Boston Properties Teams With GIC, CPP Investments on $1B Office Fund

By Keith Loria July 14, 2021 5:45 pm

reprints

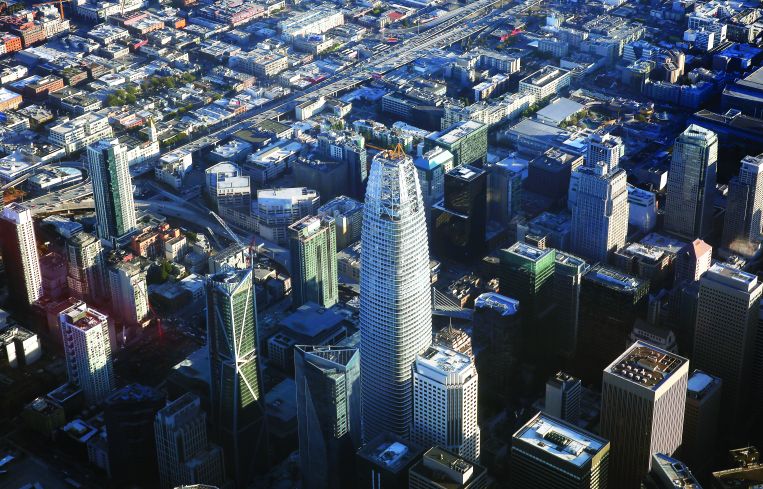

Boston Properties (BXP) has teamed with the Canada Pension Plan Investment Board (operating as CPP Investments) and Singapore’s sovereign wealth fund GIC on a $1 billion co-investment program designed to acquire and operate office properties in Washington, D.C., Boston, Los Angeles, New York, San Francisco and Seattle — BXP’s core markets.

The agreement calls for BXP to provide CPP Investments and GIC the exclusive first offers on joint venture acquisitions on any deals over the next two years. These opportunities must meet the target investment criteria, subject to certain exclusions, according to a press release.

“This new co-investment program underscores the attractiveness of Class A office investment opportunities in our markets and BXP’s track record of creating long-term value at the property level,” Owen Thomas, Boston Properties’ CEO, said in a release.

Under terms of the deal, BXP, already the largest publicly traded developer, owner and manager of Class A office properties in the United States, will serve as general partner and provide customary property management, leasing and other services to any acquisitions.

BXP and CPP Investments are each allocating $250 million, while GIC is allocating $500 million, and the partnership foresees employing leverage for an initial investment capacity of nearly $2 billion, according to the release.

“Employers in top global cities continue to seek best-in-class office environments that will attract and retain talent,” Peter Ballon, CPP Investments’ managing director, global head of real estate, said in the statement. “By expanding our relationships with both Boston Properties and GIC in this new program, we will be strongly positioned to serve this ongoing market need, and, in turn, generate returns for our fund contributors and beneficiaries.”

This isn’t the first time BXP and CPP Investments have teamed up. The two are joint venture partners on Platform 16, a 1.1-million-square-foot office campus in San Jose, Calif., that broke ground prior to the pandemic.

BXP continues to invest in office properties. In May, the company acquired the leasehold interest in Enterprise Asset Management’s 360 Park Avenue South building in Manhattan for $300 million.

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.

Keith Loria can be reached at kloria@commercialobserver.com.

![Spanish-language social distancing safety sticker on a concrete footpath stating 'Espere aquí' [Wait here]](https://commercialobserver.com/wp-content/uploads/sites/3/2026/02/footprints-RF-GettyImages-1291244648-WEB.jpg?quality=80&w=355&h=285&crop=1)