Leasing at Pre-Pandemic Levels, but Urban Decline Causes Concern: Boston Properties

By Mark Hallum January 26, 2022 1:49 pm

reprints

Boston Properties said leasing across its portfolio reached pre-pandemic levels last quarter and CEO Owen Thomas was confident the firm’s vacant space will continue to fill as companies grow dissatisfied with at-home work.

But declining conditions in some cities remain a concerning factor for bringing office workers back to urban centers, the company said on its quarterly earnings call on Wednesday.

In the final quarter of 2021, Boston Properties leased 1.8 million square feet with a weighted average lease term of 8.6 years, bringing total leasing activity in all of 2021 to approximately 5.1 million square feet.

The majority of leases were done with financial and professional services companies, while major deals in central business districts continued to be its bread and butter, particularly in Boston where volume was up about 5 percent.

“It’s pre-pandemic levels for us,” Boston Properties President Douglas Linde said on Wednesday’s call. “I think with many workers today, there’s pandemic fatigue. … It’s very anecdotal, but you hear that more and more of the employees want to come back for the camaraderie, for the learning, the training that goes on in the office.”

However, even with the good leasing news, Thomas and Linde expressed concerns over reported increases in crime in major cities that could keep companies from leasing space in the future.

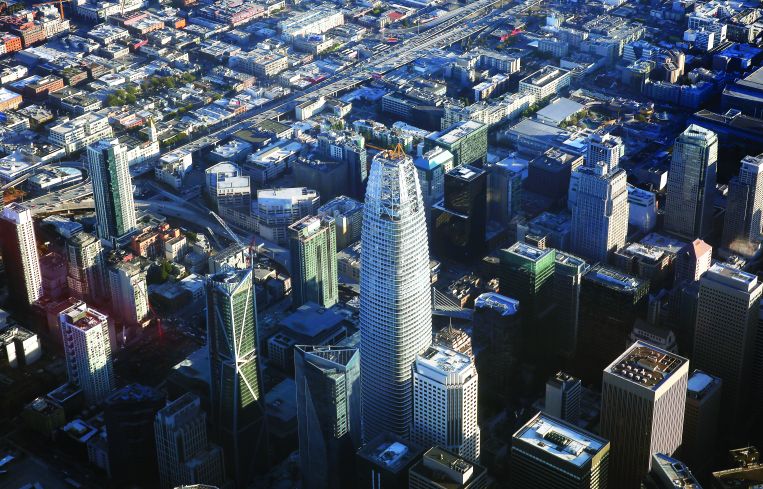

Homelessness and crime in San Francisco were concerning to investors in that market, something Boston Properties execs said they and other business leaders had been in contact with Mayor London Breed about, in the hope of bringing more policing so workers want to return to the city.

They also expressed concern about crime in New York City, especially after a rash of subway assaults that prompted Gov. Kathy Hochul and Mayor Eric Adams to assemble an interstate task force to reduce gun violence.

But, Thomas said he has confidence that a full recovery is in the near future as employers seek greater work efficiency and pressures mount for local elected officials to lower the crime numbers.

“As we have stated repeatedly, we believe this phenomenon will change over time given widespread corporate dissatisfaction with the decaying efficiency, retention and culture associated with remote work,” Thomas said.

Some of Boston Properties’ biggest deals of the quarter included a 108,000-square-foot lease at Times Square Tower and an 89,000-square-foot lease extension at 601 Lexington Avenue in Mdidtown. A spokesperson for Boston Properties did not immediately respond to a request for details on the deals.

The largest leases, however, were outside the Northeast and other markets, with a 231,000-square-foot deal for the entire 751 Gateway life sciences building in San Francisco. In Waltham, Mass., there was a 120,000-square-foot lease at 1265 Main Street and one for 165,000 square feet at 880 Winter Street were near the top of the list.

Boston Properties’ confidence in the return to the office has led it to dip its toe in new markets, including Seattle, where it bought Safeco Plaza in July 2021

Mark Hallum can be reached at mhallum@commercialobserver.com.