Presented By: Nuveen Real Estate

Single-Family Rentals: Strong Future Demand Drivers to Propel Sector Outperformance

During the next decade single-family rentals will play a more significant role in institutional real estate portfolios as investors have recognized their resiliency through the pandemic.

By Nuveen Real Estate March 28, 2022 2:00 am

reprints

Sizable Market Opportunity

During the next decade, we believe institutional real estate portfolios will transform as investors gain more familiarity with single-family rentals and start increasing their allocations to them. We anticipate single-family rentals will play a more significant role in institutional real estate portfolios in the coming decades as investors have recognized their resiliency throughout COVID-19.

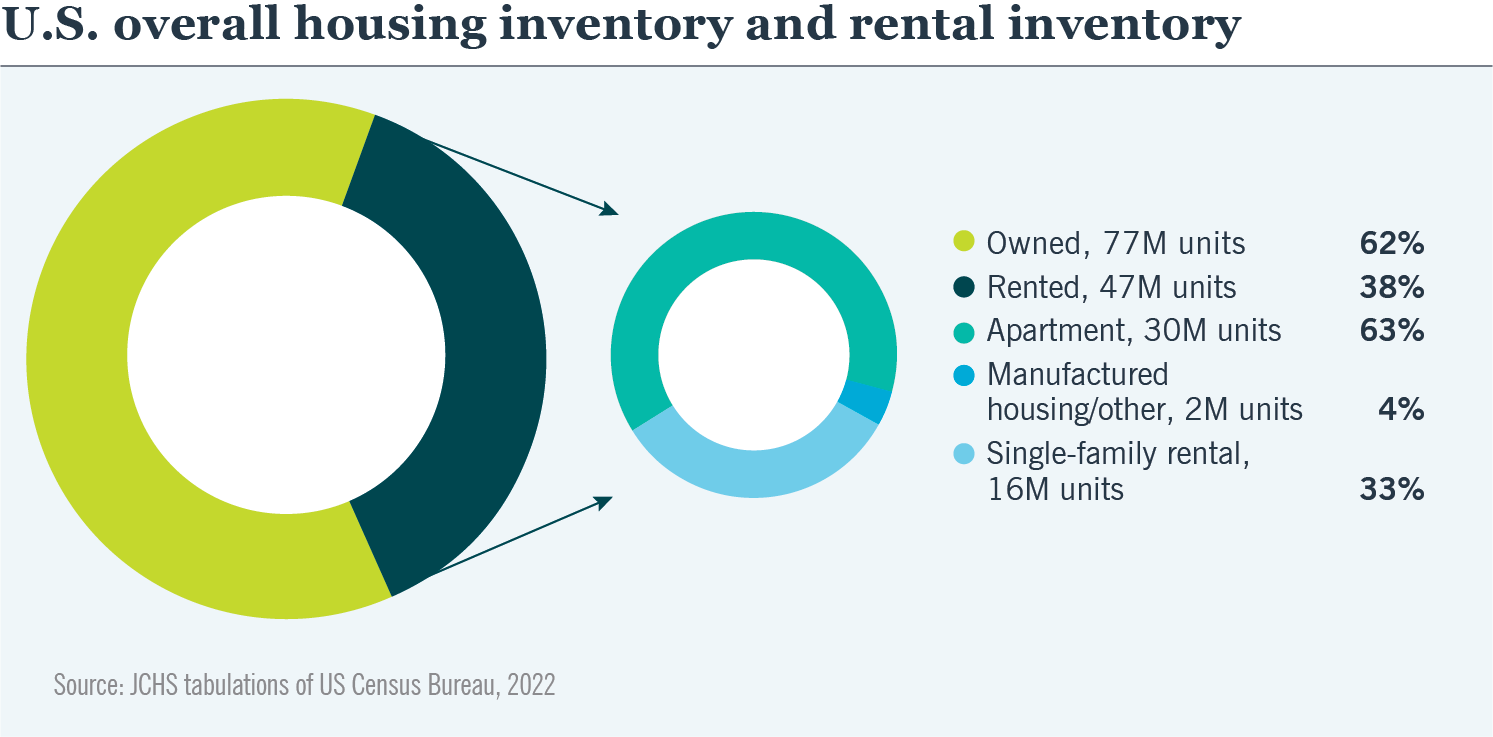

Single-family rentals are a sizable investment opportunity, as the sector comprises one-third of U.S. rental inventory with nearly 16 million units (Figure 1). The single-family rental market is currently valued at $4.4 trillion. The majority of new single-family rental inventory comes from owner-occupied stock, indicating there is potential to invest in the owner-occupied single-family housing market, currently valued at $26.2 trillion. In total, the single-family housing market (Figure 2) is valued at more than $30 trillion, which is more than double that of the traditional commercial real estate market (valued at $13.4 trillion). The single-family rental market is 98% dominated by non-institutional players. In recent years, REITs and private players have entered the single-family rental market, starting the institutionalization of the sector.

