Värde Partners Lends $110M on Gurney’s Latest Resort Buy in Arizona

By Mack Burke November 4, 2021 7:30 pm

reprints

Värde Partners has supplied $110 million in debt to a partnership between Gurney’s Resorts, BB Hotels, Metrovest Equities and BLDG Management to buy Sanctuary Camelback Mountain Resort in Paradise Valley, Ariz., Commercial Observer has learned.

The quartet of buyers will renovate it and rebrand the resort as Gurney’s Sanctuary Camelback Mountain Resort and Spa.

On Monday, the borrowing party announced their acquisition of the destination resort — located at 5700 East McDonald Drive — from private owner Robert Castellini, who’s owned the property for almost 30 years.

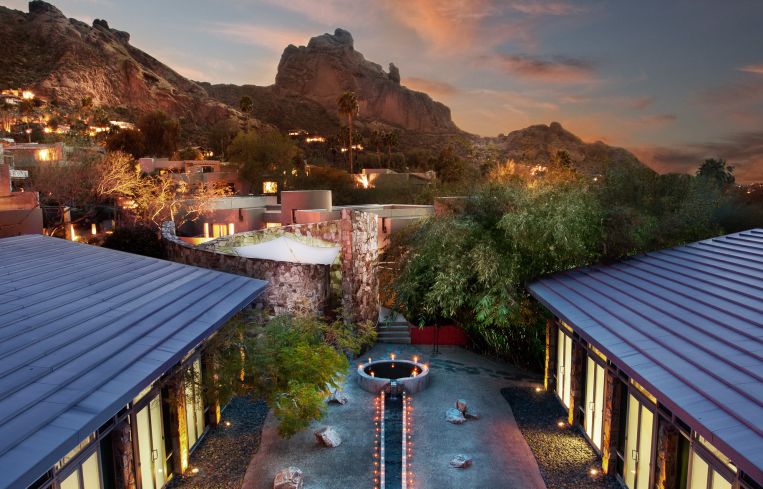

Castellini had partnered with Scottsdale, Ariz.-based Westroc Hospitality to develop the resort into what it is today, a sprawling, 5-star hospitality asset in the Camelback Mountain foothills, just northeast of Phoenix.

There are 112 detached cottages, suites and villas — as well as eight separate and private villas nestled in the mountainside — that make up the property. The new owners are planning to renovate the resort and expand it with more rooms, and they have also tapped MEI Hospitality — an affiliate of Metrovest — to manage it. The renovations are expected to commence next summer, according to Newmark, which arranged the financing on behalf of the buyers.

Newmark’s Dustin Stolly and Jordan Roeschlaub, alongside Nick Scribani and Dan Morin, arranged the financing on behalf of the buyers.

“The lender community really took to [Gurney’s],” Stolly said. “The marketed demand speaks to the reemerging desire for hospitality opportunities, particularly assets of this caliber, and the quality of the sponsorship teams.”

The 53-acre luxury resort will be open and operating during the planned renovation and expansion. It offers a 12,000-square-foot spa, a fitness center, hiking trails and multiple swimming pools and tennis courts. There is also 10,000 square feet of indoor and outdoor event space, which includes a ballroom that can accommodate 250 people. The resort’s kitchen is also run by celebrity chef Beau MacMillan, who officially serves as its executive chef.

“The Gurney’s brand holds a tremendous reputation in the industry; the assets are world-class and unrivaled,” Roeschlaub said. “The sponsorship team is among the best in the business and their products reflect the quality of their ownership.”

With the purchase, Gurney’s has officially moved westward. The luxury hotelier and hospitality company already has Gurney’s-branded destination resorts in Montauk, N.Y. and Newport, R.I.

Metrovest Equities President George Filopoulos, who owns Gurney’s Resorts alongside BLDG President Lloyd Goldman, said that the resort is “a generational asset with tremendous upside, as demonstrated by the significant pickup in occupancy and rate over the last two years. The Gurney’s Resorts team has evaluated an expansion to the western U.S. for quite some time, and [this property] checked all of the boxes for our investment thesis.”

Värde declined to comment on the deal.

Mack Burke can be reached at mburke@commercialobserver.com.