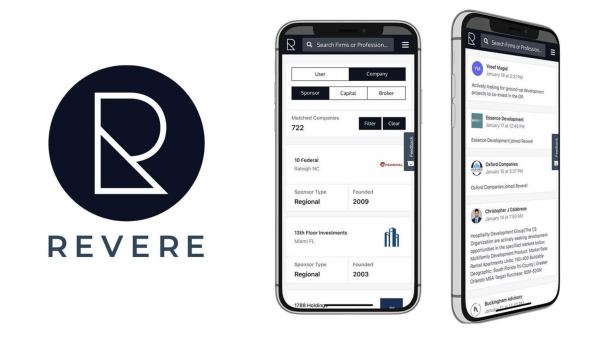

Digital Capital Markets Platform Revere Closes $5M Seed Round

RET Ventures led funding for the commission-less, members-only marketplace

By Philip Russo February 7, 2022 7:54 am

reprints

Proptech startup Revere, an online marketplace for capital markets professionals, announced Monday that it has closed a $5 million seed round, led by RET Ventures. The Manhattan-based networking and transaction platform seeks to bring greater access, transparency and efficiency to the $1.6 trillion global real estate investment market.

Other participants in the round were Related Companies, Holland Partner Group, The Feil Organization, Driftwood Capital, Davis Development, Essence Development, Jamie Henderson, executive vice president and head of commercial real estate at Capital One, and Jeff Staubach, founding partner at Staubach Capital.

Launched in May 2021, Revere is an invite-only, online marketplace for capital markets professionals looking to buy or sell a building, finance a project, or expand their network, according to a company statement announcing the funding round.

The startup seeks to provide dealmakers, including equity, debt and investment sales teams, ways to manage their entire capital markets workflow, from sourcing to closing, without commission fees for transactions done on the platform. Members pay a flat monthly fee for the SaaS.

“We’re trying to democratize access to people, money and information in the way that [Michael] Bloomberg did 40 years ago with the creation of his Bloomberg terminal,” said Fred Krom, founder and CEO of Revere. “Just as Bloomberg greatly enhanced capital markets on Wall Street, Revere’s goal is to do the same for CRE.”

Krom said his background as a vice president with DeBartolo Development, combined with his experience prior to that as a vice president with Goldman Sachs, led him to realize the opportunity in creating a more inclusive digital platform that could provide access to a growing capital markets sector. The past 30 years, he said, has seen the “public equity market cap of the entire Nareit Index grow from $10 billion to $1.6 trillion. Despite that growth, it’s still 85 to 90 percent mom-and-pop owned.”

The professionally managed global real estate investment market, too, increased from $9.6 trillion in 2019 to $10.5 trillion in 2020, according to an MSCI report.

“So the access to the information and the people on the institutional side of the business is really controlled by a few dozen firms,” Krom said. “The concept here is to level the playing field and help women- and minority-owned businesses, etc., that don’t have what I had at DeBartolo and at Goldman Sachs before that: better access. The invite-only nature of this started that way.”

Revere looks to take a slice out of that gigantic real estate capital markets pie chiefly in the “$20 million to $1 billion-plus” range, said Krom, adding that the company is “price-constricted, but property-agnostic,” rather than concentrated on a particular sector of real estate sales transactions.

RET Ventures usually invests in later-stage proptech startups, but was excited enough by Revere to lead its seed round, said John Helm, the company’s founder.

“We normally don’t do investments in companies this early, so this was a rare investment for us,” Helm said. “When we go into a seed-stage deal, we need to see a couple things that give us additional comfort in taking on that extra risk. One is, it’s just got to be a significant market opportunity, which the company is addressing. Secondly, we’ve got to believe that the team has the chops to execute and capture a big chunk of that market opportunity. We just have a much higher bar and we demand a much more experienced team.”

Since its launch last year, Revere has onboarded more than 500 companies, and projects securing $1 billion in transactions on its platform in the first half of 2022, according to the startup’s funding release.

Philip Russo can be reached at prusso@commercialobserver.com.