Lack of Supply and Outsized Demand

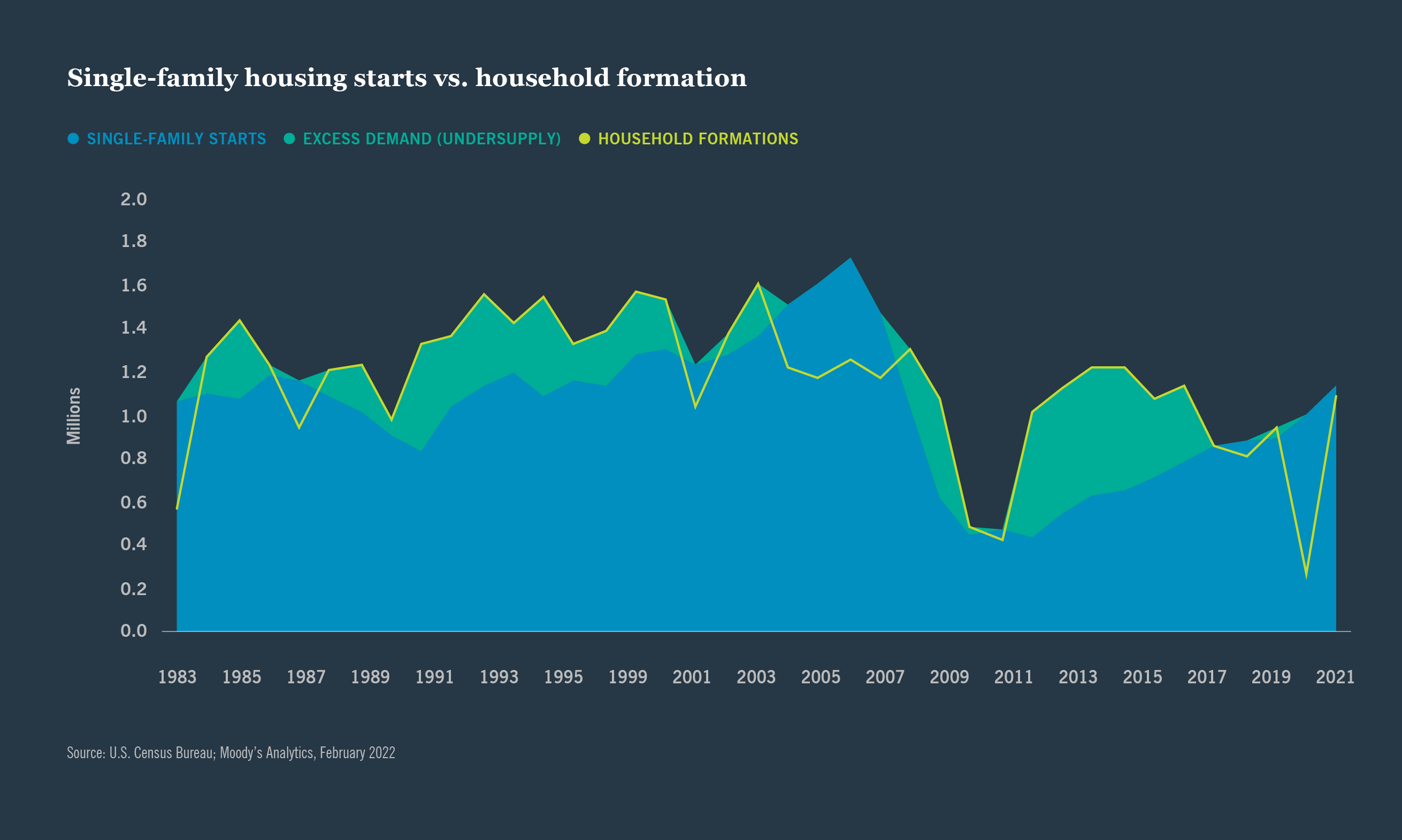

Our analysis of single-family housing starts compared to household formations indicates that there is currently an undersupply of approximately 4.7 million homes. The lack of single-family housing supply has driven months’ supply of inventory to historical lows and home price appreciation to record highs, further inhibiting homeownership for many aspiring families. Single-family rental demand has improved significantly in recent years as occupancy has grown 500 basis points since the global financial crisis from 90% to 95% in 2021.

