Related Nabs $229M CMBS Loan for West Palm Beach Office Acquisition

By Mack Burke January 27, 2021 3:08 pm

reprints

Stephen Ross’ mammoth real estate investment company, Related Companies, is continuing its expansion within West Palm Beach, Fla., a market where office performance ended 2020 on stronger footing than many primary and other secondary markets across the country.

Goldman Sachs supplied Related with $229.1 million in commercial mortgage-backed securities (CMBS) debt on Jan. 15 to facilitate its purchase of Phillips Point, a waterfront office building in West Palm Beach, Fla., that’s full of credit tenants. The 10-year, interest-only loan will pay interest at a rate of 3.34 percent, according to ratings agency analysis of the transaction.

The funds, together with $30.5 million in mezzanine debt from an unknown lender and $64.8 million in equity — nearly a quarter of the purchase price — injected by Related, covered the firm’s $281.9 million acquisition of the dual-tower property from AEW Capital Management, according to county records and per analysis from Fitch Ratings. AEW had bought the landmarked property from New York-based Colonnade Properties in the summer of 2015 for $250 million.

Goldman’s acquisition financing package also funded a $6.7 million reserve for tenant improvement and leasing commission costs and paid off $3.6 million in closing costs, per Fitch. A $75 million A-note is being securitized in the roughly $1.53 billion, BMARK 2021-B23 CMBS conduit transaction, while the $123.5 million in remaining A-notes will likely be included as part of future securitizations.

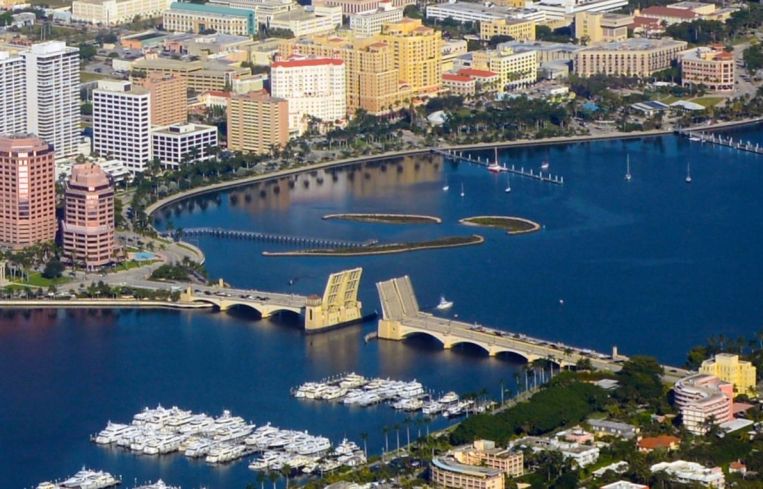

Built in 1985 and renovated last year, Phillips Point is located on the Lake Worth Lagoon waterfront at 777 South Flagler Drive in West Palm Beach’s downtown area, right at the base of the Royal Park Bridge, which leads east to the isle that is Palm Beach, Fla.

The office complex is also just a couple blocks from the firm’s 600,000-square-foot, mixed-use shopping and entertainment development Rosemary Square, which was opened in 2000 in an attempt to help transform the city’s downtown into an “urban lifestyle destination,” according to Related’s website.

Related is also in line to eventually break ground on a planned, 25-story, 277,000-square-foot office development called One Flagler that will be situated right next to Phillips Point, on the other side of the Royal Park Bridge, according to the firm’s website. The project is expected to be completed in 2024.

The firm will also open its newest office development in the area, a 20-story building called 360 Rosemary, for occupancy in the second quarter, according to its website.

West Palm Beach’s office market, while having obviously taken lumps from COVID-19, came out of 2020 with fewer bruises than many other regions of the country.

Occupancy remained stable despite asking rents falling in the fourth quarter, and net absorption year-to-date flattened in the fourth quarter due to a confluence of minimal leasing activity, tenants contracting space and office closures. The city’s office vacancy climbed just 120 basis points to 14.4 percent in the fourth quarter, according to data from advisory firm JLL, which wrote that demand in the area was bolstered at the end of the year by companies fleeing “high-tax gateway cities.”

This has directly benefited West Palm Beach and, specifically, Related’s new office complex. The Palm Beach Post reported in October that Paul Singer’s massive hedge fund investment manager Elliott Management Corporation was moving to the Phillips Point complex as part of its push to establish its headquarters in the city. JLL wrote that Elliott Management was looking to take space at Related’s other West Palm office development, 360 Rosemary.

“This marks a significant shift from small family offices and hedge funds leasing a few thousand square feet to major firms with large operations and consequential footprints touring the market,” JLL wrote in its fourth-quarter report on the West Palm Beach office market. “Rents are likely to recover in 2021 as new demand materializes and gains momentum.”

As of this month, Phillips Point has registered an average occupancy of about 92.2 percent since 1999, and as of December 2020, it was 90.5 percent occupied by 31 tenants, many of whom have been housed at the property for more than a decade, per Fitch analysis.

The largest tenant at Phillips Point is massive West Palm Beach law firm Gunster, which has been at the property since the 1980s and accounts for nearly 10 percent of base rent.

The nearly 449,000-square-foot office complex is currently open and operating, per Fitch. Only five of its 31 tenants received rent relief due to COVID-19, which included two months of deferred rent.

AEW had made substantial upgrades to the property since it acquired it in 2015. That year, it began to deploy about $15.7 million for improvements, about $13.5 million of which was injected into the asset in the last three years, according to Fitch. The work included a $4.7 million renovation of the lobby last year, $1.8 million to modernize the elevators in the east parking garage and the west tower, $1.5 million to renovate the plaza, and $1.4 million to upgrade the facade of the west building’s parking garage.