Presented By: Nuveen Real Estate

The Office is Dead. … Long Live the Office

By Andy Schofield July 6, 2020 9:22 am

reprints

Bank and tech firm CEOs have set alarm bells ringing across the real estate community with headline-grabbing comments about the possibility of downsizing their offices should working from home become the post-pandemic norm.

We’ve been here before.

The advent of the internet had people pondering if the traditional office was extinct. Then experiments like ‘hot desking’ and various remote-work schemes were later quietly shelved or scaled back. Turns out that humans are social creatures, and the office is critical not only to collaboration and results, but also in attracting talent.

What will the workplace – and the market for office real estate – look like in the years ahead?

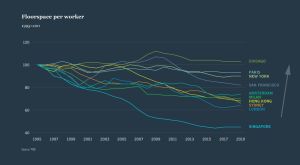

The most likely outcome will be nuanced and shaped by the pandemic’s influence on a host of trends that began playing out in the wake of the global financial crisis a dozen years ago: Workplace densities increased as tenants sought more efficient corporate real estate solutions. They favoured offices in well-connected, urban locations, and also demanded flexible space. More recently, sustainability, wellbeing and collaborative and community workspace have become central to many companies’ recruitment and retention strategies.

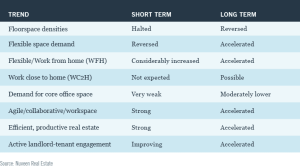

Having analysed the effects of the pandemic on these trends, Nuveen’s real estate experts see four key outcomes, all of which we discuss more fully below:

-

- – Overall demand for office space shouldn’t be affected dramatically but could reduce moderately as companies restructure their portfolios and accommodate greater workplace flexibility for employees.

- – Demand for supplementary flexible space is expected to rise, but flexible operators will need to evolve their business models and industry consolidation may occur.

- – Landlords, property managers and tenants will form closer alliances to enhance the experience and value of the office; they’ll explore new services for tenants with associated income streams for landlords, reinforcing the migration to a partnership model.

- – ‘Active animation’ will drive workplace revolution, with an enhanced focus on collaboration, community, hospitality, health and wellbeing.

Who needs an office anyway?

Disruption has always driven evolution in the office sector, and the pandemic may break the binary thinking that has frustrated change: It’s neither everyone in the office nor everyone at home.

We expect considerable differences in opinion about the best workplace solutions, but as corporate leaders continuously assess what is and isn’t working through the crisis they are citing experiences that suggest they will not abandon the office en masse: communications technologies that aren’t up to the job, loss of competitive edge and the experiences of younger or newer employees unable to learn from experienced colleagues or contribute meaningfully to meetings or projects.

One outcome of the social distancing measures expected in the workplace after the transition from lockdown may be that companies look to permanently reduce workplace densities, reversing that long-running trend.

Work-from-home (WFH) would allow for increased floor space per worker without the need for costly expansion. It would also accelerate an already prevalent trend for greater flexibility in workstyles. Even firms that value face time may come to appreciate that WFH can increase efficiency by reducing commute times.

So while companies will return to the office, we’re likely to see more WFH, too.

The future of flexible space

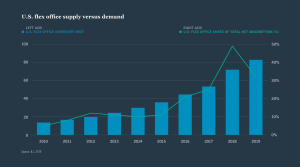

Clearly the pandemic will have a very significant impact on the serviced office market.

In the past few years operators offered highly creative and interactive communities for their member tenants and drove their profitability through smart densification of desk space around communal areas.

In the short term, we expect a major challenge for the sector. Operators will look to shed unprofitable centers as well as refit spaces to respect social distancing as researchers have found that open office floor plans increase the spread of illness among workers relative to lower density layouts.

One possible mitigating factor: Delays in completion of new offices due to the pandemic could create opportunity for serviced-office operators to provide temporary facilities pending completion of fit outs.

Longer term, however, operators will need to evolve. They’ll look to share the burdens as well as the benefits of occupancy and income volatility with building owners through new operating lease structures or management agreements, as landlords seek to reimagine their buildings while also damping some of their own risks.

And while corporate demand will still come from firms that seek to actively use the serviced office market to satisfy their flexible space quotas, operators may not be able to shoulder all of the new and increased costs -with smart densification in a post-pandemic world. We expect a higher number of conventional property owners to step up to play a greater part in satisfying the demand for flexible space.

The great accelerator

Agility has proved to be key to navigating a crisis – property, working practices, redirecting resources, adapting sales strategies.

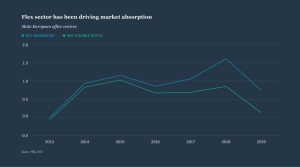

The need for companies to be nimbler should reinforce the ongoing shift towards the core-and-flex model in which companies hold the majority of their strategic real estate – say around 70 percent – on long leases, with the remainder on flexible, short-term leases.

Demand for centralised office space may reduce moderately in the longer run, with the head office focusing more on higher-value activities that foster collaboration and innovation. That means the quality of the product and service will need to be even higher than before the pandemic, so institutional landlords will also have to adapt, transforming their passive leasing practices into active engagement strategies and working closely with existing and prospective tenants.

While all of this may reduce demand for core space, the impact will be spread over future lease events and is unlikely to create market disequilibrium.

And as it transforms to accommodate lower densities, flexible office space will benefit over time.

Finally, suburban, serviced office space may also experience a revival in demand, particularly if firms decide to offer flexible office space options closer to their employees’ homes – so called ‘work close to home’, or ‘WC2H’ arrangements.

Summing up

The pandemic will impact ongoing trends that in turn will affect demand for the types and quantity of real estate. All of this will reinforce the value of the office as a strategic resource and ultimately underpin healthy long-term demand for space.

The latest insights from Nuveen Real Estate’s market-leading global research team can be found here.