Key Demand Drivers

1. Demographic Wave Into Key Renter Cohort

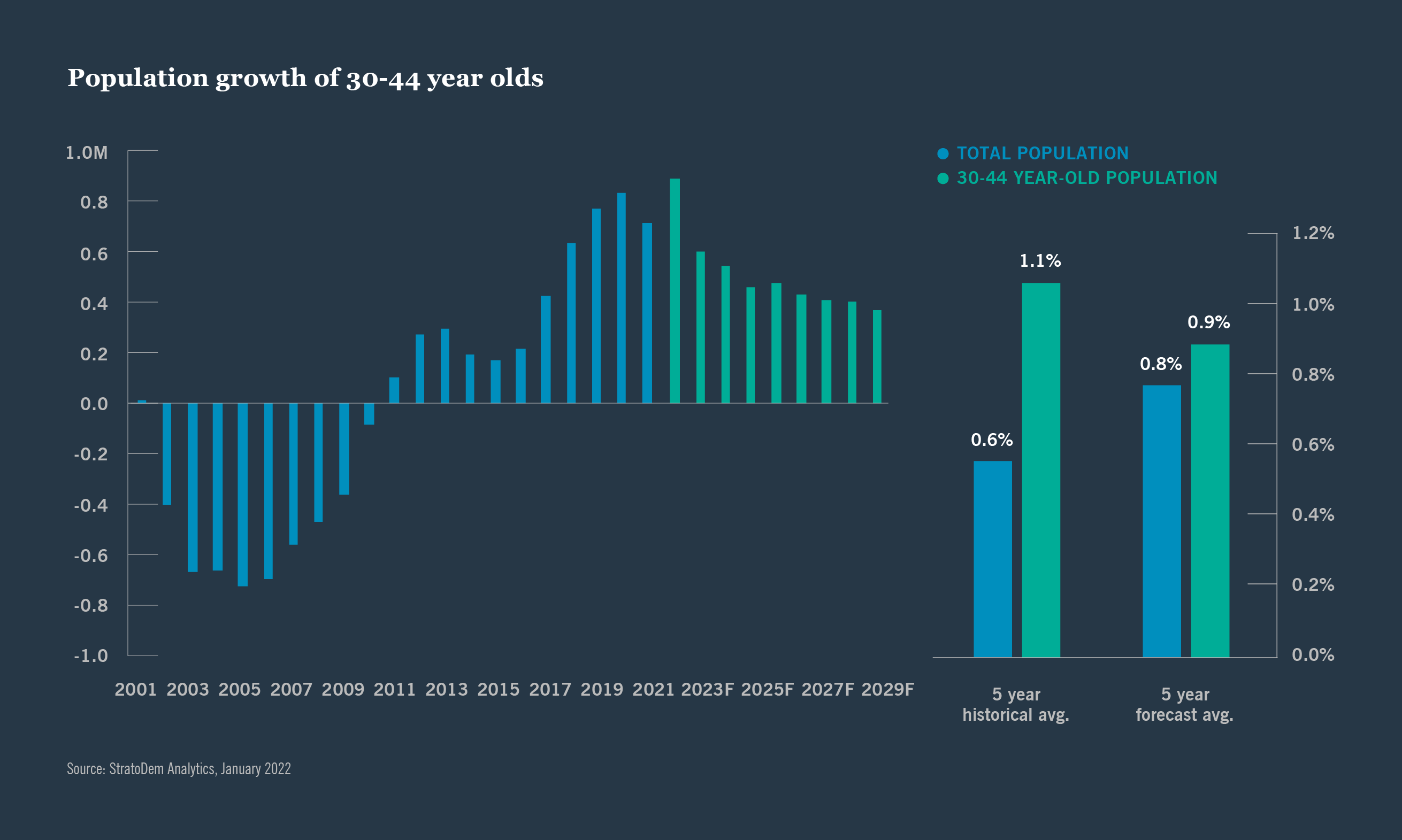

Certain key demographic shifts occurring in the United States will have profound implications for alternative housing sectors, including single-family rentals. The aging of millennials into the key single-family rental cohort (aged 30-44) is a critical secular tailwind for the sector. This key age cohort is projected to grow from 65.7 million in 2021 to 70.2 million in 2030. The growth of this cohort has outpaced the overall U.S. population over the last five years and is projected to continue outpacing the U.S. population over the next five years. Historically, the growth of this key age cohort has empirically proven to be a driver of single-family rent growth.

