Savanna Seals $264M Construction Financing for 141 Willoughby Street

With a senior loan from PIMCO and mezzanine financing from CarVal Investors, the 400,000-square-foot mixed-use project in Downtown Brooklyn is off to the races

By Cathy Cunningham May 10, 2021 4:52 pm

reprints

A distinct sense of optimism is finally in the air as the world reopens and New York City’s most-buzzed-about developments begin to rise.

On Friday, Savanna wrapped $264 million in construction financing for its signature office-and-retail project at 141 Willoughby Street in Downtown Brooklyn, Commercial Observer has learned.

“Assembling construction financing for a major ground-up commercial development is a significant feat in the best of times, and to do so successfully during an unprecedented pandemic reaffirms our belief in the 141 Willoughby vision and Savanna’s commitment to New York City,” Cooper Kramer, a managing director at Savanna, said. “We are thrilled to be joining with our development partners of Gilbane Building Company and SavCon and our lender partners on the development of 141 Willoughby.”

While deal parties declined to name the senior construction lender, sources external to the transaction told CO that the debt was provided by PIMCO. The mezzanine debt was provided by funds managed by CarVal Investors. The senior/ mezz breakdown couldn’t immediately be gleaned.

JLL’s Aaron Niedermayer and Kellogg Gaines negotiated the financing.

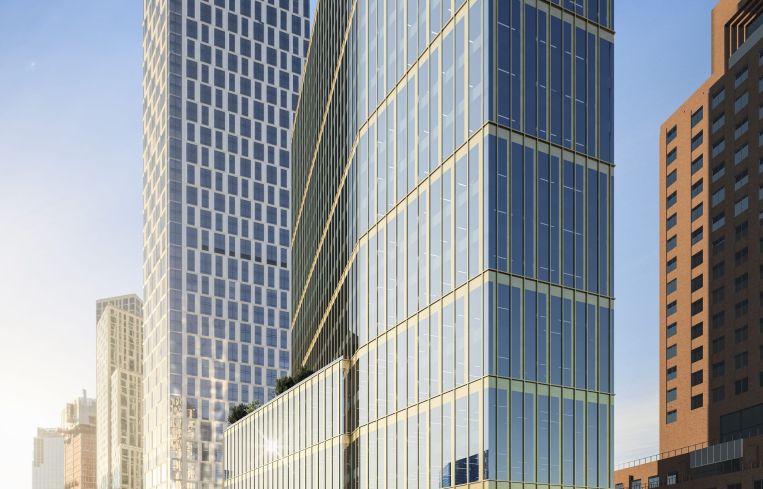

Savanna broke ground on the state-of-the-art, WELL-certified, 400,000-square-foot, mixed-use project late last year. Foundation work on the Fogarty Finger -designed building began in February. SLCE is the executive architect.

When completed, the much-anticipated development will feature floor-to-ceiling windows, outdoor terraces and 360-degree views. Its design also encompasses numerous health and wellness features — more important than ever in a post-COVID world— such as specific space planning to minimize occupant congestion in common areas and amenity spaces; touchless entry on elevators, lobby turnstiles and the building entrance; increased percentages of outside air pumped throughout the building and a top-notch HVAC system to circulate clean and healthy air; and antiviral and antimicrobial materials in high-traffic areas.

Savanna purchased the site from the Institute of Design and Construction in 2014, paying $28 million.

In addition to its competitive advantages from a health and wellness standpoint, 141 Willoughby is centrally located in Downtown Brooklyn and easily accessible via public transportation. It sits at the intersection of Willoughby Street and Flatbush Avenue, just blocks away from Barclays Center, the Jay Street-MetroTech and DeKalb Avenue subway stations are two blocks away and Acadia Realty Trust’s City Point Brooklyn sits just south of it. The property also sits diagonally across from Willoughby Square Park, the one-acre park planned by the New York City Economic Development Corporation.

“The Downtown Brooklyn neighborhood continues to attract businesses through its outstanding access to employee talent, fed by incredible transit connectivity and proximity to many of Brooklyn’s most-desirable residential addresses,” Kramer continued. “We see great potential for continued growth in the neighborhood and are confident that modern, high-quality, newly constructed office and retail space designed with a specific focus on health and wellness will be well received by the market.”

CarVal Investors, a global alternative investment manager focused on distressed and credit-intensive assets and market inefficiencies, has invested more than $128 billion since its founding in 1987. The firm focuses on four credit strategies: corporate securities, loan portfolios, structured credit and hard assets.

“We are excited to provide financing for a project as unique as 141 Willoughby,” Daniel Tanner, a director at CarVal investors, said. “In the current environment, it is so important to align ourselves with strong sponsors and projects, and we are thrilled to work with a team of Savanna’s caliber as they work to deliver some of the most attractive, thoughtfully designed space in Brooklyn. We believe the creative, flexible financing that we were able to offer will allow Savanna to deliver on that goal.”

And, at a time where lending opportunities on large office assets are under extra scrutiny, the transaction is a positive harbinger for the market, and for New York City.

“Closing a substantial speculative office construction loan in New York City during COVID is a testament to Savanna and the special project they’ve designed, and also demonstrates the lenders’ confidence in the sponsor, project and New York City office market,” Niedermayer said.

“We continue to enjoy a long and productive relationship with the Savanna team and 141 Willoughby is yet another example of how the collaboration between our two teams produces results tailored to optimize each transaction. The lender team created the ideal partnership to get this executed.” said Gaines.

The project at 141 Willoughby is another significant post-COVID closing in the books for Savanna. In July, it closed on its purchase of 1375 Broadway and landed a $388.5 million financing package in the process, as first reported by CO.

A spokesman for PIMCO did not immediately return a request for comment.