Loan on Ceruzzi’s Lipstick Building Ground Lease Hits Special Servicing

The $272 million SASB CMBS loan was transferred to special servicing after the firm missed its June mortgage payment as a result of its ground lessees failing to meet rent obligations

By Mack Burke June 8, 2020 1:02 pm

reprints

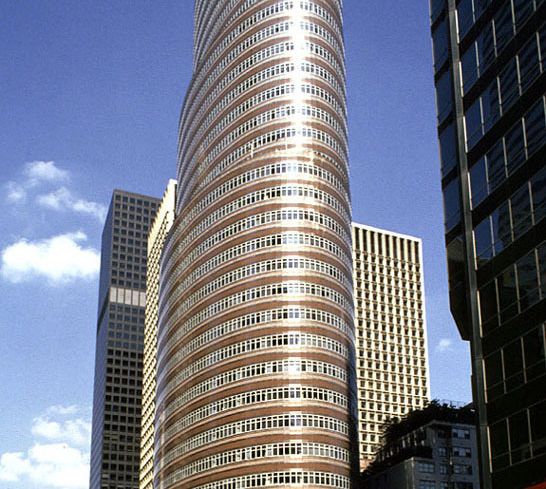

The $272 million CMBS loan originated by Credit Suisse and backed by Ceruzzi Properties’ ground lease at the 34-story Lipstick Building at 885 Third Avenue in Midtown Manhattan has been sent to special servicing, according to servicer data from this month compiled by Trepp.

The ground lease is the collateral behind the loan that makes up the Credit Suisse-led CSMC 2017-LSTK single-asset single-borrower (SASB) commercial mortgage-backed securities transaction that was originated in April 2017.

According to remittance commentary from the first week of this month, the loan’s special servicer Aegon USA Realty Advisors — a division of Aegon Asset Management — wrote that the borrower had reached out for relief and that “the ground lease tenant has defaulted in the payment of rent under the terms of the ground lease.”

While Ceruzzi missed its June mortgage payment, a source with knowledge of the situation said that the ground lessees — led by Metropolitan Real Estate Investors and IRSA, an Argentinian real estate developer — defaulted on the ground rent as of May 1, 2020 and that “Ceruzzi and SL Green have been working together with the lender … to restrict the loan and take over the situation. It went to special servicing because it had to.” The source said that because office rent collections at the building have been relatively strong since COVID-19 set in, Ceruzzi is “anxious” to get its hands on the building.

Ceruzzi president Art Hooper declined to comment on the situation.

The loan’s maturity is in August, and according to information from Trepp, the lease for the office tower’s largest tenant, global law firm Latham & Watkins, which occupies 400,000 square feet, is set to expire in June next year, although CoStar Group pegs the expiration in October 2021. The building features more than two dozen tenants, the majority of which are of the legal and financial sectors, and no tenant outside of Latham occupies more than 30,000 square feet, as per CoStar data.

Prior to COVID-19, it was reported in September last year that Ceruzzi had put the ground lease on the market after the building’s owners, led by Argentinian real estate investor and developer Inversiones y Representaciones Sociedad Anónima (IRSA), declined to pick up an option to buy the land.

Hooper told The Real Deal last fall that the firm had been discussing a sale to IRSA but to no avail, partly due to economic uncertainty in Argentina causing a pause. The ground rents at the location were supposed to reset this year, according to TRD’s report.

This $272 million loan was provided to Ceruzzi in April 2017 to refinance previous debt that it assumed upon acquiring the ground lease in 2016, according to a report at the time from The Wall Street Journal. The firm had assumed a $267.5 million loan that sported an “above-market interest rate of 6.21 [percent] made about a decade ago,” the late president of Ceruzzi Holdings, Lou Ceruzzi, told WSJ at the time. Ceruzzi said then that the building’s ownership group has an option to purchase the land for $520 million in 2020.

Ceruzzi and partner Shanghai Municipal Investment USA came together to agree to purchase the ground lease in the fall 2015 for $453 million from SL Green Realty Corp., as CO first reported at the time. The deal officially closed in February 2016 and the lease agreement was for 67 years. SL Green and Gramercy Capital had paid $317 million for a 79 percent of the asset’s fee-simple interest and a 21 percent leasehold interest, as per CO’s previous reporting.

In July 2008, one of the building’s owners Metropolitan Real Estate Investors — who had bought the building from Tishman Speyer in August 2007 for $648.5 million — announced that it had overhauled the building’s financing. That included increasing its stake in the property, restructuring the preferred equity aspect of the capital stack with Goldman Sachs and bringing in IRSA as part of the ownership group.

Two years later in November 2010, a holding entity for the building controlled by Metropolitan filed for Chapter 11 bankruptcy protection, just a few months after its senior lender, the Royal Bank of Canada, sued that June in order to force a sale. That legal action from the Canadian bank followed a default on the $210 million acquisition loan it provided in 2007 to help fund Metropolitan’s $648.5 million purchase.

The iconic Lipstick Building was built in 1986, spans around 646,000 square feet and was last renovated in 2006, according to data from CoStar.

The property’s 17th to 19th floors used to host Bernie Madoff’s Bernie L. Madoff Investment Securities, the financial organization whose wealth management division was responsible for the massive multi-billion-dollar Ponzi scheme that had been in operation for more than a decade prior to Madoff’s sentencing in 2008.