2. Suburban Resurgence and Migration to the Sun Belt

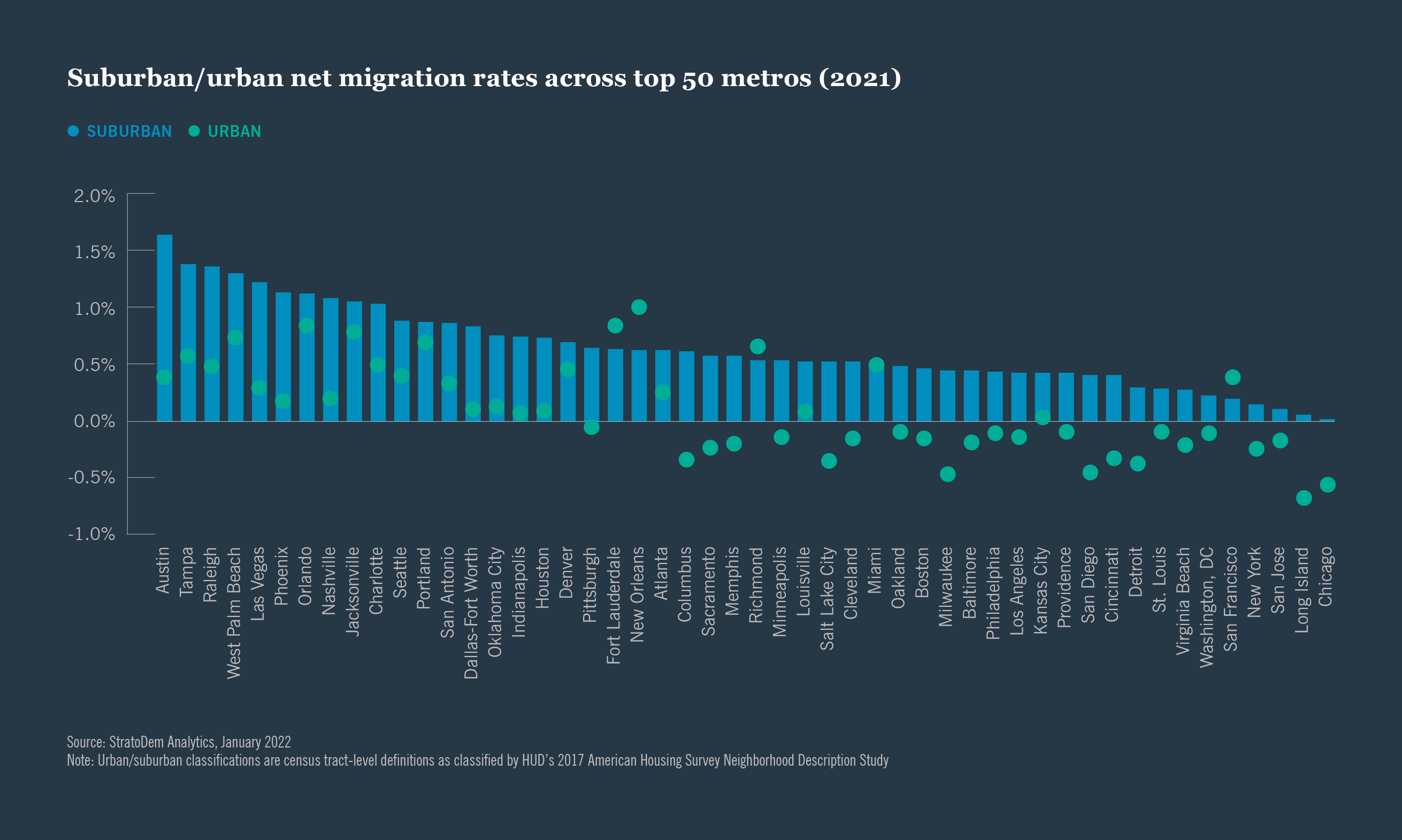

Single-family rentals are favorably positioned in a post-COVID-19 environment given the pandemic’s profound impact on urban areas. Across the majority of metropolitan areas in 2020 and 2021, net migration rates were stronger in suburban areas than urban areas. Our analysis of Placer.AI geolocation mobility data validates that the majority of those moving to Sun Belt markets have migrated from more expensive coastal markets. For example, over the last two years, the most migrants to Tampa, Fla., originated from New York, while the most migrants to Dallas-Fort Worth, Texas originated from Los Angeles. We believe the out-migration from coastal markets will accelerate due to unfavorable affordability, high taxes and elevated impacts from the COVID-19 pandemic. Forecasted migration data indicates Sun Belt markets will continue to lead the nation for population growth. This trend is favorable for single-family rentals given the large opportunity set available in the Sun Belt markets.

