NMHC’s Bibby Commends Move to Support Agency-Backed Apartments

By Keith Loria March 24, 2020 5:12 pm

reprints

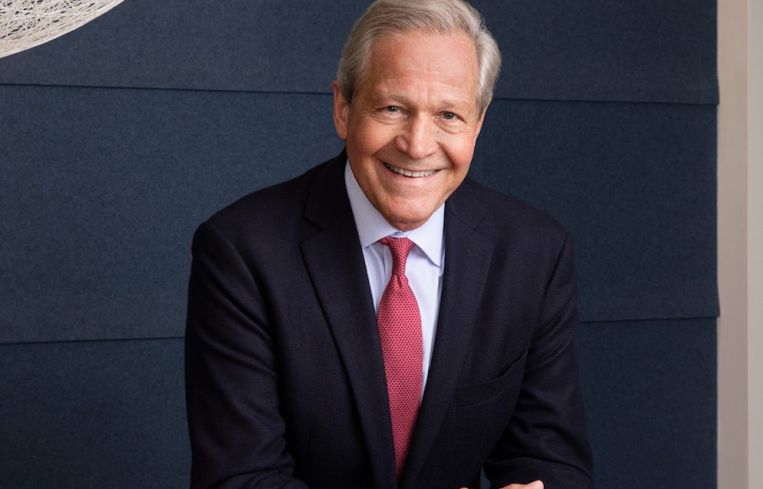

The National Multifamily Housing Council’s (NMHC) Doug Bibby weighed in on yesterday’s announcement from the federal government, which offered support for Fannie Mae and Freddie Mac-backed multifamily properties amid the coronavirus pandemic, stating that the move was necessary in this time of uncertainty.

“[The] announcement had a moratorium on evictions, but also contained a forbearance element that was beneficial to the owners and their financial relationships,” Bibby, the apartment industry group’s president, told Commercial Observer. “This was a reinforcement of the guidance we were sending out to the industry.”

Yesterday, the Federal Housing Finance Agency (FHFA) announced that it would suspend mortgage payments for landlords affected by the coronavirus, with the program applying to multifamily owners with Fannie Mae and Freddie Mac loans. The mortgage forbearance is contingent on landlords not evicting tenants affected by the coronavirus fallout.

“Renters should not have to worry about being evicted from their home, and property owners should not have to worry about losing their building, due to the coronavirus,” FHFA director Mark Calabria said in a prepared statement, as Commercial Observer reported.

Bibby noted this was a necessary step as most property owners are small businesses who are committed to working with public officials and residents to keep families safe during this national crisis.

Last week, NMHC proposed guidelines to halt COVID-19 related evictions and established payment plans for people who can’t afford rent due to the outbreak.

“What we’re trying to do is balance the interest of the renter and our members, who are owners of real estate properties, and they are under potential stress too because they have mortgages, property taxes, insurance and everything else,” Bibby said. “We knew we needed to work with residents to make sure they could keep a roof over their heads if they are severely affected either medically or through a job loss because of the coronavirus.”

At the same time, the NMHC said that tennants shouldn’t look at it as a rent holiday; people who can make their payments should continue to do so as these guidelines are meant for those challenged because of the coronavirus.

The NMHC also issued some suggested guidelines to those in the apartment industry, hoping to keep people safe and in their homes.

The recommendations included apartment firms halting evictions for three months for those who can prove the pandemic has financially impacted them; holding off on any rental increases for the next 90 days; and creating payment plans for those who are unable to pay their rent because of the outbreak and waive late fees for those residents.

“This crisis is testing all of us—every industry, every family,” Bibby said. “No one should lose the roof over their head during a pandemic. By working together—apartment residents, owners and operators, and lawmakers at all levels of government—we can develop solutions to the evolving challenges and keep Americans housed.”

Additionally, the NMHC continues to ask Congress to offer disaster housing assistance for those with pandemic-impacted incomes.

“Congress must extend mortgage forbearance to rental property owners and extend similar protections to other financial obligations such as insurance premiums, utility service payments and tax liabilities,” according to an NMHC statement. “Forbearance is needed to prevent foreclosure and other adverse actions such as lien placements, utility shut offs, defaults, and judgements that would negatively impact the viability of the property’s continued operation and ultimately put its residents at risk of additional disruption.”

Update: This story originally misattributed source material. This has been corrected. We apologize for the error.