3650 REIT Provides $36M Bridge Loan on LA Housing Community

By Mack Burke June 16, 2020 5:32 pm

reprints

Miami-based lender 3650 REIT has provided $36 million in short-term debt to a joint venture between real estate development firms Dugally Oberfeld Capital Partners and Fabulous Five for the pair to acquire and redevelop a gated manufactured housing community in Los Angeles, Commercial Observer has learned.

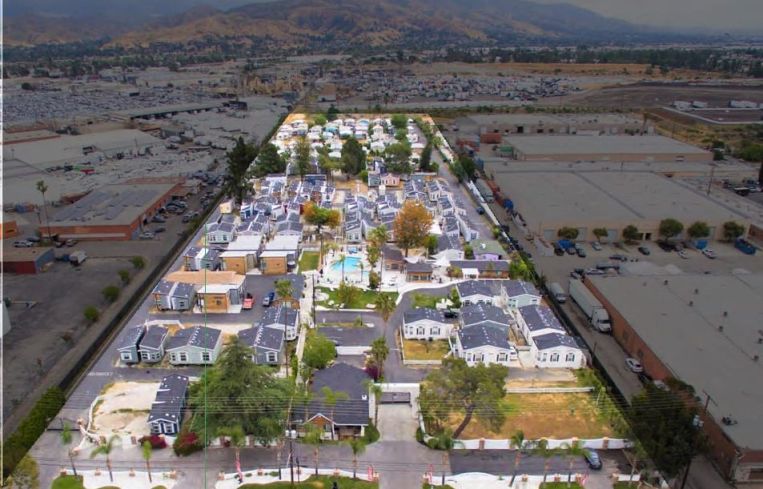

The 30-month bridge loan helps fund the JV — called Multi Opp, LLC — purchase of Hollywood Backlot Homes at 8250 Lankershim Boulevard, a 10-acre community in LA’s North Hollywood neighborhood.

Northmarq managing director Scott Monroe arranged the financing out of the firm’s Las Vegas office. He said in a statement that 3650 REIT stepped in to win the financing after a previous bridge lender, a leveraged lender whose name he did not provide, was unable to fund the proceeds due to pressures from COVID-19.

A source with knowledge of the deal said that before the previous lender backed out due to liquidity issues, the deal was about a week from closing and signature pages for the loan documents had been circulated.

“[3650 REIT was] solution driven, nimble, and committed … which allowed the developers to close in less than 30 days from term sheet signing,” Monroe said. ”This was a complex project and in the end, [3650 REIT’s staff] … met the challenges of loan closing and became a key advisor in the process whose level of expertise lifted the entire business plan to ensure successful stabilization and a maximum lift in value.”

3650 REIT co-founder and managing partner Jonathan Roth said in prepared remarks that “as the global pandemic continues to impact real estate market environments across the country, we are very pleased to have executed on this truly distinctive opportunity. The sponsors’ vision for the [property] aligns extremely well with the age of social distancing.”

3650 REIT’s assumption of the debt position and its understanding of the business plan allowed them to “navigate an incredibly complex transaction in less than 30 days,” Dugally Oberfeld founding partner Mauricio Oberfeld, a co-founder of the JV, Multi-Opp, said in a statement.

Oberfeld added that when his group came across the property, they saw it as a good opportunity to “launch our detached multifamily rental concept, where renters can enjoy all the benefits of a class A multifamily asset while living in a detached residential environment with attainable rents.”

3650 REIT said the JV’s redevelopment will include designing and then installing about 140 individual homes on the 10-acre site.

The more “private, detached” configuration and single-family nature of the site’s residences provides tenants with “true separation alongside class A multifamily features,” Roth said. “It dovetails with our ongoing goal of socially responsible investing, including providing attainable housing options to renters nationwide, especially in high cost, demand constrained markets like Los Angeles, where there remains tremendous demand for such product.”

The property, which is located within a designated opportunity zone, currently offers one-, two- and three-bedroom floor plans, according to its website. Amenities at the gated location include a spa, a game room with billiards and an outdoor lounge with a fire pit and gas grills. There is also an outdoor pool area, a fitness center and dog runs, according to information from 3650 REIT.

Monthly rents for the two- and three-bedroom floor plans currently range from around $2,300 t0 about $2,800, according to listing information on Apartments.com.