3. Millennials Outgrowing Apartments

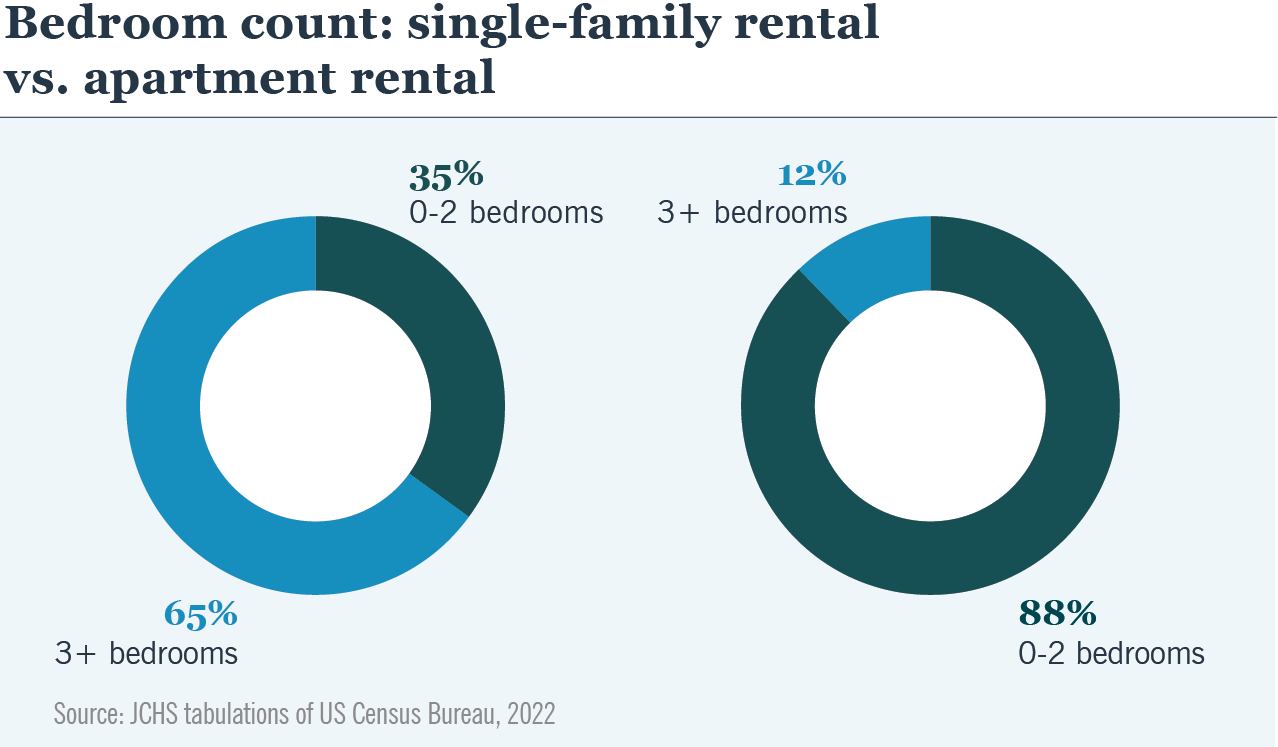

Throughout the last decade, millennials have been a major driver of conventional apartment demand. As millennials age, start families and demand space for home offices/remote learning, they are likely to outgrow their one- and two-bedroom apartments. Yet, only 12% of apartment units in the U.S. have three or more bedrooms, compared to 65% for single-family homes. Nearly one-half of new single-family renters in Q3 2021 moved from apartments, according to John Burns’ Single-Family Rental Survey. The permanent adoption of flexible work-from-home policies as a result of the pandemic is likely to serve as an additional tailwind for single-family rentals as professionals demand more space in their homes to conduct business.

