Direct-to-Consumer Stores See More Foot Traffic During Pandemic

The pandemic, which has been looked to as a death-knell for in-person shopping, might prove an opportunity for growth.

By Celia Young May 13, 2021 8:00 am

reprints

The pandemic — which many have seen as a death knell for brick-and-mortar shopping — may be pushing more brands to open their own stores, rather than selling through other retailers.

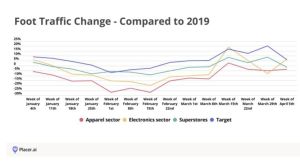

Foot traffic at direct-to-consumer stores rose by 20 percent during the first week of April for athletic brands like Nike, Under Armour and Adidas compared to the same week in 2019, according to a new white paper from foot traffic analytics firm Placer.ai.

Having a physical location cuts operating costs by allowing for in-store pickup options and in-person returns, saving businesses on expensive, far-away shipping, Ethan Chernofsky, vice president of marketing at Placer.ai, told Commercial Observer. Physical stores also offer brands the opportunity to build a unique experience and grow a loyal customer base, according to the report.

“If I have a location I can do something like buy online and pick up in-store, which is much cheaper for a brand than having to deliver it to your home,” said Chernofsky. “Brands are struggling because someone like Amazon [will] deliver everything [and] that’s part of the set cost. Whereas, for [other retailers], [they] won’t charge you for it but then [they’re] swallowing that cost …That operational logistical support is a huge asset of having a retail footprint.”

Placer.ai has also found that younger consumers — who are heading to major cities like New York after seeing shrunken pandemic rents — tend to prefer authentic brands, and an in-store store experience is crucial for developing a connection with them, Chernofsky said. While Chernofsky acknowledged that there is, perhaps, an overabundance of malls in the United States, not all malls are created equally.

“A large number of those C-Class malls either need to be redeveloped, reimagined or maybe it’s the land that’s the value,” said Chernofsky. “When we look at Class A malls, they’re really strong, and they’re likely to get stronger.

Not only are they bouncing back, but they’re using this strength to drive more innovative ideas,” Chernofsky added. “So they’re thinking differently about tenant mix, and they’re thinking differently about how they serve their customers.”

These malls are considering adding residential or office space to the mall landscape and some have even considered inviting local schools in as tenants.

The report also found that middle-of-the-road retailers — those somewhere between luxury and value stores like Target, Kohl’s and Ulta — were surprisingly successful during the pandemic. Target in particular saw consistently higher foot traffic after March 2021 than the same period of 2019, according to the report.

Placer.ai uses anonymized location data from 30 million mobile devices to track foot traffic through AI and machine learning technology. It is part of a growing number of startups aiming to use similar data to help mall owners and brands make decisions.

But even with some positing that COVID-19 completely changed shopper’s behaviors, Chernofsky expects a quick return to normalcy — at least for consumer trends.

“Consumer behavior has drastically been changed, [but] that change doesn’t appear to be very sticky,” said Chernofsky. “As soon as things open up, behaviors start to look more like 2019 than they do like 2020. And it’s very rapid.”