Chase Refis New York Outer Boroughs Industrial Portfolio With $61M Loan

Seagis Property Group has secured a $60.8 million refinancing for a fully leased, seven-property light industrial portfolio totaling 199,457 square feet in Brooklyn, Queens and the Bronx, Commercial Observer can first report. Chase provided the 10-year, fixed-rate, interest-only non-recourse loan.

The JLL Capital Markets Debt Placement team representing the borrower was led by Gregory Nalbandian, Jim Cadranell, Michael Lachs and Alex Staikos.

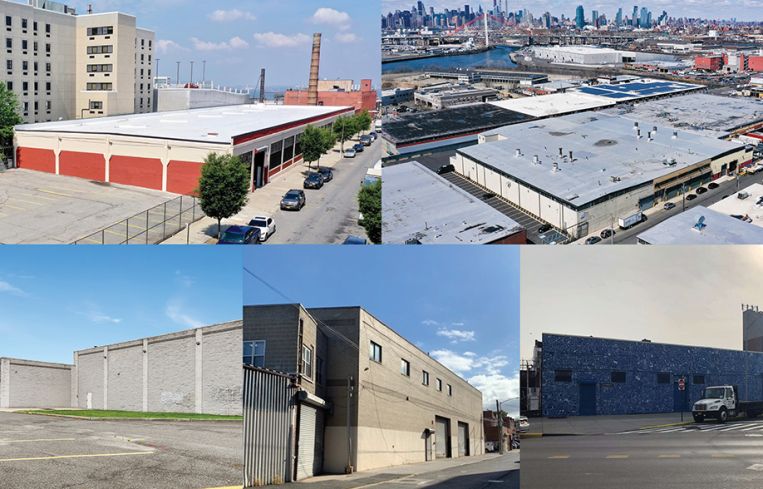

The fully leased Class B portfolio includes industrial properties in Brooklyn at 250 Johnson Avenue, 124-134 Forrest Street and 132 54th Street; in Maspeth, Queens, at 58-17 59th Drive and 5700 49th Place; and in the Bronx at 1108 Zerega Avenue and 2500 Waterbury Avenue.

“As one of the premier owners of industrial real estate in the outer boroughs industrial market, Seagis acquired these highly demanded assets at an extremely attractive basis and implemented their value-add strategy very effectively post-acquisition,” Nalbandian said. According to JLL research, industrial vacancy in the outer boroughs declined in the fourth quarter of 2021 to 1.6 percent, and asking rates increased 15.5 percent annually to $30.28 per square foot.

Seagis and Chase officials did not immediately respond to requests for comment.

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.

Emily Fu can be reached at efu@commercialobserver.com.