Macquarie Capital Refis FiDi Condo Development With $167M Loan [Updated]

By Mack Burke October 25, 2021 6:02 pm

reprints

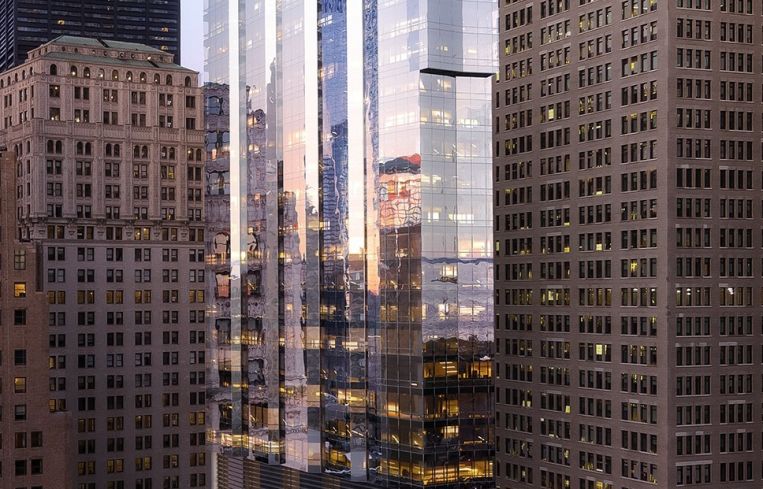

Macquarie Capital, an investment division within Sydney, Australia-based financial services firm Macquarie Group, has refinanced the 40-story mixed-use, residential condominium development at 77 Greenwich Street in Manhattan’s Financial District ahead of forbearance with existing lenders that were set to expire at the end of this month.

Trinity Place Holdings (TPH), the developer behind the condo project, announced on Monday that it had secured a $167 million condo inventory financing to take out existing construction debt from Massachusetts Mutual Life Insurance Company and fund costs related to the completion of the project, according to JLL, which arranged the refinance.

As part of the refinance, TPH also nabbed equity investments from MFP Partners and Third Avenue Management that was facilitated via a private placement, and the firm’s previous mezzanine lender, Davidson Kempner Capital Management, provided $14.5 million in additional mezz debt as well, according to an announcement from TPH and U.S. Securities and Exchange Commission filings. The developer said it sold nearly 2.6 million shares of common stock to MFP and Third Avenue Management, resulting in just under $4.83 million in total proceeds.

The new financing from Macquarie Capital includes a two-year term, with an additional one-year extension option, according to information from TPH.

“We are very selective, and are incredibly excited to support the full sellout of this unique mixed-use building being executed by a high-caliber team at Trinity Place Holdings, in an ever more vibrant Downtown neighborhood,” Macquarie Capital Global Co-Head of Real Estate Principal Investing, Jackie Hamilton, said in a statement.

TPH had nabbed construction financing in December 2017 from MassMutual, and in December 2020, it secured about $7.5 million in mezzanine debt from Davidson Kempner amid the pandemic to help support the 90-unit project, which will include an elementary school and about 7,500 square feet of retail space.

MassMutual and Davidson Kempner had forbearance agreements in place with TPH that were set to expire at the end of this month, and the senior debt was set to mature in January, according to financial filings and information from a representative for TPH.

“We are nearing completion on this new trophy asset in Lower Manhattan, and the building looks spectacular,” TPH President and CEO Matthew Messinger said in a statement. “The loan from Macquarie gives us the flexibility to maximize the value of the asset in this vastly improving residential sales market.”

He added that the loan will cover the final phase of development on 77 Greenwich — named Jolie — as the firm continues the process of trying to sell units and move new residents into ready-made residences.

JLL’s Geoff Goldstein, Steve Klein and Alex Staikos tackled the financing arrangement for TPH’s 500-foot-tall development.

A report last week from The Real Deal said that TPH was staring down foreclosure action on both the senior and mezzanine debt pieces and needed the refinance to avoid it. The two lenders had actually been working with TPH for some time to extend forbearance agreements to give TPH enough time to refinance them out, according to a representative for TPH and an official affiliated with MassMutual.

Barings Chief Communications Officer Cheryl Krauss said in an emailed statement provided to Commercial Observer that “Massachusetts Mutual Life Insurance Company has not instituted foreclosure proceedings against the borrower on 77 Greenwich Street in New York. [MassMutual], acting through its investment adviser, Barings LLC, has and continues to work with its borrowers who have been impacted by the COVID-19 pandemic.”

Since nabbing the senior construction financing in late 2017 and starting development, TPH has run into a bevy of issues with the project, including the pandemic, which shut down development for a few months, as well as delayed construction, less-than-stellar sales activity and liquidity issues.

TPH defaulted on the senior construction loan in September 2019, due to liquidity issues that violated the terms of the loan agreement with MassMutual, according to The Real Deal, which cited financial filings. Several months later, the developer had to deal with the fallout of COVID-19, which stalled construction until June 2020 and stymied sales.

The developer is now poised to take the project across the finish line with the introduction of a new lender and the additional equity it secured from a couple of its investors, while also being able to take advantage of recovering Manhattan sales figures.

In April, TPH brought in celebrity real estate broker Ryan Serhant to help kick-start sales at the property. The inclusion of Serhant led to a rebranding of the property as Jolie. On Sept. 28, TPH announced that it had started to close a number of sales at the property, and some residents have already begun to move in.

“As Lower Manhattan has transformed into New York City’s most dynamic neighborhood and place to live and work, we always knew that Jolie’s location at the center of it all, in addition to its standout design and collection of thoughtful amenities, would appeal to professionals and families alike,” Messinger said at the time of the Sept. 28 announcement. “As we open Jolie to its first residents, we’re so thrilled this has proven true.”

Messinger said in a statement on Monday that “third-quarter home sales in Manhattan were the highest in 32 years, and have been especially active at the high end. Home sales above $4 million have increased by 133 percent since the same period in 2019. As international travel reopens next month and companies set a return-to-work date early next year, we remain bullish on Downtown Manhattan.”

The building’s exterior was designed by FXCollaborative, and the interior design was spearheaded by Deborah Berke Partners. The development, which includes a range of one- to four-bedroom condos, has at most four units per floor, with residences averaging more than 1,500 square feet.

The public elementary school at the base of the property will have a separate entrance along Trinity Place, and will serve students in kindergarten through fifth grade. The New York City School Construction Authority is still building out the interiors of the school, which was conceived in April 2020, right after the onset of the pandemic, according to TPH. TPH expects the school to hold almost 500 students and open in September 2022.

Mack Burke can be reached at mburke@commercialobserver.com.

This story has been updated to include a comment from Barings and clarify the forbearance agreements that had been struck between the developer and its two lenders, prior to the refinance. An earlier story, which cited The Real Deal, wrote that a foreclosure was looming.