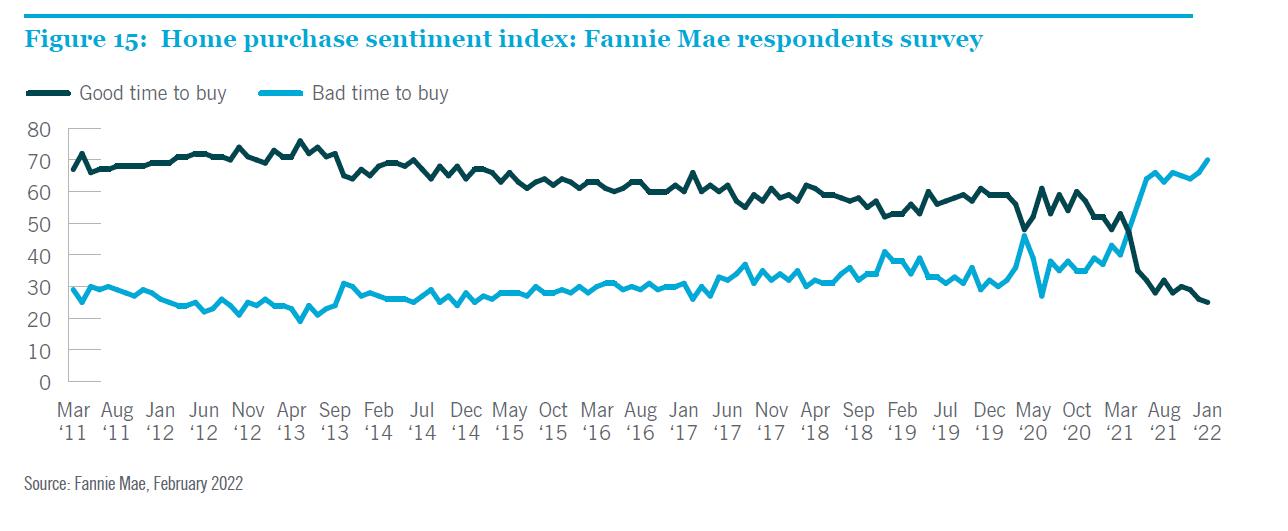

4. Millennials’ Financial Headwinds to Homeownership

Purchasing a single-family home would be the next natural step for millennials as they age, but this is out of reach for many. Millennials have experienced two recessions in their young adult lives (global financial crisis and COVID-19) and are largely unable to afford a (20%) down payment and mortgage. Our analysis of household net worth for those under 44 years old indicates that across 64% of metropolitan areas, households under 44 years old do not have adequate funds for a 20% down payment. A poor debt-to-income ratio was the leading reason mortgage lenders rejected buyer applications for those aged 31 to 40, according to the National Association of Realtors. Experian data indicates that student loan debt continues to be the major driver of debt compared to credit cards. Poor credit is an additional headwind for millennials. High amounts of debt and low FICO scores will prevent millennials from owning homes at the same rate as previous generations.

Resilient Historical and Projected Performance

Historically, single-family rentals have achieved stronger rent growth, NOI growth and overall commercial property price index (CPPI) growth than apartments. Throughout several recessions, apartment rent growth has turned negative and has had higher volatility compared to single-family rent growth which was steadily positive and less volatile. Similarly, single-family rental NOI growth has remained positive throughout COVID-19, unlike apartments and traditional real estate property types overall that turned negative. Given the sector’s numerous tailwinds, single-family rentals have favorable NOI growth and return projections. Further, the single-family rental sector has historically been higher yielding than the apartment sector. Since 2017, single-family rentals have achieved nearly a 40-basis point premium over apartments. This spread has widened since COVID-19 and is currently over a 100-basis point premium.

Given the sector’s favorable pricing relative to other property types and resilient demand drivers, single-family rentals are expected to achieve higher risk-adjusted returns than apartments and traditional commercial real estate property types overall. Therefore, investors should consider adding single-family rentals to their portfolios as a way to drive outperformance and generate enhanced returns.

To read more Nuveen Real Estate insights click here.