed to diversify our business, and our ability to pivot and bring the best solutions to our clients was exemplified by our 2021 activity. In terms of our debt advisory business, we grew our transaction volume from about $9 billion in 2020 to $27 billion in 2021.

What prominent trends do you think the capital markets are most likely to see in the year ahead?

I think we will continue to see diverse sources of capital, including more “retail” capital as the distribution channels evolve and reach even more individual investors. Historically, these were the investors who didn’t have access to institutional-quality real estate unless they were investing in public REITs. With the rise of a new class of nontraded REITs and crowdsourcing platforms reaching more of the population, the result is more money flowing into private real estate.

I also think we will continue to see the rise of sub-sectors in the major property sectors such as life science assets or medical office. In residential, it’s not just traditional multifamily anymore, but investors are looking at more niche plays such as manufactured housing, single-family rentals or build for rent (BFR) assets. Our team has been at the forefront of the BFR trend, closing over $2 billion in transaction volume and currently has an active pipeline of $5.6 billion. One such development was recently completed by our Phoenix team arranging $26.3 million in financing for Seneca at Southern Highlands in Las Vegas, with a luxury development scheduled to be finalized in May 2023. The final terms of the loan included a three-year term with interest-only payments at a very competitive rate.

Seneca at Southern Highlands, a 50-unit, luxury build-for-rent community to be constructed in Las Vegas.

As more capital flows into the space from alternative sources, investors will search for enhanced yield which they perceive can be obtained by investing in these less traditional assets.

View more articles on capital markets from coast to coast here.