Late 2020 Deals Sign of Things to Come in Maryland’s Life Sciences Sector

The sector has driven nearly a quarter of leasing demand in the area since the start of 2019

By Keith Loria January 4, 2021 5:56 am

reprints

A joint venture between GlenLine Investments and Singerman Real Estate has acquired 5640 Fishers Lane and 12441 Parklawn Drive in Rockville, Md., two lab buildings totaling 74,500 square feet that the venture plans to transform into Class A life sciences space.

JLL represented the partnership in the acquisition, which highlighted the general health of the life sciences industry in the Maryland suburbs outside of Washington, D.C. A lot of that vigorous health, too, is due to the race for COVID-19 vaccines and therapeutics.

“GlenLine and Singerman saw in this property the ability to leverage existing infrastructure to deliver state-of-the-art, Class A in the second quarter 2021,” Dave Baker, director of JLL’s capital markets group in D.C., told Commercial Observer. “Given the tight market conditions in the life science space and robust demand, being able to offer this speed to market is a critical part of the opportunity. Those considerations are on top of this being in an established life science cluster here in Maryland, and in a location that offers both walkable metro and amenity access.”

The property, which is in the fourth-largest life science market in the U.S., sits only yards from the National Institute of Allergy and Infectious Diseases (NIAID) headquarters in the heart of a vibrant life sciences cluster that will experience continued strength for the foreseeable future. Anticipated delivery on the upgraded Class A lab space is the second quarter 2021.

“In Maryland, market vacancy was less than 3 percent at the end of Q3, and there have been several notable Q4 leasing deals that will drive this availability rate down further,” Baker said.

In another Maryland life sciences deal at the end of 2020, Morning Calm Management acquired the Twinbrook Office Center, a 163,936-square-foot property in Rockville, Md., popular with life sciences companies, from Ivy Realty in a $32.7 million deal.

Newmark facilitated the deal for both sides.

“It is located within walking distance of NIAID and some [Department of Health and Human Services] and [Federal Drug Administration] facilities,” Jud Ryan, an executive managing director at Newmark, told CO. “It is also connected via the Redline to [National Institutes of Health]’s main campus and a short drive from FDA’s campus. Not surprisingly, over 50 percent of the tenancy are bioscience and life science industry participants.”

Located at 1700 Rockville Pike, the Twinbrook Office Center comprises six floors on 2.36 acres. The property was 80 percent leased at the time of the sale. Notable tenants include Johnson & Johnson, Merck, Dovel and Novartis.

Twinbrook Office Center recently underwent a $3.4 million capital improvements plan that included a renovated main lobby, exterior facade, a full elevator modernization, and common area renovations.

The property is near some of the largest health care, biotech and life sciences institutions in the U.S., which generate a significant amount of demand throughout the Montgomery County market.

Commercial real estate located in bioscience clusters around the country continues to outperform the broader marketplace, but it’s been especially strong in Maryland.

“It has the tightest vacancy rate of all product types in the region, with constraints on overbuilding,” Ryan said. “It is strong due to the government headquarters … the educated workforce, strong university involvement, and concentration of leading corporations in this space.”

Since the first quarter of 2019, life sciences tenants have driven 870,000 square feet of leasing demand, nearly a quarter of all activity in suburban Maryland.

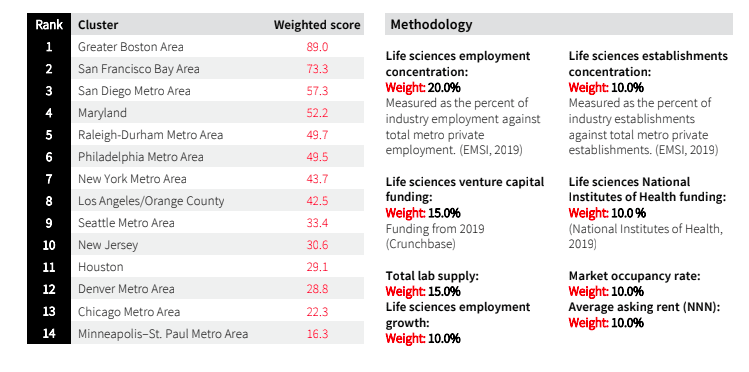

According to JLL’s most recent Life Science Real Estate Outlook report, the top three ranked clusters for life sciences ecosystems in 2020 were Boston, San Francisco and San Diego, capturing 70 percent of all venture capital investment. Maryland came in fourth, rising a spot from the previous year.

The report shows that the Maryland cluster has a vacancy rate of a little over 7 percent and few large blocks available in what is known as the BioHealth Capital Region, with a wave of new construction positioned to meet future demand.

For instance, two build-to-suit developments from Alexandria Real Estate Equities totaling 262,000 square feet are currently awaiting tenant build-outs in this region.

Additionally, several proposed build-to-suit developments along the I-270 Corridor are awaiting preleasing and will keep the construction pipeline active in the near future. The JLL report notes Frederick County, Md., remains a price-conscious alternative to the I-270 Corridor and presents additional development opportunities for R&D space uses.

“Rents are approaching new highs, especially for new construction, with asking rents among prime assets approaching the $40 per square foot,” the report noted. “Several suburban Maryland firms are actively involved in the production of COVID-19 vaccines and therapeutics, producing industry-record funding and billion-dollar partnerships.”

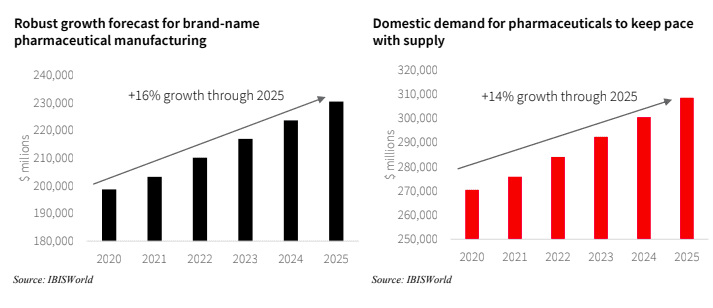

Across the country, life sciences leasing markets are characterized by robust demand, low vacancy, and strong rent growth.

“This is being driven primarily by funding flowing into the underlying biotech and pharma space, which is the product of rapid scientific advancements and streamlined FDA approval processes,” Baker said. “All of these trends have only accelerated over the course of 2020 with the COVID-19 pandemic.”

He explained COVID-19 has sparked an unprecedented pace of development in the biotech and pharma industries, with equally unprecedented collaboration across all industry participants.

“As the vaccine rolls out and we achieve herd immunity as a country, I think the biotech and pharma industries and their regulators will build on the experience of 2020 with continually more impressive scientific discoveries for treatments of both known and unknown diseases and ailments,” Baker said, “which will, in turn, attract more capital into the space and continued and increasing strength in real estate markets.”