Finmarc Acquires 11-Building Portfolio in Springfield for $128M

By Keith Loria June 17, 2022 10:36 am

reprints

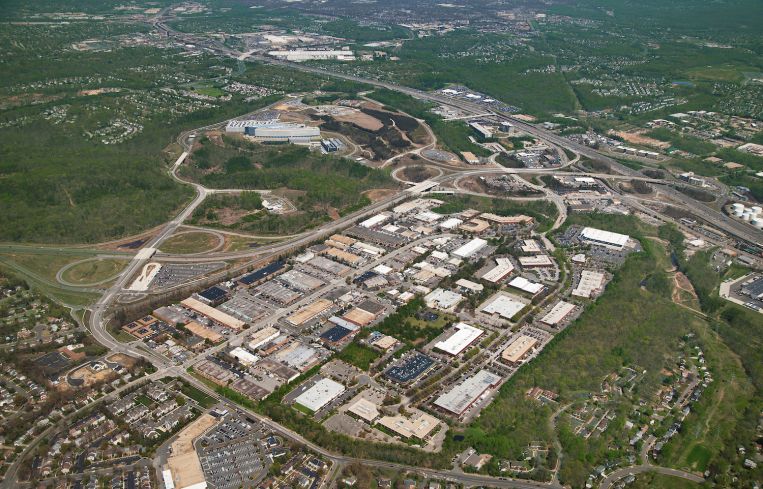

Finmarc Management has purchased an 11-building, mixed-use portfolio of 740,000 square feet in Springfield, Va., for $127.5 million.

Boston Properties was the seller.

“Warehouse and flex has always been a significant component of the Finmarc investment strategy, and with Finmarc selling close to 1 million square feet of flex/warehouse in 2021, we were looking for the right opportunity to reinvest in this asset class,” Sean Sullivan, executive vice president of Finmarc Management, told Commercial Observer. “This portfolio was that opportunity.”

The portfolio consists of both single-story and two-story assets and was 74 percent leased at the time of the sale.

“Most capital will be dedicated to re-leasing the vacancy in the portfolio,” Sullivan said. “Warehouse space continues to be in high demand, and retrofitting spaces to meet that demand will be a big part of our renovation plans.”

The buildings are on Boston Boulevard, Corporate Court and Grainger Court and all near Fort Belvoir, the National Geospatial-Intelligence Agency and Marine Corps Base Quantico.

Both data center and life sciences space are heavily in demand in the area, according to Sullivan, noting that the Northern Virginia industrial market ended 2021 with a record-low 4.2 percent vacancy rate.

“Given the utility infrastructure in place with these buildings and the limited supply of land for data centers, this site will undoubtedly garner interest from data center users,” he said. “As for life sciences, funding is only increasing and the demand for lab space is not stopping any time soon.”

Notable tenants in the portfolio include ADT Security Systems, Avaya, The Vomela Companies and the United States General Service Administration.

William Collins and Eric Berkman of Cushman & Wakefield represented the seller in the deal, while Finmarc was self-represented.

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.

Keith Loria can be reached at Kloria@commercialobserver.com.